Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 01, 2015

Malaysia's credit shines among Asean peers

Malaysia's sovereign credit has steadily improved as global oil prices have stabilised

- Malaysia's sovereign 5-yr CDS spread has tightened 27bps over the last two months

- Malaysian government bonds have had the best returns among the Asean nations in 2015

- Risks remain as the country diversifies away from oil revenues; 1MDB uncertainty

Last month Malaysia released its 11th five year economic development plan, in which the country plans to attain developed nation status by 2020.

The second largest natural gas exporter in the world also plans to target GDP growth of 5%+ over the next five years, outpacing the global economy. Malaysia's latest GDP reading, 5.6%, came in ahead of expectations and above the average for the Asean group. Even the knock-on effects of falling commodity prices over the last year have done little to dent Malaysia's growth momentum as it attempts to diversify away from oil revenue dependency.

Malaysian credit

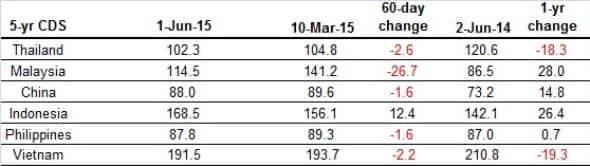

In the credit markets, the last few months have seen Malaysia become the stand out performer among its Asean peers. Malaysia's 5-yr CDS spread, which measures the cost to protect against sovereign debt default, has tightened 27bps over the last 60 days. In contrast, the next best performer among the Asean credits over the last 60 days has been Thailand, which has seen its credit spread tighten just 3bps to 102bps.

Indonesia was the only sovereign to see credit spreads widen, from 156bps to 169bps. The country has been struggling to reignite growth in a stalling economy, with latest GDP figures showing the slowest pace of growth for five years. The Philippines, the fastest growing among the ASEAN-5, has seen its credit spread converge on par with Asia's biggest economy, China, at 88bps.

Malaysia's recent outperformance has much to do with the stabilisation in global oil prices. The price of oil (WTI crude) bottomed out at $43 in mid-march and has since rebounded over the past month to reach $60. Malaysia generates around 30% of its revenue through oil, but has promised to reduce this to 15% by 2020 as it further diversifies the economy.

But it's worth noting that CDS spreads for Malaysia remains 28bps higher than levels seen one year ago. In fact, only Thailand and Vietnam, the smaller economies in the region, have seen year on year credit spread improvement.

Bonds

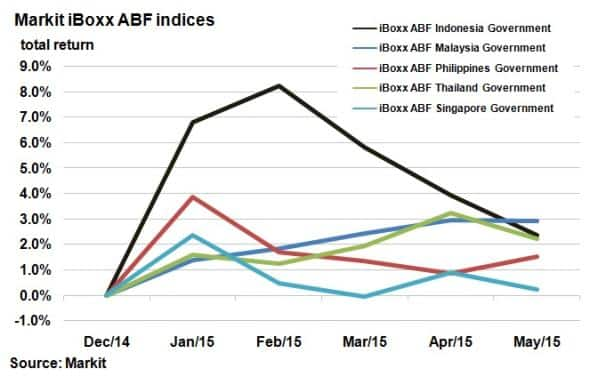

This year, Malaysian government bonds have outperformed Asean peers on a total return basis.

The Markit iBoxx ABF Malaysia Government index has returned 2.9% this year, ahead of the Markit iBoxx ABF Indonesia Government index and the Markit iBoxx ABF Thailand Government index which have returned 2.4% and 2.2% respectively.

These figures mark a sharp contrast in performance compared to the beginning of the year, when Malaysia was the laggard among its peers. But successive months of positive Malaysian returns coupled with negative monthly return among peers have made Malaysia the best performer year to date.

Indonesia, whose government bonds returned 8.2% in the first two months this year, has seen the majority of its gains wiped out.

Malaysian government 10-yr bonds yield around 4.06%, down from 4.3% at the start of the year, according to Markit's bond pricing service. Bonds have been less affected by the global sovereign bond selloff.

While Malaysia has been an outperformer this year on the credit front, risks remain. Oil revenue dependence will be a difficult to unshackle, while 1MDB, Malaysia's sovereign wealth fund, faces political disputes with possible systemic repercussions.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062015-credit-malaysia-s-credit-shines-among-asean-peers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062015-credit-malaysia-s-credit-shines-among-asean-peers.html&text=Malaysia%27s+credit+shines+among+Asean+peers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062015-credit-malaysia-s-credit-shines-among-asean-peers.html","enabled":true},{"name":"email","url":"?subject=Malaysia's credit shines among Asean peers&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062015-credit-malaysia-s-credit-shines-among-asean-peers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Malaysia%27s+credit+shines+among+Asean+peers http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062015-credit-malaysia-s-credit-shines-among-asean-peers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}