Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 01, 2017

US PMI survey translates into disappointing signals for official manufacturing data

The latest US PMI survey showed a renewed stuttering of the manufacturing economy during August. The headline seasonally adjusted PMI fell from 53.3 in July to 52.8, the latest reading dropping below the average seen in the year-to-date and registering one of the weakest improvements in the overall health of the sector seen over the past year.

Weakened production trend

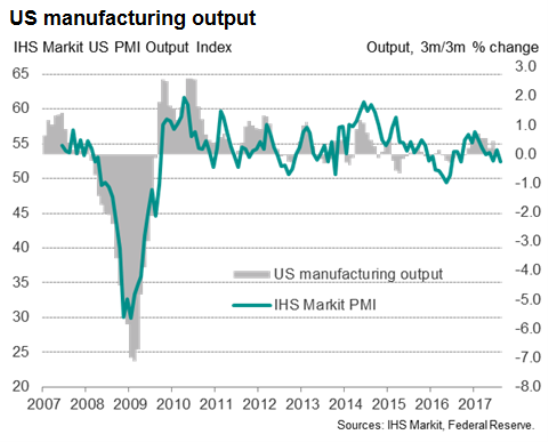

The drop in the PMI was largely the result of a decline in the survey's output index, which is one of five components of the PMI. The output index is an especially important sub-index to watch as it correlates closely with official factory production data. An 89% correlation is observed with the PMI's output index tracked against the three-month rate of change in the official data (a preferred measure as the three-month trend is more stable than month-on-month changes).

Although still above the 50.0 'no change' level at 52.4, indicating that the number of companies reporting an upturn in output exceeded the number reporting a decline, the current reading in fact translates into a weakening of official output data.

A simple regression which uses the PMI output index to explain changes in the official data series suggests that the latest PMI reading indicates a 0.3% quarterly rate of decline in factory output (or 1.2% annualised). Note that the regression suggests that an output index reading of 50 in fact translates into a 1.0% quarterly rate of decline in the official data (4.0% annualised).

So far for the third quarter, the July and August survey data are collectively pointing to a 0.1% decline in manufacturing output. This suggests a marked loss of growth momentum since the start of the year, when the index peaked at 56.7, indicating a 0.8% quarterly rate of expansion.

Order book malaise

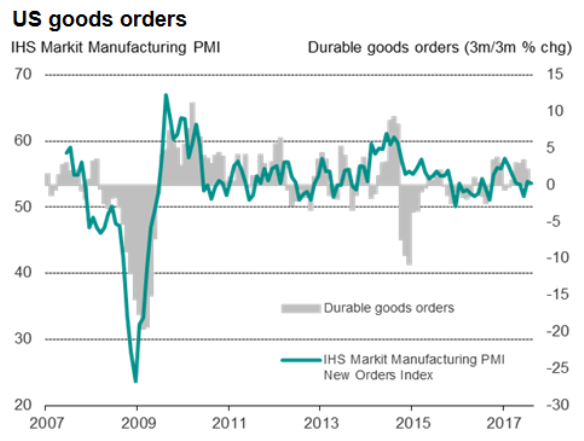

The weakened production trend is explained by slower growth of new orders compared with earlier in the year. The PMI's new orders index, which measures volumes of new work received relative to the prior month, fell to 53.6 in August compared to a peak of 57.4 in January.

Like the PMI output index, a reading of the new orders index of 50 in fact equates to a decline in the official factory orders data (when measured by three-month-on-three-month changes). The latest reading in fact points to an approximate stalling of demand as given by the official data on both new orders and durable goods orders.

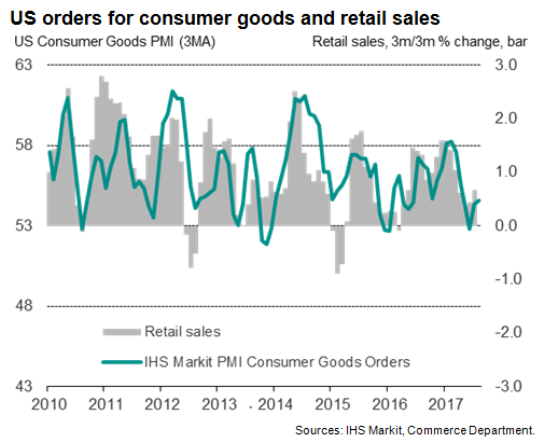

The principal area of weakness in the PMI's order book data was in new export orders, with companies reporting no overall growth during the third quarter so far. This has often been linked to the historical strength of the US dollar, which has left producers largely dependent upon domestic demand. The survey's index of new orders for consumer goods, for example, showed a further increase in demand, led by the home market, consistent with steady retail sales growth in the third quarter so far.

Disappointing employment trend

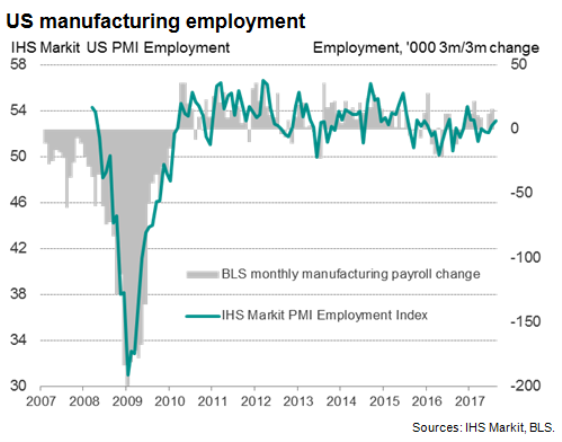

One bright spot in the August PMI survey was a rise in the employment index to a six-month high, suggesting firms were hiring in increased numbers. However, when compared to official data, the implied rate of job creation signalled by the survey is only modest.

The survey's employment index exhibits a 94% correlation with official manufacturing payroll data but, as with the output and new orders indices, an index reading of 50 does not equate to no change in the official data. A regression using the PMI's index to explain changes in the official employment data indicates that an index reading of 50 in fact signals a 27k monthly drop in the official payroll series. The latest reading of 53.1 translates into a mere 5k rise.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092017-Economics-US-PMI-survey-translates-into-disappointing-signals-for-official-manufacturing-data.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092017-Economics-US-PMI-survey-translates-into-disappointing-signals-for-official-manufacturing-data.html&text=US+PMI+survey+translates+into+disappointing+signals+for+official+manufacturing+data","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092017-Economics-US-PMI-survey-translates-into-disappointing-signals-for-official-manufacturing-data.html","enabled":true},{"name":"email","url":"?subject=US PMI survey translates into disappointing signals for official manufacturing data&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092017-Economics-US-PMI-survey-translates-into-disappointing-signals-for-official-manufacturing-data.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+PMI+survey+translates+into+disappointing+signals+for+official+manufacturing+data http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092017-Economics-US-PMI-survey-translates-into-disappointing-signals-for-official-manufacturing-data.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}