Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 02, 2016

UK construction in deepest downturn since 2009

UK construction activity fell sharply for a second successive month in July, pointing to an ongoing impact of Brexit-related worries.

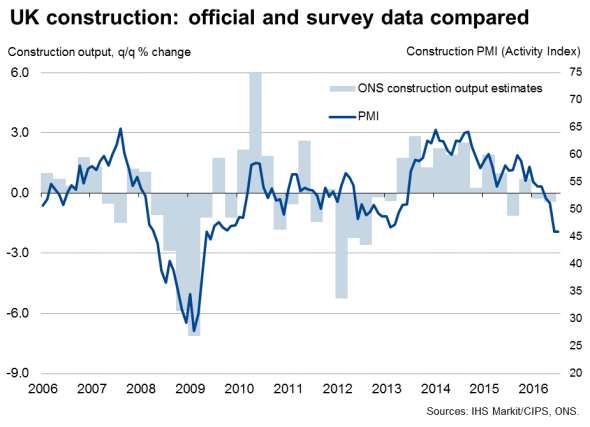

The Markit/CIPS Construction PMI edged lower from 46.0 in June to 45.9 in July, signalling a rate of decline not seen since June 2009.

While the June data has mainly reflected business activity prior to the June 23rd referendum, the July data were collected between 12th and 28th July inclusive.

Just 15% of firms reported higher activity in July against 23% reporting a decline.

The poor start to the third quarter deals a further blow to a sector that was already in recession in the second quarter and has been greatly underperforming the rest of the economy, according to official data.

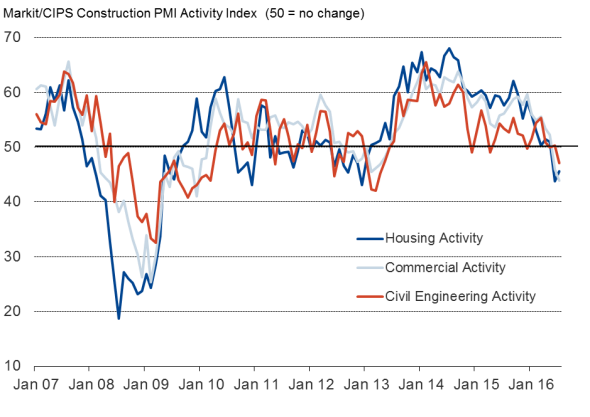

Whereas a marginal rise in civil engineering had helped to moderate the rate of decline in June, the drop in activity in July was broad-based as civil engineering activity suffered the largest monthly fall since April 2013.

However, the sharpest downturn came in commercial activity, which fell for a second month running and at the fastest rate since December 2009. The decline points to slumping business investment in property such as offices, industrial units and retail space.

Housebuilding also fell sharply, down for a second straight month but at a slightly slower pace than in June. The average drop over the past two months has nevertheless been the most severe for seven years.

Construction activity by sector

Sources: IHS Markit, CIPS

Business expectations about activity levels over the coming year eased to the lowest since April 2013, but it should be noted that the number of optimists continues to exceed pessimists (in fact some 41% citing optimism against just 15% that are pessimistic).

Employment likewise fell, down for the first time in just over three years, as firms scaled back capacity. Similarly, use of subcontractors fell to the greatest extent in nearly three years.

A ray of hope was provided, however, by the rate of decline of new orders easing slightly compared to June's three-and-a-half year record, though it was still worryingly steep.

There were mixed signals on inflationary pressures. While prices for materials spiked higher as the weak pound caused import prices to rise, showing the largest monthly rise since March of last year, rates charged by subcontractors showed the smallest rise for just over three years as firms competed for business on price.

Recession risk

If the construction PMI is combined with the final manufacturing and the flash services PMI, the 'all sector' PMI will have sunk to 47.3 from 51.9. As well as the surveys potentially signalling the steepest fall in business activity since April 2009, the possible turnaround in the index (4.6 point drop) would be the largest ever deterioration recorded since the surveys began in 1997. We await tomorrow's final services PMI for an updated signal.

While we remain cautious about reading too much into the survey signals from months in which both political and economic uncertainty was so intense, the data raise the prospect of the economy sliding into decline in the third quarter and entering recession.

Policy stimulus on the cards

The extent of any downturn remains highly uncertain, and dependent on any policy reaction to the weak data. It seems likely that this week will see the Bank of England take interest rates down to at least a record low of 0.25%, and also discuss the possibility of further non-standard measures such as additional quantitative easing and a revival of the Funding for Lending Scheme. Pressure has mounted, however, for policymakers to show new creativity in finding ways to stimulate demand.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02082016-Economics-UK-construction-in-deepest-downturn-since-2009.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02082016-Economics-UK-construction-in-deepest-downturn-since-2009.html&text=UK+construction+in+deepest+downturn+since+2009","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02082016-Economics-UK-construction-in-deepest-downturn-since-2009.html","enabled":true},{"name":"email","url":"?subject=UK construction in deepest downturn since 2009&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02082016-Economics-UK-construction-in-deepest-downturn-since-2009.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+construction+in+deepest+downturn+since+2009 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02082016-Economics-UK-construction-in-deepest-downturn-since-2009.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}