Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 01, 2016

Chinese factory job cull continues as manufacturing activity stumbles in May

Manufacturing operating conditions in China deteriorated at the fastest rate for three months in May, reflecting a renewed fall in new orders, declining output, destocking and ongoing job losses. Price pressures meanwhile persisted, largely on the back of rising global commodity prices.

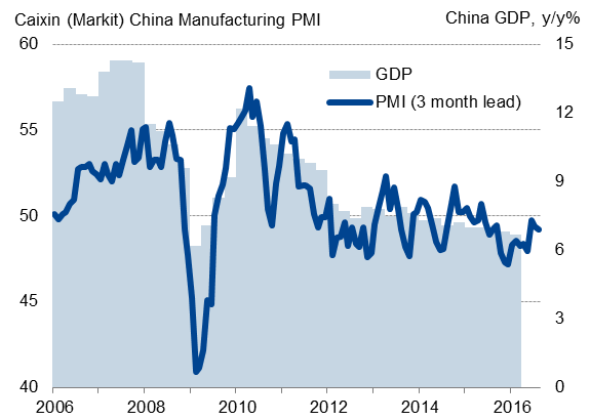

However, despite the slight deterioration in May, the underlying trend in activity appears to be one where the rate of decline bottomed out late last year. The average PMI reading over the past three months has been the highest since April of last year.

Manufacturing hit by weaker exports

The Caixin China General Manufacturing PMI", compiled by Markit from a representative sample of manufacturing firms across China, fell from 49.4 in April to 49.2 in May, its lowest reading since February.

Manufacturing PMI v GDP

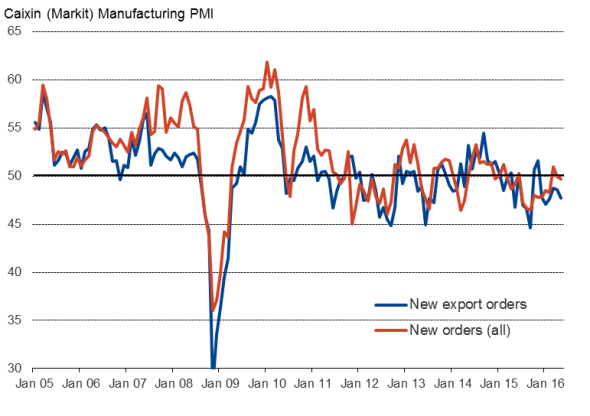

Having briefly returned to modest growth in March, output has shown marginal declines in the past two months, linked to a renewed fall in new orders (the first for three months) in May.

Order books were hit by an increased rate of decline in new export orders during May. Producers of investment goods such as plant and machinery reported the steepest decline in export sales, as well as reduced total new orders, pointing to weak domestic and global investment demand. In contrast, manufacturers of consumer goods reported improvements in new orders and exports.

Order books

The survey has now signalled 15 months of continual manufacturing decline with the trend deteriorating slightly again so far in the second quarter. That said, the rate of decline remains less severe than seen over the second half of 2015 and the opening months of 2016.

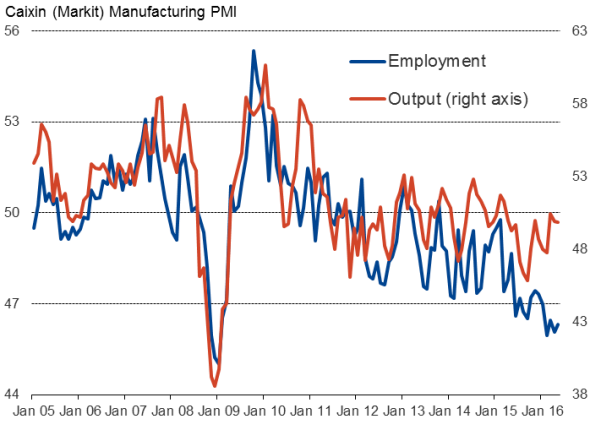

Steep job losses reported again

Companies nevertheless responded to the ongoing weak demand environment with a further marked cut in staffing levels, with the overall decline in employment similar to that seen in the prior three months.

Employment and output

Sources for all charts: Markit, Caixin.

The past year has seen the largest culling of factory jobs seen over the survey's 11 year history, exceeding that seen during the height of the global financial crisis as firms cut capacity to bring production in line with demand. So far this year, the highest incidence of job cutting has been seen in the energy & extraction, transport and chemicals & plastics sectors. The food & drink sector has seen the lowest rate of job cutting.

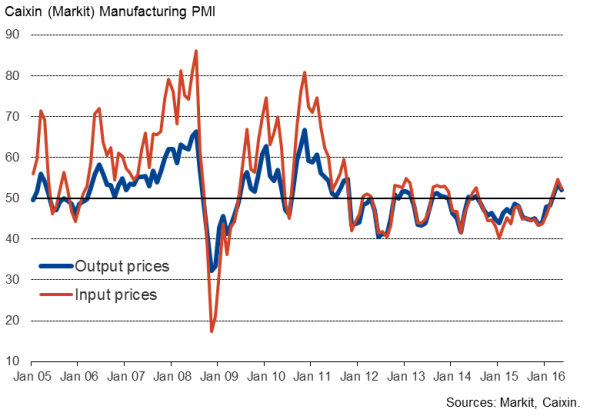

Price pressure highest since late-2011

Prices charged by manufacturers meanwhile rose for a third month running. Albeit down slightly on that seen in April, the last three months have seen the strongest upturn in charges since late-2011. However, the upturn in charges reflects rising costs as much as any improvement in pricing power, with average input costs also rising for a third consecutive month in May, due mainly to rising global commodity prices, notably oil.

Producer prices

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062016-economics-chinese-factory-job-cull-continues-as-manufacturing-activity-stumbles-in-may.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062016-economics-chinese-factory-job-cull-continues-as-manufacturing-activity-stumbles-in-may.html&text=Chinese+factory+job+cull+continues+as+manufacturing+activity+stumbles+in+May","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062016-economics-chinese-factory-job-cull-continues-as-manufacturing-activity-stumbles-in-may.html","enabled":true},{"name":"email","url":"?subject=Chinese factory job cull continues as manufacturing activity stumbles in May&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062016-economics-chinese-factory-job-cull-continues-as-manufacturing-activity-stumbles-in-may.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Chinese+factory+job+cull+continues+as+manufacturing+activity+stumbles+in+May http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062016-economics-chinese-factory-job-cull-continues-as-manufacturing-activity-stumbles-in-may.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}