Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 03, 2017

Vietnam's manufacturing sector ends 2016 on strong note

Nikkei manufacturing PMI data for Vietnam, produced by Markit, have painted a generally positive picture during 2016. Moreover, growth is shown to have picked up as the year drew to a close, suggesting that the sector is in a good position heading into 2017.

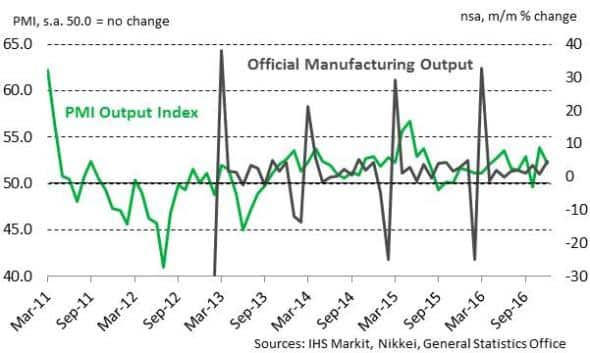

The headline manufacturing PMI - which measures changes in the health of the sector - registered above the 50.0 no-change mark throughout 2016, peaking at 54.0 in November. The average reading for the final three months of the year was higher than in any of the first three quarters.

Official data showed that manufacturing output rose 4.6% month-on-month during December, with the annual rate of expansion picking up to a three-month high of 21.2%.

Manufacturing PMI Output Index v Official data

Central to the improvements in the manufacturing sector in 2016 was the ability of firms to secure new orders. New business increased for the thirteenth successive month in December, and at a solid pace. The rate of expansion had shown signs of picking up earlier in the year before easing back, so firms will hope that momentum can be maintained heading into 2017. Vietnamese manufacturers continued to have success in international markets, with growth of new export orders quickening for the second month running at the end of 2016.

Competitiveness key to export wins

The competitiveness of firms in Vietnam is one of the factors helping them to secure new business. Selling prices decreased through much of the first half of 2016, although there have been signs in recent months of charges being raised in response to higher input costs. The return of inflationary pressures has been particularly evident in the past two months. Cost inflation hit a two-and-a-half year high in November and slowed only marginally in December.

Manufacturers mentioned oil-related products in particular as having increased in price, a marked turnaround from the start of the year when the oil price was exerting downwards pressure on costs. In line with these trends, official data on consumer prices pointed to inflation picking up to 4.7% year-on-year in December, the strongest pace since July 2014.

Growth set to improve in 2017

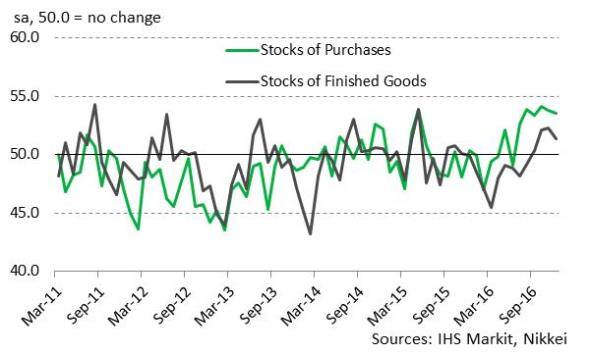

Several of the PMI sub-indices provide optimism that the sector will perform well at the start of 2017. Staffing levels have risen continuously over the past nine months, while stock-building was a feature of the survey in the final quarter. Stocks of purchases rose at the sharpest pace in the survey's history in October, while the rate of accumulation in stocks of finished goods was at an 18-month high in November. Firms have reported increasing inventories, not just in response to current workloads, but also as part of efforts to build stock reserves in anticipation of further growth in future.

IHS Markit forecasts a rise in GDP of 6.3% in 2017, which would represent a slight acceleration from the increase of 6.2% recorded in 2016 and see Vietnam maintain one of the strongest GDP growth rates globally.

PMI Inventory Indices

TPP deal set to fail

One exception to the generally positive picture is the probable cancellation of the Trans-Pacific Partnership (TPP) trade agreement by the United States under President Trump. We had noted in the past that Vietnam was set to be one of the key beneficiaries of the deal, but with the largest economy pulling out of proceedings the TPP is effectively dead. This means that Vietnamese firms won't see the longer-term benefits of tariff-free trade with the US in areas such as textiles and clothing, a major export industry.

Despite this setback, the near-term outlook for Vietnam remains positive. The PMI data will continue to be an important indicator in showing how the manufacturing sector performs during 2017. The January PMI data are set for release on February 2nd.

Andrew Harker | Economics Associate Director, IHS Markit

Tel: +44 149 1461016

andrew.harker@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03012017-Economics-Vietnam-s-manufacturing-sector-ends-2016-on-strong-note.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03012017-Economics-Vietnam-s-manufacturing-sector-ends-2016-on-strong-note.html&text=Vietnam%27s+manufacturing+sector+ends+2016+on+strong+note","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03012017-Economics-Vietnam-s-manufacturing-sector-ends-2016-on-strong-note.html","enabled":true},{"name":"email","url":"?subject=Vietnam's manufacturing sector ends 2016 on strong note&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03012017-Economics-Vietnam-s-manufacturing-sector-ends-2016-on-strong-note.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Vietnam%27s+manufacturing+sector+ends+2016+on+strong+note http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03012017-Economics-Vietnam-s-manufacturing-sector-ends-2016-on-strong-note.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}