Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 02, 2015

UK construction sector sees post-election rebound as confidence hits nine-year high

UK building activity rebounded in May after showing the smallest rise for almost two years in April, and looks set to strengthen further in coming months.

The Markit/CIPS Construction PMI rose from a 22-month low of 54.2 in April to 55.9 in May. Although signalling stronger growth, the PMI remains well below the average of 59.0 seen in the first quarter, attributed in many cases to uncertainty caused by the general election.

When viewed alongside the disappointingly modest growth seen in the manufacturing sector in April and May, the slowdown in construction in the second quarter puts the onus on the service sector to help the economy achieve any rebound from the lacklustre 0.3% GDP rise seen in the first quarter.

The picture is perhaps brighter looking further ahead. There are clear indications from the survey that construction sector activity will revive further in the summer months, which bodes well for the economy's performance in the second half of the year.

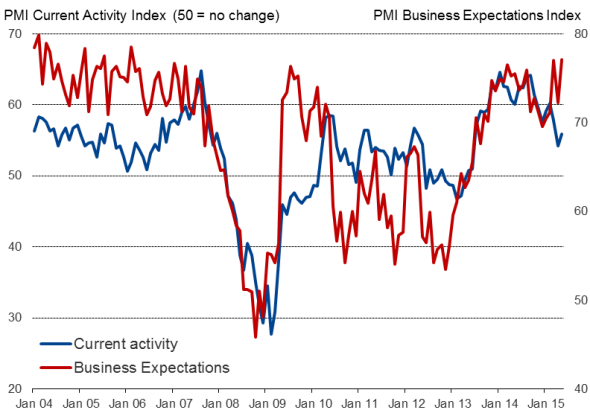

Firstly, companies' views on their business activity levels over the next year showed the greatest degree of optimism since February 2006. Firms are anticipating an upturn in housebuilding as well as increased investment in fixed assets such as offices, retail units and industrial floor space.

Future expectations v actual activity

Secondly, employment rose at the fastest rate since December as firms responded to the brightening prospects and increased levels of new work received during the month. Growth of new construction orders rebounded sharply from April's lull.

Employment

Strength of rebound in question

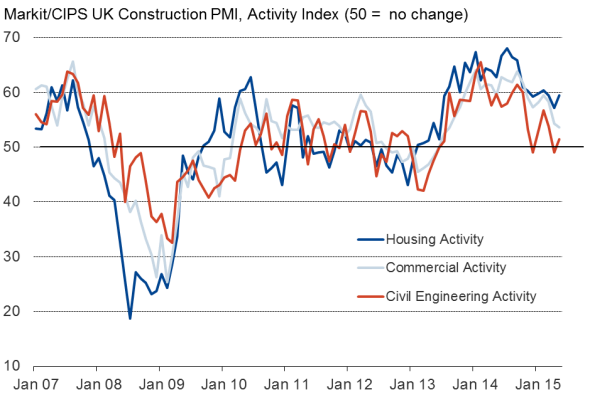

Despite the brighter signs for coming months, the strength of the rebound remains uncertain. Civil engineering activity, for example, has been showing signs of weakness since late last year, and ongoing austerity is likely to limit government-funded infrastructure spending. Planning bottlenecks also puts a limit on the extent to which housebuilding can continue to expand at the solid rate indicated by the PMI. EU membership uncertainty could also stymie business investment spending.

Construction activity by sector

Source: Markit.

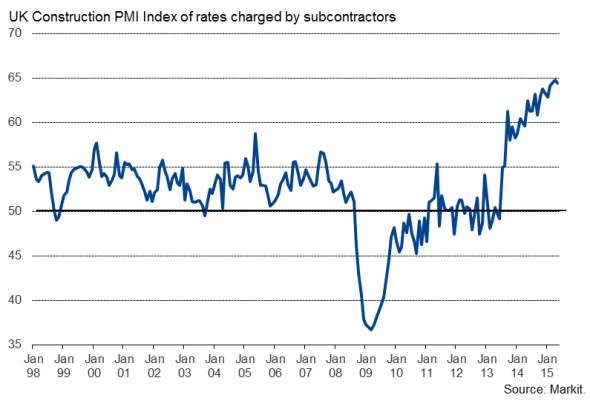

Higher interest rates could also cool growth in the sector: after all, the May survey showed sub-contractor pay rates continuing to rise at a rate not previously seen in the surveys 18-year history, and input prices also rose at a markedly higher rate than April, emulating a similar rise in manufacturing, as higher oil prices fed through the supply chain.

Subcontractor pay

Recession?

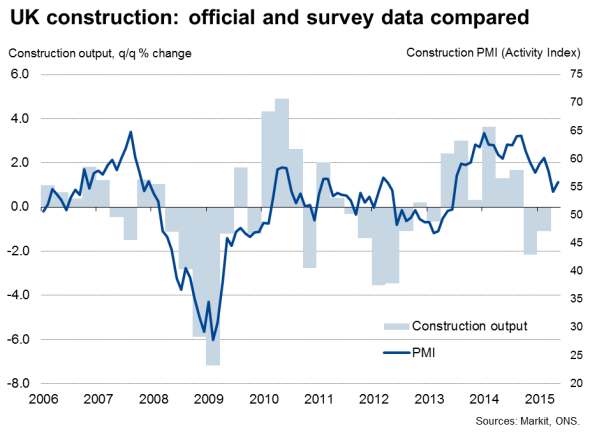

Finally, although signalling a slowdown in construction activity around the election, ongoing growth signalled by the PMI survey continues to paint a brighter picture of the sector than the official data. Data from the Office for National Statistics showed construction output contracting 1.1% in the first quarter. The fall, coming on the heels of a 2.1% decline in the final quarter of last year, puts the sector in a technical recession - something which seems at odds with not just the PMI, but also the continued robust corporate performance of construction firms in terms of earnings and dividend pay-outs. We continue to believe that the official data are under-recording recent growth in the construction sector.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02062015-economics-uk-construction-sector-sees-post-election-rebound-as-confidence-hits-nine-year-high.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02062015-economics-uk-construction-sector-sees-post-election-rebound-as-confidence-hits-nine-year-high.html&text=UK+construction+sector+sees+post-election+rebound+as+confidence+hits+nine-year+high","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02062015-economics-uk-construction-sector-sees-post-election-rebound-as-confidence-hits-nine-year-high.html","enabled":true},{"name":"email","url":"?subject=UK construction sector sees post-election rebound as confidence hits nine-year high&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02062015-economics-uk-construction-sector-sees-post-election-rebound-as-confidence-hits-nine-year-high.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+construction+sector+sees+post-election+rebound+as+confidence+hits+nine-year+high http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02062015-economics-uk-construction-sector-sees-post-election-rebound-as-confidence-hits-nine-year-high.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}