Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 01, 2017

Hung parliament set to benefit short sellers

UK short sellers are positioned to profit from a hung parliament through their large exposure to domestically exposed stocks.

- Short sellers continue to target domestically exposed stocks ahead of election

- Carillion most shorted UK firm while retailers continue to be targeted

- FTSE 350 short interest holds steady heading into election

UK short sellers are well positioned to profit from a slump in domestically exposed equities should a hung parliament ensue from next week's general election. Since last year's Brexit referendum, the market script for UK political uncertainty and a slump in the pound have driven a gap between domestic stocks and those that derive revenues from overseas. Short sellers have studied the script and are disproportionally targeting UK firms that earn a large portion of revenue from the British isle.

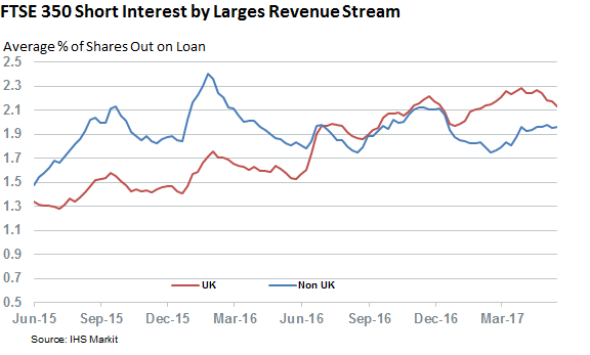

Shorts were initially ill prepared to profit from this phenomenon as the 211 FTSE 350 constituents which rely on the UK as their largest single market according to FactSet were less shorted on average than their overseas exposed peers. Short sellers have spent the last 12 months revising this position however as domestically exposed FTSE 350 constituents have gone on to see a 34% increase in average shorting activity. This surge means that short sellers are now most active in domestically exposed UK names due to greater average demand to borrow these shares relative to their overseas exposed peers.

Such a shift in strategy would suit short sellers well, as the pound has shown early signs of strain in the run-up to the UK general election. With the possibility of a hung parliament now back on the agenda, shorting UK firms may be a good hedge from the possibility of political uncertainty.

Short targets

Outsourcing firm Carillion is at the heart of the domestic short trade. The service provider, which relies on the UK for three quarters of its business, has seen demand to borrow its shares tick up to 25% of shares outstanding. Carillion results have so far managed to stay buoyant, a fact that seems lost on its share price, which has fallen by a third over the last 12 months. Short sellers are staying the course in Carillion, as its borrow demand has increased by 9% in the last month.

Mitie, which has a similar revenue and operating profile as Carillion, also finds itself in short sellers' crosshairs, with about 16% of its shares out on loan - enough to quantify the firm as the third most shorted FTSE 350 constituent.

Retailers are another favorite short target heading into the election; especially those which cater to non-essential purchases. The top non-essential retail shorts include online grocer Ocado, high street retailer Mark & Spencer and recently listed pet store operator Pets at Home.

Short sellers hold steady into election

The market has remained relatively steady since the election was called a little over six weeks ago. However, there are early indications that investors are seeking the safety of overseas firms: these shares have returned 2.5% on average over the last month, which is over a third more than the 1.8% returned by UK firms.

While short sellers were well positioned to profit from the recent bout of underperformance, bearish investors have yet to commit further capital to domestically exposed firm since the election got underway. In the last month, the average demand to borrow shares of FTSE 350 constituents has fallen slightly to 2.1% of shares outstanding; this lack of commitment is evidenced in the wider index that shows a slight decrease in borrowing demand.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062017-equities-hung-parliament-set-to-benefit-short-sellers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062017-equities-hung-parliament-set-to-benefit-short-sellers.html&text=Hung+parliament+set+to+benefit+short+sellers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062017-equities-hung-parliament-set-to-benefit-short-sellers.html","enabled":true},{"name":"email","url":"?subject=Hung parliament set to benefit short sellers&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062017-equities-hung-parliament-set-to-benefit-short-sellers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Hung+parliament+set+to+benefit+short+sellers http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062017-equities-hung-parliament-set-to-benefit-short-sellers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}