Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 04, 2016

Credit markets steer into calmer waters

After a volatile start to 2016, falling US Corporate bond spreads and receding credit risk among European financials has calmed investor fears over the past few weeks.

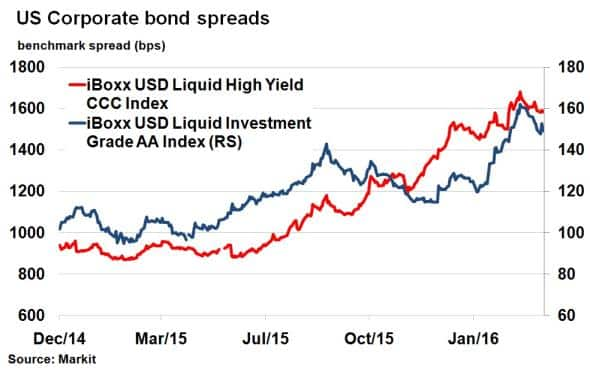

- Markit iBoxx USD Liquid Investment Grade AA Index has tightened 12bps over the past three weeks.

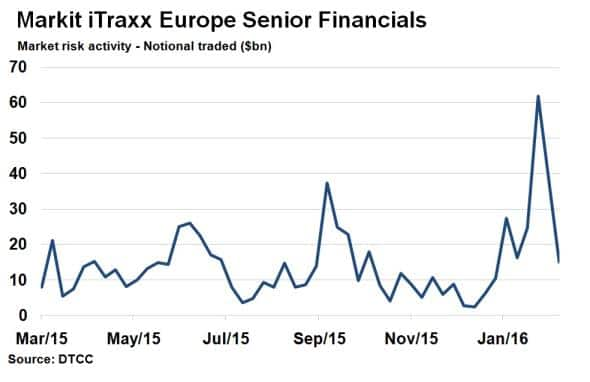

- CDS trading volumes on the Markit iTraxx Europe Senior Financials index have fallen fourfold as volatility in the sector has receded.

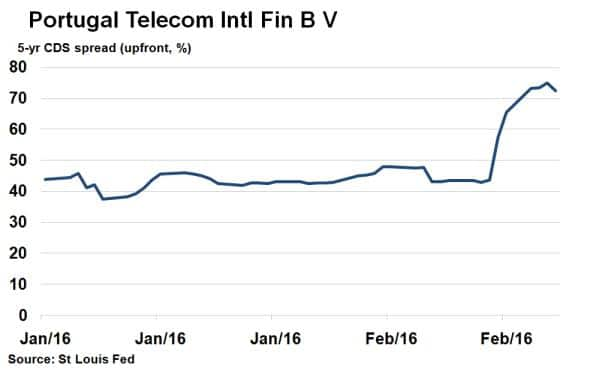

- Following another downgrade, Portugal Telecom's 5-yr CDS spread implies a high probability of default.

US corporates turn corner

Positive sentiment in US fixed income markets continued as bond spreads (yield over US treasuries) tightened for the third consecutive week. It marks a stark contrast to the period of heightened volatility seen at the start of the year which peaked on February 11th.

The Markit iBoxx USD Liquid Investment Grade AA Index, constituents of which are corporations such as Walmart and Coca Cola, saw its spread widen to 161bps as of February 11th, the widest since May 2012. Highly rated corporate bond risk is often a gauge of broader fears in the US economy, and although they remain at elevated levels, calmer waters have since seen spreads recede 12bps to 149bps.

At the opposite end of the credit spectrum, CCC rated US corporate bonds have also seen risk recede with the Markit iBoxx USD Liquid High Yield CCC Index seeing its spread tighten from 1679bps to 1581bps over the past three weeks.

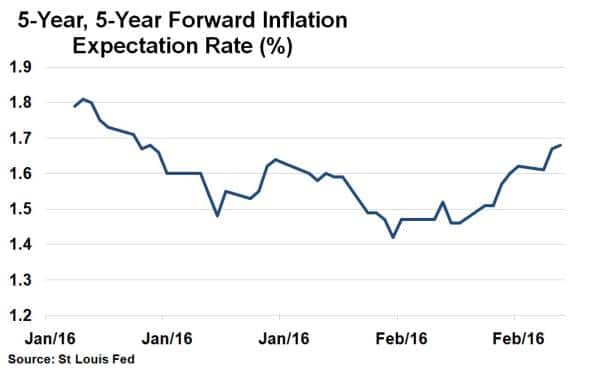

Positive market sentiment has also helped US inflation expectations, spurred on by the rebound in commodity prices. The 5y5y forward inflation expectation rate (what the market expects average five year inflation to be five years on from now) has jumped 28bps from its depths in February. As employment figures continue to impress (latest non-farm payrolls were a better than expected 242k), inflation has become a key driver of US monetary policy.

European banks brighter

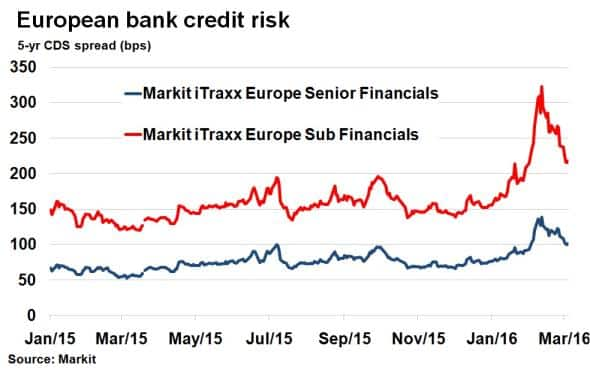

Calmer waters have also translated across the Atlantic led by Europe's financial sector.

The Markit iTraxx Europe Senior Financials index has seen its 5-yr CDS spread tighten to a one month low, while it's riskier counterpart the Markit iTraxx Europe Sub Financials index has seen credit risk tighten over 100bps.

Among the constituents, heavily in the spotlight Deutsche Bank AG has seen its 5-yr CDS spread tighten 20% over the past three weeks, while French banks BNP Paribas and Societe Generale each saw a 30% tightening.

The heightened volatility in the sector also saw trading volumes surge on the Markit iTraxx Europe Senior Financials as investors hedged downside risk in the sector. Since then however, volumes have fallen fourfold as volatility in the sector has receded.

Portugal Telecom woes

Following the credit downgrade of its Brazilian parent company Oi to CCC this week, credit spreads on beleaguered Portugal telecom now imply a near certain default.

Trading on an upfront basis (typical of credit in distress), spreads now indicate investors have to pay upfront $7.2m per $10m notional, plus 125k per quarter to insure against default.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032016-Credit-Credit-markets-steer-into-calmer-waters.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032016-Credit-Credit-markets-steer-into-calmer-waters.html&text=Credit+markets+steer+into+calmer+waters","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032016-Credit-Credit-markets-steer-into-calmer-waters.html","enabled":true},{"name":"email","url":"?subject=Credit markets steer into calmer waters&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032016-Credit-Credit-markets-steer-into-calmer-waters.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Credit+markets+steer+into+calmer+waters http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032016-Credit-Credit-markets-steer-into-calmer-waters.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}