Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 01, 2015

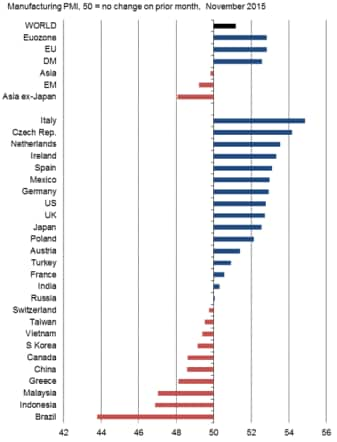

Eurozone economies dominate global manufacturing growth rankings

Global manufacturing remained stuck firmly in the slow lane in November, hindered by slumping demand in many key emerging markets.

The J.P.Morgan Global Manufacturing PMI", compiled by Markit, dipped from 51.3 in October to 51.2 in November, registering another month of weak industrial expansion. The survey is broadly consistent with global factory output rising at an annual rate of just under 2% in the fourth quarter so far. However, this is an improvement after the even-slower growth seen in August and September.

Global factory output

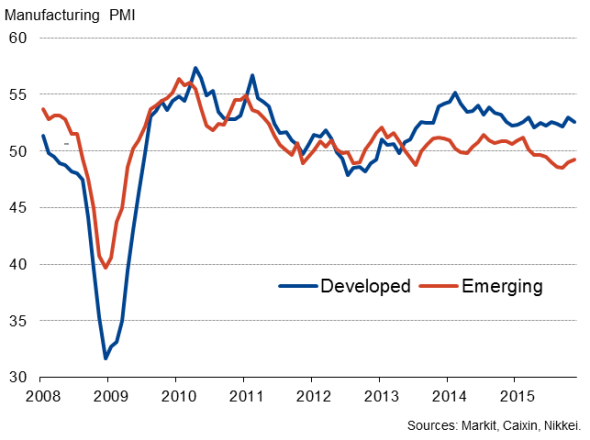

Asia ex-Japan remained the major drag on global manufacturing growth, despite seeing the smallest contraction for five months. The malaise seen in emerging Asia contributed to a further drop in worldwide emerging market activity, contrasting with ongoing growth in the developed world. However, the differential narrowed, due to a slower pace of expansion in developed countries while the emerging markets saw the smallest decline since June.

Developed world growth was led by European countries, though the US and Japan also enjoyed ongoing solid expansions during the month.

Global trade flows remained disappointingly meagre. The surveys New Export Orders Index registered only slightly above 50 for a second successive month, although this was better than the declines seen in the prior three months.

The hiring trend also remained weak, as rising developed world employment was offset by a decline in the emerging markets, especially Asia ex-Japan.

Firms benefitted, however, from a third consecutive monthly fall in average input costs, widely linked to lower commodity prices, notably oil. Average selling prices meanwhile fell for the fifth month running, suggesting lower costs continued to be passed onto customers.

November manufacturing PMI rankings

Sources: Markit, JPMorgan, Nikkei, Caixin.

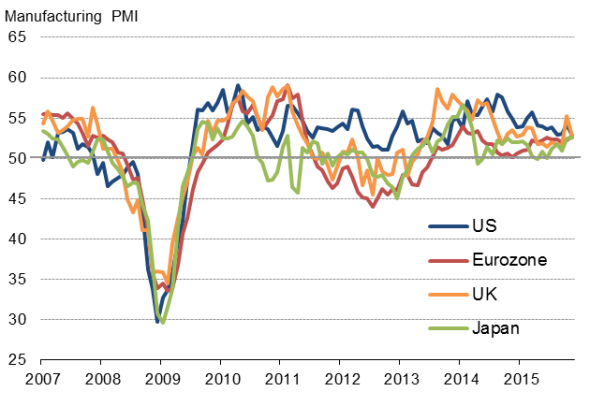

Developed world growth differentials linked to exchange rates

The five fastest growing manufacturing economies were all found in Europe, and with the exception of the Czech Republic were all eurozone members. Italy jumped to the head of the rankings for the first time ever in the PMI surveys' history, with strong growth also being recorded in the Netherlands, Ireland and Spain, as well as Germany in seventh place. The Eurozone as a whole saw the fastest rate of expansion for just over one-and-a-half years, with firms benefitting in particular from export competitiveness being aided by the weaker euro.

A surge in exports, likewise linked to a weak currency, pushed the Nikkei PMI for Japan to a 20-month high, propelling Japan up the growth rankings.

Growth slowed in the US, however, partly linked to falling exports as the stronger dollar appeared to have taken its toll on trade, leading to a drop in export orders. However, robust domestic demand ensured the US PMI remained in healthy expansion territory.

Growth also slowed in the UK, despite exports rising at the fastest rate for over a year. While the strong pound has hurt competitiveness, UK producers are enjoying the benefit of reviving growth in their main export market, the euro area. However, domestic sales appear to be being hit by import substitution.

Developed and emerging markets

Developed world

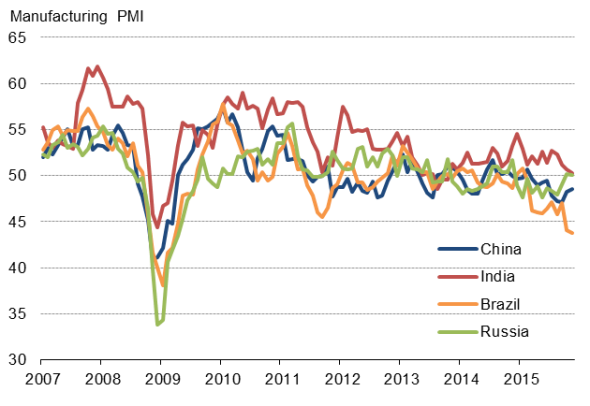

Emerging markets dominate foot of table

Brazil remained at the bottom of the table, with its PMI signalling the steepest monthly deterioration in business conditions since the height of the global financial crisis in March 2009.

Malaysia and Indonesia also suffered particularly sharp downturns, linked to weak global trade flows and a knock-on effect of China's slowdown. China was fifth from the bottom of the PMI table, just ahead of Greece, though its PMI showed a welcome easing in the rate of decline to suggest that the recent slowdown in the world's largest manufacturing economy may be easing.

South Korea, Taiwan and Vietnam also experienced weakened manufacturing activity, while growth slowed to near stagnation in India, rounding off a disappointing month for Asian producers. Canada also remained near the foot of the rankings, reflecting weak global demand for its commodities.

There was better news in Russia, where the PMI held above 50 for a second successive month, albeit merely signalling only marginal growth after ten months of continual decline, but at least pointing to stabilisation.

Main emerging markets

Sources: Markit, Nikkei, Caixin.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122015-economics-eurozone-economies-dominate-global-manufacturing-growth-rankings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122015-economics-eurozone-economies-dominate-global-manufacturing-growth-rankings.html&text=Eurozone+economies+dominate+global+manufacturing+growth+rankings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122015-economics-eurozone-economies-dominate-global-manufacturing-growth-rankings.html","enabled":true},{"name":"email","url":"?subject=Eurozone economies dominate global manufacturing growth rankings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122015-economics-eurozone-economies-dominate-global-manufacturing-growth-rankings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+economies+dominate+global+manufacturing+growth+rankings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122015-economics-eurozone-economies-dominate-global-manufacturing-growth-rankings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}