Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 02, 2015

Fast casual: shaking up the Big Mac Empire

Traditional fast food empires struggle to fend off fresh competition from younger companies as sales slump and analysts cut forecasts.

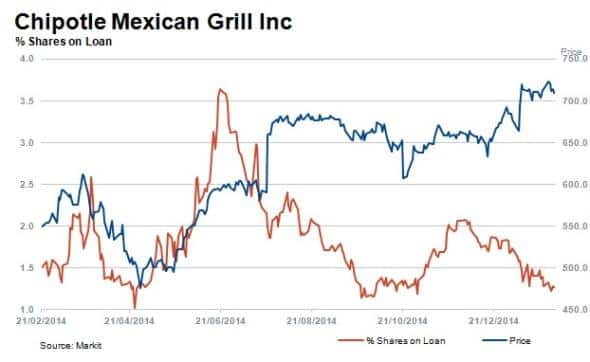

- Short sellers cover positions by 65% in Chipotle in the last year as growth continues

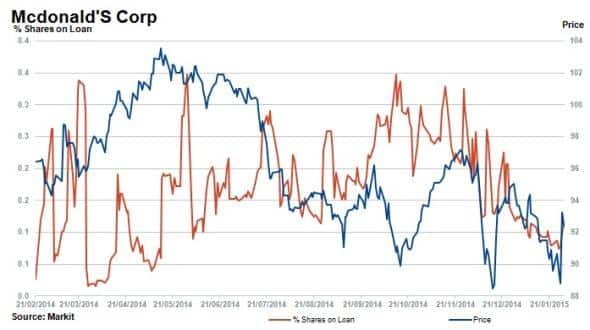

- McDonald's scored badly for sales growth coming into its latest earnings release

- Potbelly and Noodles and Co currently see high levels of short selling

Fast casual is the new phrase shaking up the Quick Service Restaurant (QSR) sector as relative newcomers continue to grab market share from established global chains. Consumers are opting for fast meals that are perceived to be healthier, more transparently sourced and prepared in front of their eyes, and they are seemingly more than happy to pay for the service.

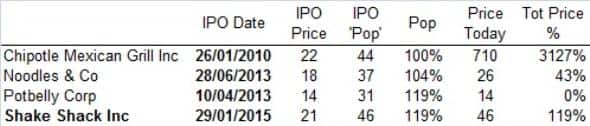

14 year old Shake Shack's recent IPO on January 29th did not disappoint investors looking for a pop in the share price. Shake Shack's 119% share price increase on its debut is comparable to other recent restaurant IPOs, including the hugely successful Chipotle which first opened its doors in 1993.

McDonalds, once a proud early stage investor in Chipotle, last week reported its first annual same-store sales decline in 12 years.

Besides battling burritos, noodles and pizza, the battle of the golden arches versus the premium burger is being fought by Shake Shack, Smashburger, and others which is manifesting in lower sales and earnings at the world's largest fast food chain, McDonald's.

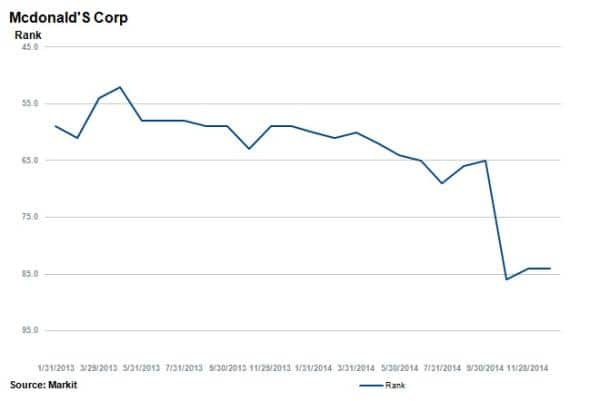

This has been evident in recent months, as McDonalds' rank in the 1 Year Change in Sales, a factor in Markit's Research Signals factor suite, fell significantly since the company's last earnings announcement. The company used to score in the middle of the group within restaurant constituents of the Markit US Large Cap universe, but its third quarter earnings saw it report falling year on year sales. As a result, the firm has fallen down the ranks to earn the 15th worse rank on a scale of 1-100.

The morning after the IPO

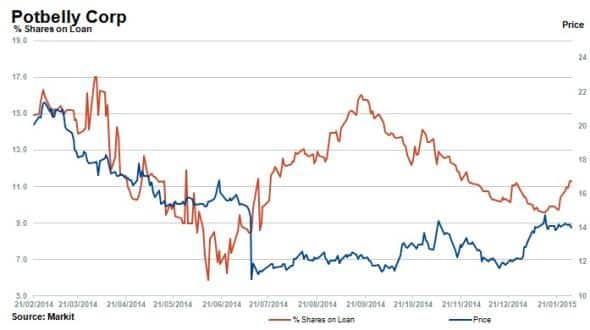

While Chipotle has given investors returns of over 3000% to feast upon since going public in 2006, some other recent IPOs of new chains have seen returns sour. Potbelly Corp and Noodles and Co went public in April and June 2013 respectively. Both stocks saw significant investor interest and demand, sending shares soaring over 100% on the first day of trading.

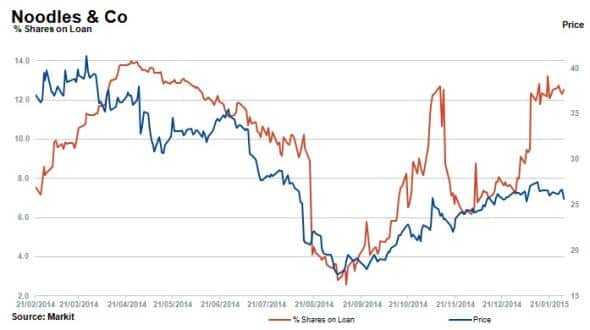

Subsequently, both companies delivered disappointing results in terms of price performance. To date, Noodles and Co has given up half of its gains, currently up by 43% since listing, while Potbelly has relinquished all gains and is back to square one with a 0% return since IPO.

Noodles and Potbelly have seen high levels of short interest standing at 12.5% and 11.3% respectively; three fold higher than that of their peers.

Shake Shack IPO: cooked to perfection or well done?

Shake Shack has just over 60 stores, with half located in the US, compared to McDonalds' 35,000 stores, spread across 100 countries. However, current market values for McDonalds and Shake Shack stand at $1.6bn and $90bn respectively, meaning that one Shake Shack store is worth approximately ten times more than a single MacDonald's store.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02022015-equities-fast-casual-shaking-up-the-big-mac-empire.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02022015-equities-fast-casual-shaking-up-the-big-mac-empire.html&text=Fast+casual%3a+shaking+up+the+Big+Mac+Empire","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02022015-equities-fast-casual-shaking-up-the-big-mac-empire.html","enabled":true},{"name":"email","url":"?subject=Fast casual: shaking up the Big Mac Empire&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02022015-equities-fast-casual-shaking-up-the-big-mac-empire.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Fast+casual%3a+shaking+up+the+Big+Mac+Empire http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02022015-equities-fast-casual-shaking-up-the-big-mac-empire.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}