Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 01, 2017

Week Ahead Economic Preview

Worldwide releases of August services PMI surveys will provide important steers on third-quarter growth and inflation trends for major economies. A number of central banks will also decide on monetary policy, with markets eagerly awaiting the latest ECB policy meeting. Other key data highlights include US trade and factory orders as well as updated GDP numbers for the euro area and Japan.

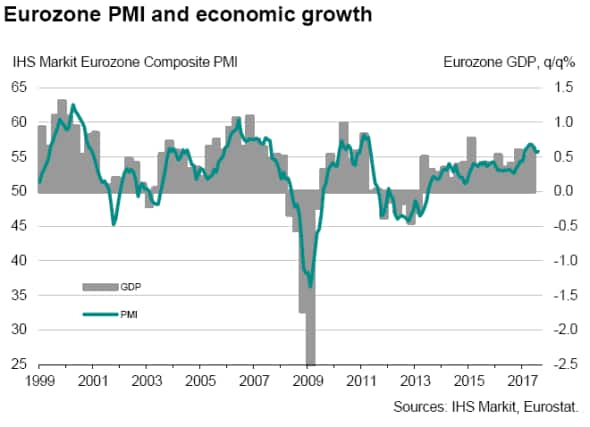

The ECB meeting next week is likely to see little action, but the focus is on any indications of when the central bank might begin tapering its asset purchases. Weak inflation remains a trouble spot for the central bank despite a strong economic recovery in the euro-area. The ECB is also worried that recent euro strength could be exacerbated by hawkish rhetoric, and may therefore pose as a threat to the upturn.

The Eurozone Services PMI survey will meanwhile provide more clues as to whether the impressive upturn and rising inflationary pressures are being sustained in the third quarter. The key question for policymakers is the extent to which these price pressures will feed through to consumers and wages.

In the US, updated data from the IHS Markit services PMI and ISM will be keenly watched for updated signs of the health of the economy in the third quarter and the timing of the next Fed interest rate rise. Markets are pricing in a roughly 40% probability of a December rate hike. Other key US data includes trade figures and factory orders, which would give further clues as to the health of US manufacturing sector.

A fresh batch of UK economic data wil provide details on GDP growth and labour market trends in the third quarter. Strong data will add fuel to recent hawkish sentiment among some Bank of England Monetary Policy Committee members. Services and construction PMI data for August will allow a clearer GDP estimate to be made for the quarter, accompanied by official trade, construction and industrial output data.

The REC recruitment industry survey will meanwhile provide clues as to whether the UK's recent impressive labour market performance has been sustained into August.

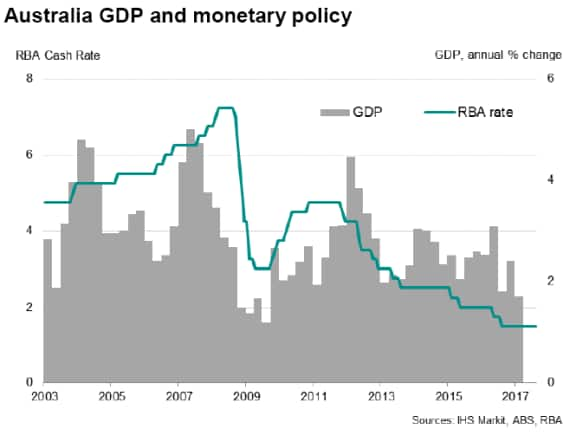

Second-quarter GDP data for Australia is expected to show that growth picked up from the first quarter, according to market forecasts. Accelerated economic activity will add to the recent flow of buoyant data, such as business investment and construction spending, and would be welcomed by the Reserve Bank of Australia. The central bank is deciding on interest rates in the same week, but no changes in monetary policy are expected. The policy rate has been maintained at a record low 1.5% since August 2016. Recent PMI data continued to indicate a solid upturn in the economy.

Download the report for a full diary of key economic releases.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092017-economics-week-ahead-economic-preview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092017-economics-week-ahead-economic-preview.html&text=Week+Ahead+Economic+Preview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092017-economics-week-ahead-economic-preview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092017-economics-week-ahead-economic-preview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092017-economics-week-ahead-economic-preview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}