Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 02, 2015

Manufacturing upturn adds to resurgent optimism on UK economic outlook

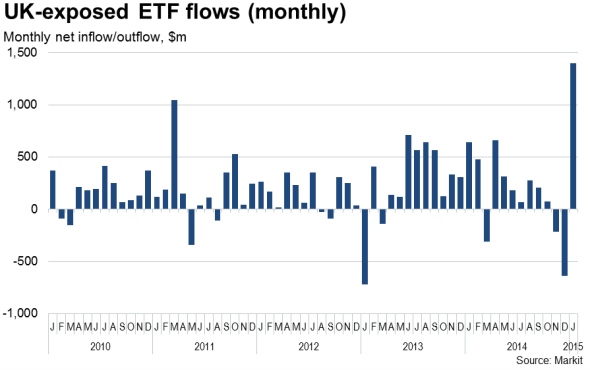

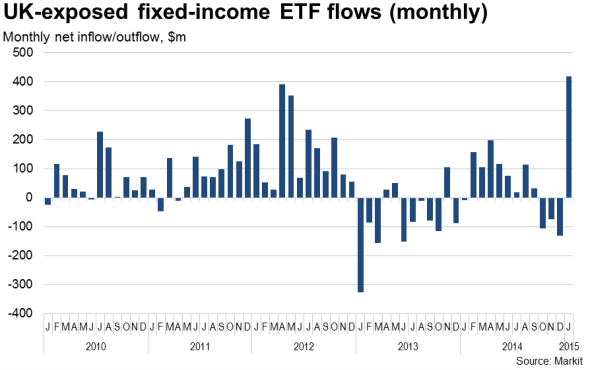

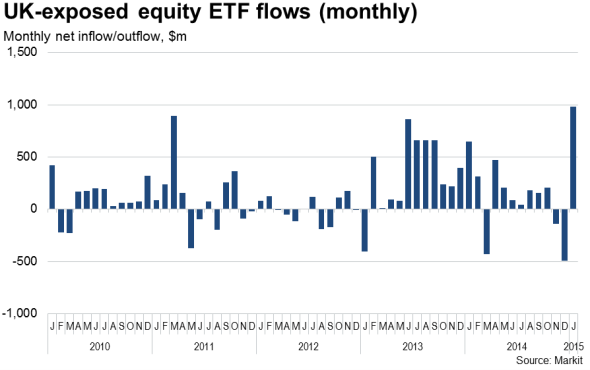

UK manufacturing PMI data for January had something for everyone, whether your cup is half full or half empty. Investors are certainly taking a positive view on the UK economy, with exchange-traded funds seeing record monthly net inflows in January.

On the positive side, the headline manufacturing PMI rose from 52.7 to 53.0, beating market expectations of the index holding steady at 52.7.

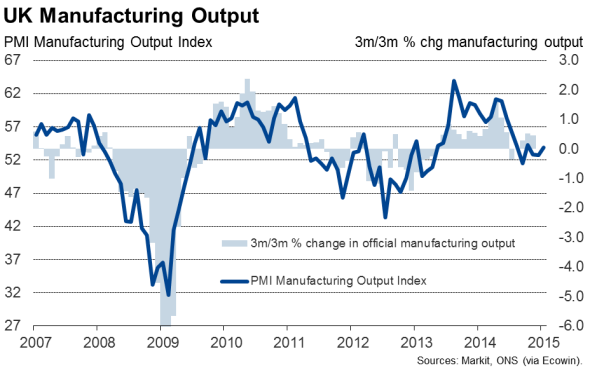

On the other hand, pessimists will note that the PMI remains far lower than the highs of last year, indicating that manufacturing remains stuck in a lower gear. The index averaged 56.6 in the 12 months up to June of last year but has since averaged a more modest 53.1.

This weaker performance has been mirrored in the official data. Factory output growth has waned markedly since the 1.1% surge seen in the first quarter of last year, slowing to just 0.1% in the final quarter of 2014. The weakness of the manufacturing sector was a key contributor to the GDP slowdown late last year, with the pace of overall economic growth slowing to 0.5% in the final quarter.

