Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 03, 2016

Brexit fears hit sterling corporate bonds

Pound denominated corporate bonds have seen their benchmark spreads jump by a much wider margin than their Euro denominated peers year to date as the "out" vote gathers pace.

- The spread gap between Euro and Pound denominated IG bonds has more than doubled YTD

- Banks and Basic Materials bonds have come under the most pressure relative to their " peers

- UK's sovereign CDS spread has doubled to 38bps as "Brexit" talks grow louder

Recently, the camp lobbying for the UK to leave the European Union gathered momentum as London Mayor Boris Johnson joined a slew of cabinet ministers campaigning for "Brexit". The ensuing market reaction sent the pound to its lowest level in seven years with the largest one day fall against the dollar since 2010. While the currency has recovered some of its lost ground, it is still down by over 9% against the dollar in the last 12 months.

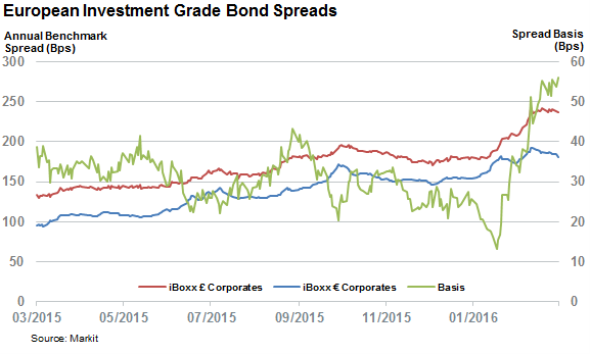

This volatility around Brexit and the possible implications to UK business has not been isolated to the value of the pound as spreads over benchmark UK rates of the Markit iBoxx " Corporates index have jumped by more than a third in the last two months to 240bps. This measure of credit risk now sits at a three and a half year high as the bond market demands increasingly large premiums in order to hold pound denominated corporate bonds as the UK ponders its relationship with the European Union.

Spreads surge overtaking Euro bonds

While the spread widening is not isolated to UK bonds, the surge in UK investment grade bonds credit risk has been much more violent than their Euro denominated peers. The spread difference between the Markit iBoxx " Corporates index and that of the Markit iBoxx " Corporates now stands at 60bps, over twice the level seen at the start of the year.

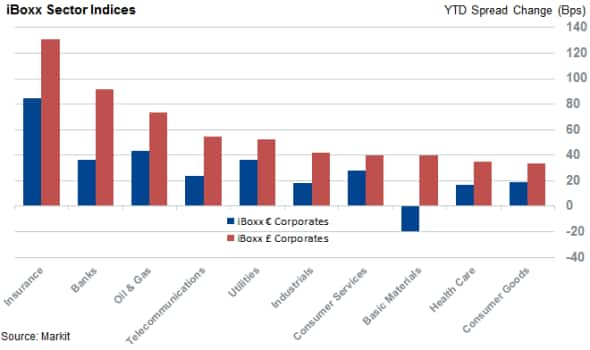

This trend does not look to be driven by any particular sector due to the fact that all ten pound sector sub-indexes have widened by a much wider margin than the corresponding euro denominated index.

The two pound sectors that have seen the largest jump in credit risk relative to euro bonds are basic materials and bank bonds which have both seen their basis widen by over 50bps since the start of the year. The latter of the two is arguably most driven by Brexit fears.

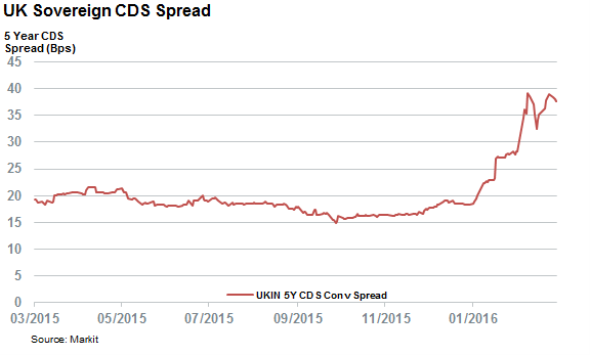

Sovereigns also under pressure

Brexit uncertainty is also felt in the sovereign space as the UK's five year CDS spread has continued to hover near record recent highs in the wake of the referendum announcement. The most recent spread of 37.6bps, is in fact over twice the level seen at the start of the year, before the 'out' campaign started to gather pace in earnest.

While UK sovereign bond returns have yet to be materially impacted by the recent surge in credit risk, the jump in CDS spread indicates the unease felt by investors as the UK faces the real possibility of taking a step into the unknown should Boris Johnson and his "out" peers get their wish.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032016-credit-brexit-fears-hit-sterling-corporate-bonds.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032016-credit-brexit-fears-hit-sterling-corporate-bonds.html&text=Brexit+fears+hit+sterling+corporate+bonds","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032016-credit-brexit-fears-hit-sterling-corporate-bonds.html","enabled":true},{"name":"email","url":"?subject=Brexit fears hit sterling corporate bonds&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032016-credit-brexit-fears-hit-sterling-corporate-bonds.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Brexit+fears+hit+sterling+corporate+bonds http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032016-credit-brexit-fears-hit-sterling-corporate-bonds.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}