Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 03, 2017

Global manufacturing ends 2016 with fastest growth for nearly three years

Global manufacturing sector business conditions improved at the fastest rate for nearly three years at the end of 2016, as the recovery from the stagnation seen earlier in the year continued to gather momentum.

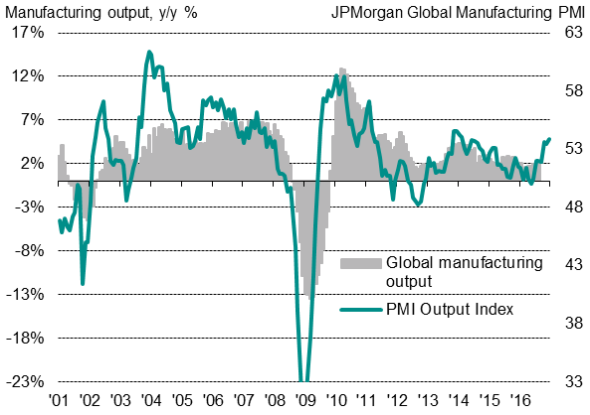

Global manufacturing output

The JPMorgan Global Manufacturing PMI, compiled by Markit from its business surveys in 28 countries, rose from 52.1 in November to 52.7 in December, its highest since February 2014. The survey has signalled a steady upturn the pace of manufacturing growth in the second half of 2016 after indicating a near-stagnant malaise in the first half of the year. The December survey is broadly indicative of global manufacturing output growing at a robust annual rate of 4-5%.

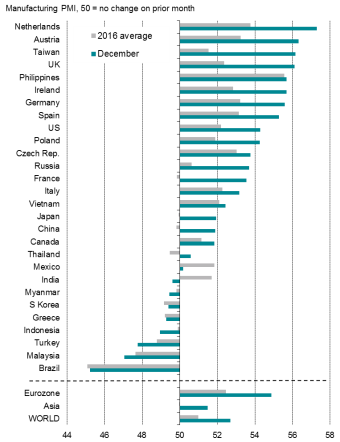

Expansions were recorded in 20 countries in December with only eight reporting deteriorations. The strongest improvement was seen in the Netherlands, followed by Austria, while Brazil recorded the steepest decline, followed by Malaysia.

Worldwide manufacturing PMI rankings

Japan's ranking is based on the flash PMI.

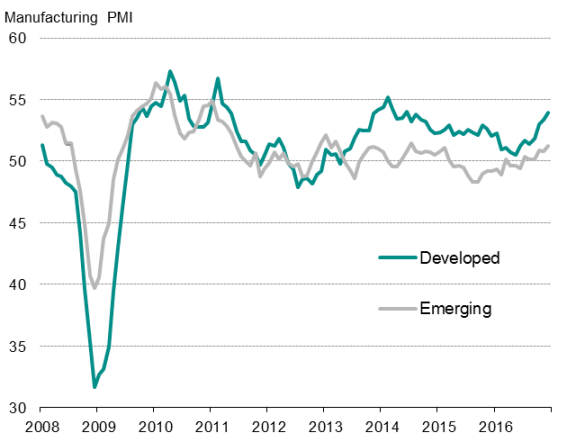

While both developed and emerging markets are seeing improved performance, with December's PMI readings being the highest in over two years in both cases, the latest survey pointed to developed/emerging market divergences.

Broad developed world upturn

The developed world's growth momentum is broad-based. The US Manufacturing PMI hit a 21-month high in December, while a two-and-a-half year high was seen in the UK. In the Eurozone, manufacturing conditions improved to the greatest extent since April 2011. Japan also saw growth accelerate, the flash PMI rising to its highest for nearly a year.

While developed world growth picked up across all major economies, the drivers of those expansions varied. In the US, the strong dollar curbed export growth slightly but producers benefitted from rising demand in the home market. In the UK, Eurozone and Japan, it was the weakness of currencies, notably against the US dollar, that played a role in driving output higher.

Emerging markets stymied by lack of exports

With the exception of long-suffering Greece, all of eight countries reporting declines in December were so-called emerging markets. Emerging markets as a whole consequently continued to trail behind the developed world in December. The emerging market PMI of 51.2 compared with a developed world reading of 54.0.

However, the deteriorating conditions seen in seven emerging economies were countered by strong performances in countries such as Taiwan, the Philippines and Vietnam, as well as the strongest expansion in China for just under four years.

A key element of the developed/emerging divergence, which has been evident since early-2013, is trade, and specifically the underperformance of emerging market exports compared to the developed world. In December, emerging markets as a whole saw new export orders more or less stagnate (having failed to record any significant growth over the last two years) while the developed world saw exports rise at a rate identical to the 27-month high seen in November.

Developed v emerging markets

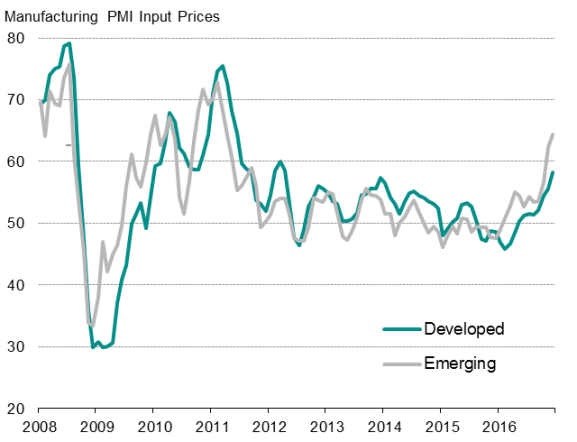

Price hikes exacerbated by strong dollar

A side effect of the stronger growth in global production is an accompanying rise in commodity and raw material prices. This has been exacerbated in countries where weakened exchange rates have pushed up the cost of US dollar denominated imports.

Average input costs rose globally at the fastest rate for just over five-and-a-half years in December, with emerging markets recording a significantly higher rate of increase than the developed world. However, rich-world countries where the exchange rate has fallen against the dollar (notably the UK and euro area) are also seeing prices spike higher.

Manufacturing input prices

Worldwide manufacturing PMI input price rankings

Sources for charts: JPMorgan, Nikkei, Caixin, IHS Markit.

Employment trends diverge

A further variance has been employment. Emerging market producers, faced with a higher rate of input cost inflation and stagnant exports, reported a drop in factory headcounts for a twenty-second straight month in December. By contrast, developed world producers took on extra staff at the strongest rate since May 2011.

Exports

Employment

Sources: IHS Markit, JPMorgan, Nikkei, Caixin.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03012017-Economics-Global-manufacturing-ends-2016-with-fastest-growth-for-nearly-three-years.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03012017-Economics-Global-manufacturing-ends-2016-with-fastest-growth-for-nearly-three-years.html&text=Global+manufacturing+ends+2016+with+fastest+growth+for+nearly+three+years","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03012017-Economics-Global-manufacturing-ends-2016-with-fastest-growth-for-nearly-three-years.html","enabled":true},{"name":"email","url":"?subject=Global manufacturing ends 2016 with fastest growth for nearly three years&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03012017-Economics-Global-manufacturing-ends-2016-with-fastest-growth-for-nearly-three-years.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+manufacturing+ends+2016+with+fastest+growth+for+nearly+three+years http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03012017-Economics-Global-manufacturing-ends-2016-with-fastest-growth-for-nearly-three-years.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}