Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 02, 2014

US-listed foreign dividends grow to over $14bn

With a growing portion of US companies choosing to head across the border for tax purposes, we look at the current proportion of S&P 500 dividends coming from companies domiciled outside of the US.

- Dividends from foreign domiciled companies account for 3.8% of total S&P dividends

- Internationally domiciled companies are expected to grow their dividends by a greater proportion than the rest of the index

- Schlumberger and LyondellBasell are the two largest foreign domiciled dividend payers

US companies have gained an appetite for international relocation in the latest wave of M&A deals. While US companies have long had a penchant for international domiciles, and the tax advantages they bring, the recent pace has some US lawmakers alarmed, with the Treasury Department stating that it was "reviewing a broad range of authorities for possible administrative actions that could limit the ability of companies to engage in inversions, as well as approaches that could meaningfully reduce the tax benefits after inversions take place".

While it's still too early to tell what those broad ranges might be, we look at the proportion of total US dividends paid by companies in the S&P 500 with an international tax domicile in the wake of the recent wave of corporate tax inversion. It's worth noting that payments made by foreign companies listed in the US are eligible for "qualified dividend' status on par with those made by domestic companies and that we make no speculation of any change to the current status quo.

Foreign dividends share of total

There are currently 27 constituents of the S&P 500 index which hold a foreign tax domicile. Of these 27 firms, 25 are forecasted to make a dividend payment to shareholders in the coming fiscal year, according to Markit Dividend Forecast. Foreign domiciled companies have a greater propensity to pay dividends as the current proportion of foreign domiciled constituents that are forecasted to pay dividends (93%) is greater than the 86% seen in the overall index.

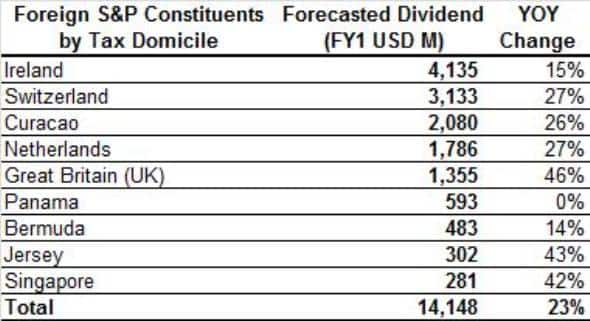

These payments are expected to total $14.1bn for the coming fiscal year, with foreign domiciled S&P 500 constituents contributing 3.8% of the forecasted aggregate payments for the index.

Sector wise, the three foreign listed energy firms will represent nearly a third of total foreign domiciled payments with $4.2bn of aggregate forecasted payments. This is led by Schlumberger which is expected to make $2.08bn of payments.

Foreign payments expected to outpace the index

The forecasted payments from foreign constituents are set to grow at a faster pace than the rest of the index.

The latest forecast for the coming fiscal year represents a 23% lift on the previous year's total, which is nearly two and a half times the growth seen by the overall index forecast.

Schlumberger is again expected to lead the way as its payment is forecasted to jump by $424m in the coming fiscal year.

Chemical firm LyondellBasell Industries, which is forecasted to make the largest aggregate foreign payment, is also expected to boost its payment by a healthy amount with a 26% jump in total pay-out.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02092014US-listed-foreign-dividends-grow-to-over-14bn.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02092014US-listed-foreign-dividends-grow-to-over-14bn.html&text=US-listed+foreign+dividends+grow+to+over+%2414bn","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02092014US-listed-foreign-dividends-grow-to-over-14bn.html","enabled":true},{"name":"email","url":"?subject=US-listed foreign dividends grow to over $14bn&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02092014US-listed-foreign-dividends-grow-to-over-14bn.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US-listed+foreign+dividends+grow+to+over+%2414bn http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02092014US-listed-foreign-dividends-grow-to-over-14bn.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}