Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 02, 2015

Week Ahead Economic Overview

The release of services PMI results will provide data watchers with more insights into global economic trends in September. Meanwhile, industrial production and trade data are published across Europe. The policy highlights are the release of FOMC minutes and the announcements of the Bank of England's latest monetary policy decision.

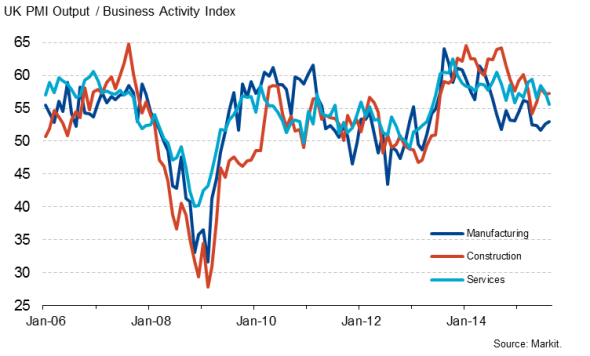

There have been mixed signals on the health of the UK economy in recent months. On the one hand,strong pay growth and a tight jobs market favour a rise in interest rates. Moreover, one of the nine members of the Monetary Policy Committee, Ian McCafferty, has already warned that inflation could overshoot the bank's target in two to three years' time, if "we do not act soon". He was the only MPC member that voted for a rate rise at the banks latest meeting. However, weak retail sales and a slowing economy as signalled by recent PMI results are arguments against a rate hike, and Bank chief economist Andy Haldane also reminds us that the next move in policy could even be a loosening. It is therefore widely expected that the Bank of England will leave interest rates unchanged at its October meeting on Thursday.

UK PMI Output/ Business Activity Index

Before the MPC meeting, Markit releases its services PMI results on Monday. UK services activity grew at the weakest rate in over two years in August and companies also reported a reduced rate of new business growth.

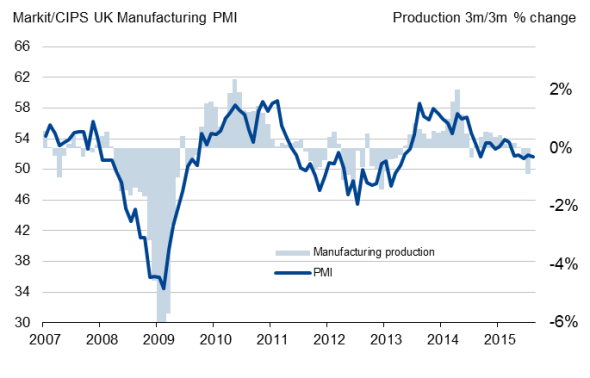

Meanwhile, the Office for National Statistics (ONS) releases UK industrial output numbers for August. Production had fallen for two months running, highlighting a possible return to recession in the industrial sector. The release of construction output and trade data will also add to the policy debate, especially as a question mark hangs over the quality of UK trade data. Although official data showed that a surge in overseas trade boosted the UK economy in the second quarter, survey data suggest that exporters are enduring a far tougher time in the battle to win overseas sales than indicated by the official data.

UK manufacturing production and the PMI

In the US, the Federal Open Market Committee releases minutes from one of the most eagerly awaited monetary policy meetings in recent times, in which the Fed decided to keep interest rates on hold. Speculation has shifted to December as the next most likely month for US rates to start rising. The "data dependent' Fed will want to see a pick-up in non-farm payroll growth between now and then, as well as indications that the pace of economic growth is not wilting under the pressure of China's slowdown.

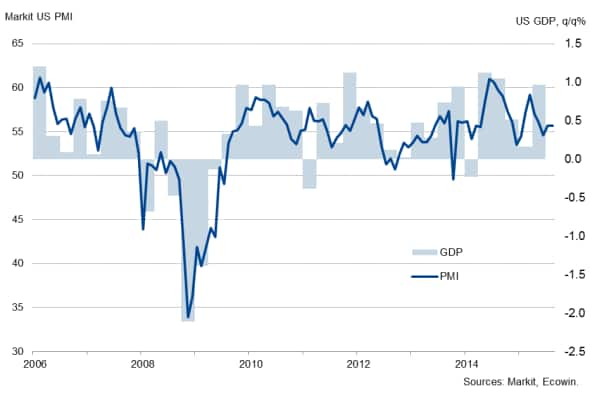

Further insights into the health of the US economy are offered by final services PMI results, which are released on Monday, after flash data pointed to slowing growth in the world's largest economy. Although the surveys suggest the economy expanded at a 2.2% annualised rate in the third quarter, growth slowed in September and could weaken further in coming months. Moreover, average prices charged for goods and services fell at the steepest rate since the survey began in 2009, suggesting US consumer price inflation could weaken in coming months. With growth slowing, warning lights flashing and prices falling at the fastest rate for at least six years, the survey data play into the hands of dovish policymakers and will reduce the odds of interest rates rising any time soon.

US GDP and the PMI

A number of countries in the eurozone see the release of industrial production data, including France, Germany, Greece, Italy and Spain. According to business survey data, manufacturing continued to expand at a healthy, although unspectacular, rate in September. Encouragingly, France moved back into expansion territory, but growth slowed in Spain and Germany and production contracted further in Greece. The sector is therefore likely to only have a minor boost to overall GDP growth in the third quarter. Further insights into the eurozone's private sector performance are provided by services PMI results.

Eurozone policy makers will also be eager to see how the retail sector is faring in the third quarter. Official data are published by Eurostat, while PMI results are released by Markit. Business survey data signalled a further rise in retail sales in August. Despite the index signalling a much weaker increase in sales than in July (54-month high), the data were still consistent with a rise in consumer spending in the region. PMI results for September will provide a clearer picture of the underlying trend for consumer spending at the end of Q3.

Monday 5 October

Services and whole economy PMI results are released worldwide.

The AIG Services Index is released in Australia.

Russia sees the publication of consumer price figures.

Meanwhile, business confidence data are issued in South Africa.

Retail sales figures and the latest Sentix Index are out in the eurozone.

Tuesday 6 October

In Australia, Canada and the US, trade balance data are published.

The Reserve Bank of Australia announces its latest interest rate decision.

The Eurozone Retail PMI is released by Markit.

Germany sees the release of industrial orders numbers.

Meanwhile, the Office for National Statistics issues industrial production numbers for the UK.

Wednesday 7 October

Global sector PMI results are issued by Markit.

The Bank of Japan issues a statement on monetary policy.

New home sales numbers and the AIG Construction Index are published in Australia.

Japan's Cabinet Office releases its Leading Economic Index.

Meanwhile, trade data are issued in France and Russia.

Industrial output numbers are published in Germany and Spain.

Building permit figures are out in Canada.

Thursday 8 October

Current account data are out in Japan.

Manufacturing and mining production figures are meanwhile released in South Africa.

In Germany, trade data are published by statistics agency Destatis.

Greece sees the release of unemployment figures.

The latest KPMG/REC UK & English Regions Report on Jobs is released. Moreover, The Bank of England announces its latest monetary policy decision and releases minutes of the meeting.

House price data are out in Canada.

In the US, consumer credit and initial jobless claims numbers are issued.

Friday 9 October

Industrial output numbers are published in France, Italy and Greece, with the latter also seeing the release of consumer price data.

Construction output and trade data are issued by the Office for National Statistics in the UK.

In Canada, employment numbers are released.

Import and export price and wholesale inventory data are out in the US.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02102015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02102015-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02102015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02102015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02102015-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}