The ongoing weakness of the PMI relative to last year's highs suggests that the manufacturing economy is unlikely to provide any meaningful boost to the economy in the first quarter of 2015, unless business conditions improve significantly in coming months. Forecasts for the UK to grow by 2.5-3.0% in 2015 will be challenged by such a weak start to the year.

Cause for cautious optimism

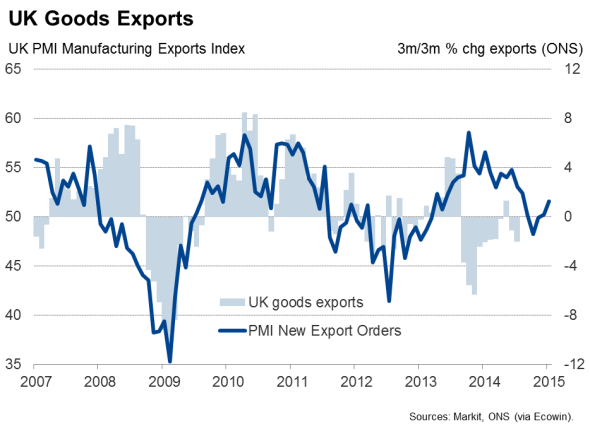

However, the cup-half-full crowd can point to two key aspects of the survey which give cause for optimism. First, the survey's index of new export orders rose to a five-month high in January, indicating that orders from overseas markets are rising again after either more or less stagnating or declining over the prior four months.

With ECB stimulus likely to boost euro area demand further in coming months, the outlook for exports has improved alongside an upbeat domestic outlook. Lower oil prices and rising wages should help boost domestic demand. At the same time, the Bank of England should not need to tighten policy in 2015 due to the drop in inflation, already down to 0.5% at the end of last year.

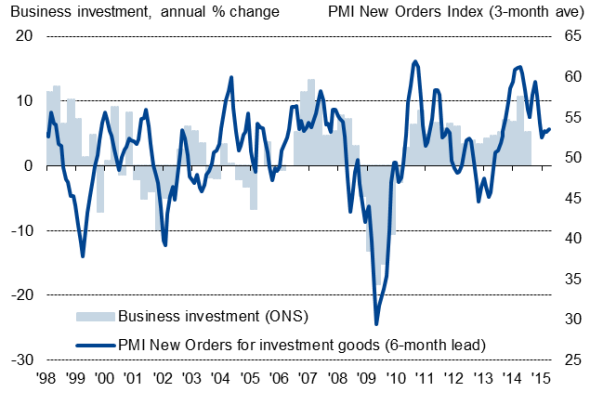

The second cause for optimism was a marked rise in orders for investment goods, such as plant machinery and IT equipment. The underlying trend in demand for these goods is now the strongest seen for four months, suggesting investment spending is picking up again. Such spending is vital for a sustainable and robust economic upturn.

Investment

Any optimism needs to be qualified by concerns over "Grexit', Russia, the potential for instability following an inconclusive UK General Election and an appreciating exchange rate, but at present the PMI data give reasons to be cautiously optimistic on UK economic growth.

Record ETF inflows

Such optimism was already clearly evident in January, when UK-exposed ETFs enjoyed record net inflows, contrasting with net outflows in the final two months of 2014.

Investors piled money into both equity and fixed-income funds, both of which saw record net monthly inflows at the start of the year after suffering net outflows in the fourth quarter.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02022015-Economics-Manufacturing-upturn-adds-to-resurgent-optimism-on-UK-economic-outlook.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02022015-Economics-Manufacturing-upturn-adds-to-resurgent-optimism-on-UK-economic-outlook.html&text=Manufacturing+upturn+adds+to+resurgent+optimism+on+UK+economic+outlook","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02022015-Economics-Manufacturing-upturn-adds-to-resurgent-optimism-on-UK-economic-outlook.html","enabled":true},{"name":"email","url":"?subject=Manufacturing upturn adds to resurgent optimism on UK economic outlook&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02022015-Economics-Manufacturing-upturn-adds-to-resurgent-optimism-on-UK-economic-outlook.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Manufacturing+upturn+adds+to+resurgent+optimism+on+UK+economic+outlook http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02022015-Economics-Manufacturing-upturn-adds-to-resurgent-optimism-on-UK-economic-outlook.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}