Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 02, 2016

Week Ahead Economic Overview

Service sector and whole economy PMI results will provide additional information on global economic trends in the third quarter. Meanwhile, industrial production results are out in Germany and the UK. The policy focus turns to the European Central Bank as it announces its latest monetary policy decision.

All eyes will turn to the European Central Bank on Thursday as indications have grown that the Bank may introduce more stimulus. On the one hand, low inflation, high unemployment and subdued economic growth are clear signs that could push the ECB towards further action. On the other hand, French central bank chief Francois Villeroy de Galhau, who sits on the ECB's Governing Council said that the bank should stick to its current monetary policy stance, adding that "monetary policy cannot and should not be overburdened". Whether or not the ECB will take further action will therefore be a close call.

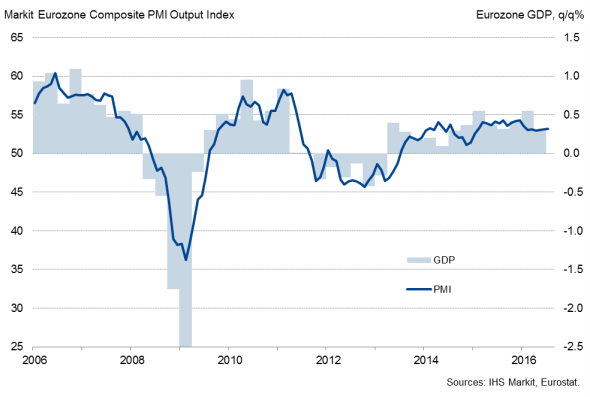

Eurozone GDP and the PMI

The week also sees the release of industrial production data for some of the region's largest economies. In Germany for example, the latest IHS Markit forecast sees industrial production having risen 0.7% in July, and recent PMI data suggest that industry should have a positive contribution to overall GDP growth in the third quarter. In the second quarter, the sector acted as a drag on growth, linked largely to some payback from an exceptionally strong first quarter. Final services and retail PMI results will meanwhile provide more information on economic trends across the euro area.

In the UK, industrial production results are eagerly awaited, after July's UK Manufacturing PMI signalled the strongest decline in the sector since early-2013. We therefore expect the official data to point to a fall in the official measure for industrial production (the latest IHS Markit forecast predicts a 0.7% decrease). However, there was more positive news for UK manufacturing in August, with the business surveys indicating a solid rebound in the sector's performance and adding to hopes that any contraction will be short-lived. Construction output numbers, trade data and the Services PMI are also released during the week.

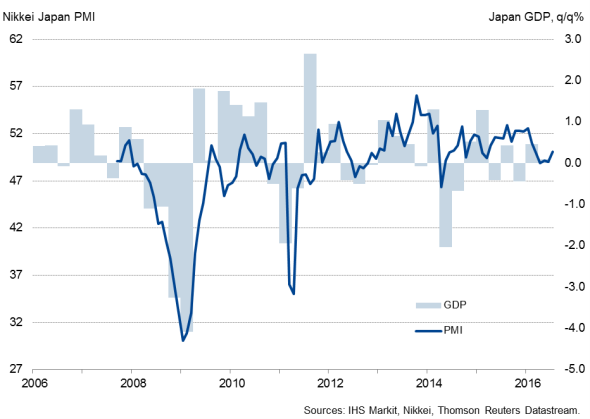

Over in Asia, revised second quarter GDP results are published in Japan. The preliminary estimate saw the Japanese economy come to a near halt, posting just 0.2% annualised growth. The latest poll by Reuters suggests that GDP will be revised down to 0.0%, which would be broadly in line with signals sent by the Nikkei PMI (the average PMI reading over the second quarter was 49.4). Meanwhile, China sees the release of latest inflation and trade numbers.

Japan GDP and the Nikkei PMI

The search for clues to whether the Federal Reserve will raise US interest rates again this year meanwhile continues. The "data dependent" Fed will pay particular interest to survey results from both ISM and Markit and eye the latest mortgage data.

Monday 5 September

Service sector and whole economy PMI results are published worldwide.

The AIG Services Index and business inventory data are released in Australia.

In Russia, latest inflation figures are issued.

The Eurozone Sentix Indicator and retail sales numbers are published in the currency union.

Tuesday 6 September

In Australia, current account data are updated. Moreover, the Reserve Bank of Australia announces its latest monetary policy decision.

South Africa and the eurozone see the release of updated second quarter GDP results.

The Eurozone Retail PMI is published.

Factory orders numbers are issued by Destatis in Germany.

The British Retail Consortium publishes retail sales figures.

ISM non-manufacturing and Markit services PMI results and data on employment trends are out in the US.

Wednesday 7 September

Global sector PMI results are published.

Second quarter GDP numbers are updated in Australia.

Business confidence data are out in South Africa.

Destatis releases industrial production figures for Germany, while current account and trade numbers are issued in France.

In the UK, Halifax releases house price data, while the Office for National Statistics publishes industrial production figures.

The Bank of Canada announces its latest monetary policy decision.

Mortgage data are meanwhile issued in the US.

Thursday 8 September

Australia sees the release of trade data.

Revised second quarter GDP results and current account data are meanwhile published in Japan.

In China, latest trade data are out.

Manufacturing production numbers are issued in South Africa.

The European Central Bank announces its latest monetary policy decision.

Revised second quarter non-farm payroll figures are released in France.

Results from the latest RICS Housing Survey are issued in the UK. Moreover, the latest REC UK & English Regions Report on Jobs is released.

Building permit and house price data are meanwhile published in Canada.

Initial jobless claims numbers are released in the US.

Friday 9 September

Mortgage lending data are issued in Australia.

China sees the release of inflation figures.

Trade data are published in Germany and Russia, with the latter also seeing the release of revised GDP numbers.

Industrial production figures are updated in France and Spain.

In the UK, construction output and trade data are released by the Office for National Statistics.

Consumer credit and wholesale inventory numbers are issued in the US.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02092016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02092016-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02092016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02092016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02092016-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}