Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 01, 2015

PMI shows Vietnamese manufacturers performing strongly in Q2

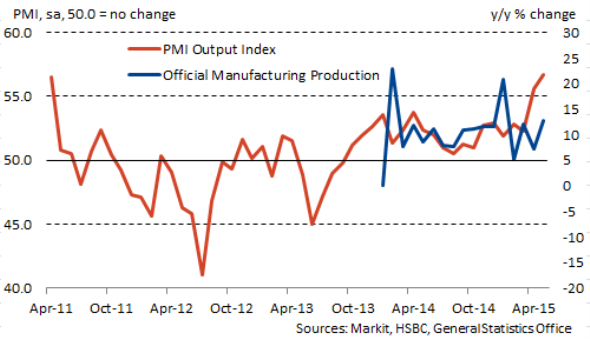

The HSBC Vietnam Manufacturing PMI climbed to its highest in the four-year survey history in May, with producers enjoying strong growth of output and new orders. Firms reacted to fuller order books by raising employment at the sharpest pace since January and ramping up material purchasing. There were, however, signs of inflationary pressures returning amid currency devaluation and rising oil prices.

With the General Statistics Office for Vietnam reporting strong growth of GDP during the first quarter of the year (6.03% y/y), the PMI figures suggest that the manufacturing sector at least is continuing to perform strongly in the second quarter.

Manufacturing output growth quickens

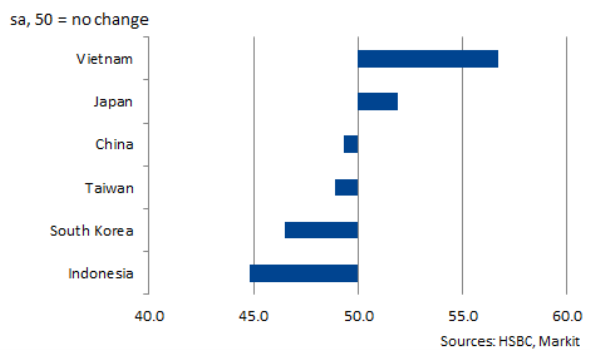

The robust PMI data for Vietnam contrast markedly with other countries in South East Asia. Solid reductions in output were seen in Indonesia and South Korea in May, while Taiwan and China also contracted. With Japan posting only a modest expansion of production, Vietnam is the star performer of the region.

Manufacturing PMI Output Indices, May 2015

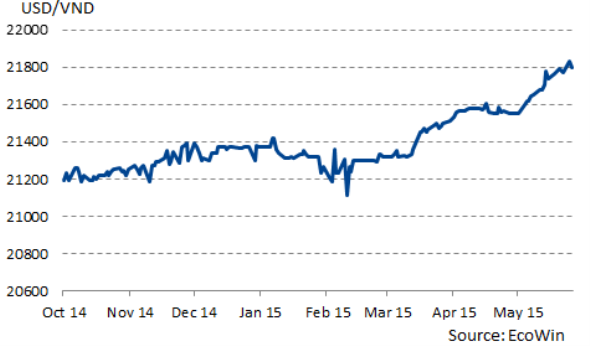

Central to the recent success of firms in Vietnam has been their ability to secure new work in a competitive environment. The rate of growth in new export orders has dropped below that of total new business, however, due in part to exchange rate factors. The Vietnamese dong operates in a crawling peg with the US dollar. Therefore, the dollar's recent strength has led the dong to appreciate against other currencies. To this end, the State Bank of Vietnam adjusted the inter-bank exchange rate with the dollar by 1% from 21,458VND to 21,673VND to the dollar on May 7th. This was the second adjustment so far this year and the market rate has weakened since.

Vietnamese dong per US dollar

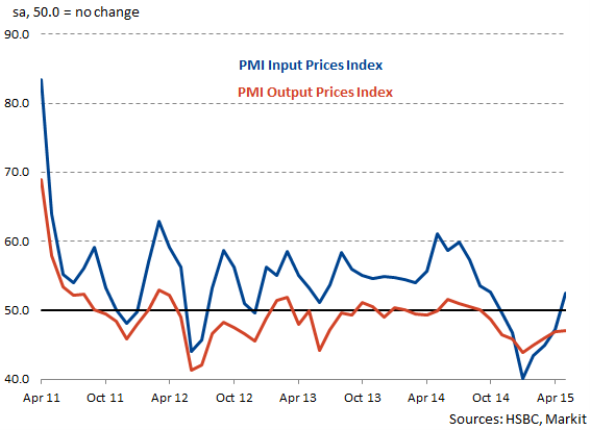

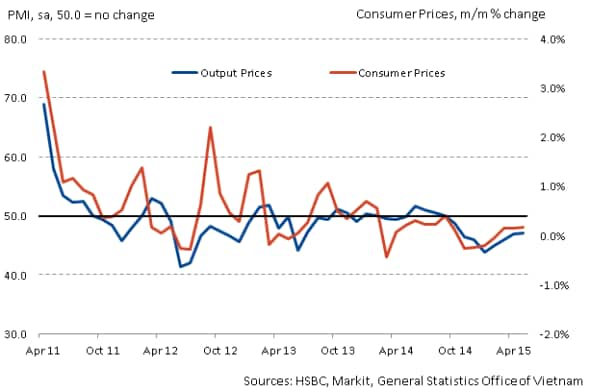

PMI survey responses also indicated that the weaker dong has led to rises in the cost of imported items. Input costs increased for the first time in seven months in May, with firms also highlighting the impact of rising oil prices. Furthermore, the ministries of Finance and Trade & Industry have approved a rise in petrol prices - the second in the month of May - which is likely to add to cost pressures in coming months. Although manufacturers continued to reduce their output prices in May, any further rises in costs will add to pressure on firms to increase their tariffs.

PMI Price Indices

Consumer Price Inflation

The prospect of price rises in coming months is a potential headwind for Vietnamese manufacturing firms, but this shouldn't detract from the generally positive picture presented by the PMI figures during the second quarter of 2015 so far.

Andrew Harker | Economics Associate Director, IHS Markit

Tel: +44 149 1461016

andrew.harker@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062015-Economics-PMI-shows-Vietnamese-manufacturers-performing-strongly-in-Q2.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062015-Economics-PMI-shows-Vietnamese-manufacturers-performing-strongly-in-Q2.html&text=PMI+shows+Vietnamese+manufacturers+performing+strongly+in+Q2","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062015-Economics-PMI-shows-Vietnamese-manufacturers-performing-strongly-in-Q2.html","enabled":true},{"name":"email","url":"?subject=PMI shows Vietnamese manufacturers performing strongly in Q2&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062015-Economics-PMI-shows-Vietnamese-manufacturers-performing-strongly-in-Q2.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI+shows+Vietnamese+manufacturers+performing+strongly+in+Q2 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062015-Economics-PMI-shows-Vietnamese-manufacturers-performing-strongly-in-Q2.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}