Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 03, 2015

Global PMI surveys signal lacklustre start to the year for manufacturing

The world's factories reported a slight upturn in growth of business activity in January, but the pace of expansion remained one of the weakest seen over the past year-and-a-half.

Sluggish start to the year

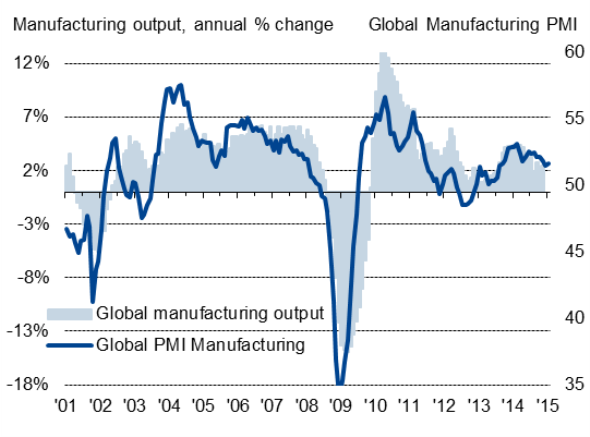

The JPMorgan Manufacturing PMI, compiled by Markit, edged higher from December's 16-month low of 51.5 to 51.7 in January. Output grew at the fastest rate for three months, but new orders merely showed the largest monthly increase since November amid near-stagnant export flows.

The survey signals global manufacturing output growth continuing to run at an annual rate of approximately 2.5% in January, roughly half the pace seen in the lead up to last summer.

Global manufacturing output

Sources: Markit, JPMorgan, HSBC

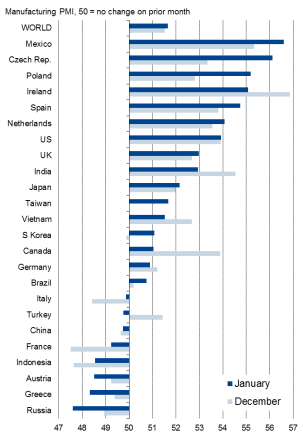

In a change to recent months, when the PMI rankings have been dominated by developed countries such as the UK, the US and Ireland, January saw the top three places held by emerging markets, led by Mexico.

Manufacturing PMI ranking

Sources: Markit, CIPS, HSBC.

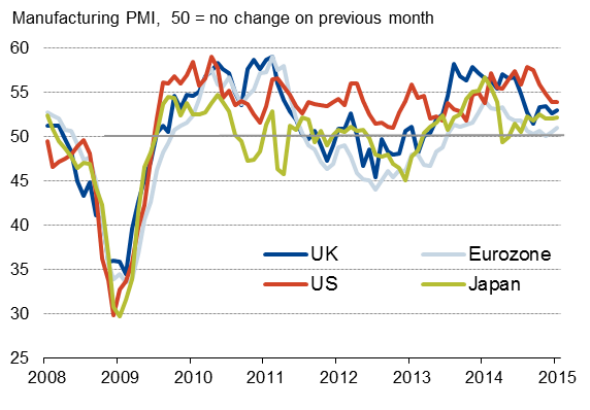

Polarised eurozone

The US and UK, which led the global expansion in 2014, both saw rates of growth similar to the modest expansions seen at the end of last year, indicating that both have moved down a gear from surging rates of increase last summer.

The fastest growth in the developed world was therefore again seen in Ireland, followed by Spain and the Netherlands, highlighting how the eurozone economy has become polarised, struggling now due to weakness in the "core' countries of Germany and France. Of the eight countries that saw manufacturing conditions worsen in January, four were euro countries.

Greece and Russia in crisis

The economic plight of Russia, hit by sanctions and the oil price collapse, and Greece, hit by uncertainty caused by elections, was meanwhile highlighted by both countries falling to the bottom of the manufacturing league table.

Russia suffered the steepest rate of decline of all countries surveyed, with its PMI descending to a 67-month low, indicating that Russia is seeing the steepest downturn since the height of the financial crisis in 2009.

Greece's PMI signalled the steepest decline for over a year.

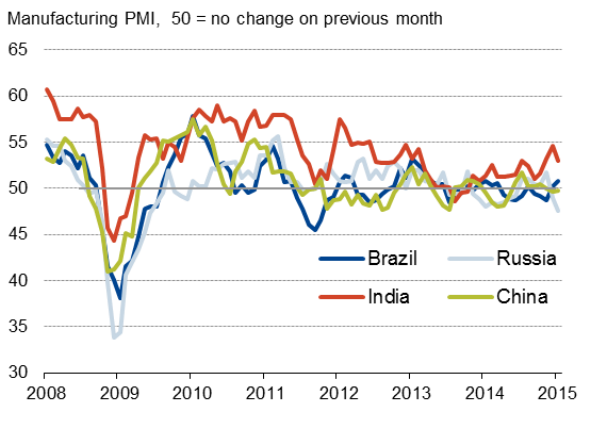

Asia ex-Japan stagnates

Japan saw an expansion of manufacturing activity, continuing the sluggish recovery trend seen in prior months, but the rest of Asia more-or-less stagnated, with an overall PMI reading of just 50.3. China saw a marginal contraction for a second successive month, and Indonesian factories reported a fourth successive monthly downturn. But growth picked up slightly in both Taiwan and South Korea and modest expansions continued to be reported in Vietnam and India.

Oil price rout pushes costs lower

The January survey also provided signs of the slump in oil prices feeding through to manufacturers' costs. Average input costs fell for the first time since May 2013, registering the steepest monthly fall for two-and-a-half years. Average selling prices also fell, down to the greatest extent since last March, albeit only modestly overall.

Manufacturing PMI

Emerging markets

Developed world

Sources: Markit, HSBC

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03022015-Economics-Global-PMI-surveys-signal-lacklustre-start-to-the-year-for-manufacturing.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03022015-Economics-Global-PMI-surveys-signal-lacklustre-start-to-the-year-for-manufacturing.html&text=Global+PMI+surveys+signal+lacklustre+start+to+the+year+for+manufacturing","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03022015-Economics-Global-PMI-surveys-signal-lacklustre-start-to-the-year-for-manufacturing.html","enabled":true},{"name":"email","url":"?subject=Global PMI surveys signal lacklustre start to the year for manufacturing&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03022015-Economics-Global-PMI-surveys-signal-lacklustre-start-to-the-year-for-manufacturing.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+PMI+surveys+signal+lacklustre+start+to+the+year+for+manufacturing http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03022015-Economics-Global-PMI-surveys-signal-lacklustre-start-to-the-year-for-manufacturing.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}