Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 01, 2015

Manufacturing soft-patch persists amid deteriorating global trade flows

Global manufacturing eked out only very modest growth again in May. The JPMorgan PMI, compiled by Markit, rose from April's 21-month low of 51.0 to 51.2, but that was still the second-lowest reading seen for almost two years.

The disappointing performance in May reflected the first, albeit only marginal, decline in worldwide exports since June 2013, indicating a stalling of global trade flows.

Global factory output

Global goods exports

US and UK dominance wanes

Of the major developed economies, the US - the main engine of global growth over 2014 and 2015 so far - continued to record the strongest pace of manufacturing growth, even with its rate of expansion slowing to a four-month low. Markit's US PMI slipped to 54.0, in part reflecting a second-successive monthly decline in export orders - blamed in turn by many companies on the strong dollar.

The UK had also seen one of the fastest growing manufacturing sectors in the world last year according to the PMI surveys, but has seen the pace of expansion slow sharply in recent months as the appreciating pound has hit exports. At 52.0, the UK PMI was the third-weakest seen for two years with exports dipping for the third time in the past four months.

Eurozone revival

In contrast to the export-led weakness seen in the US and UK, the eurozone saw faster manufacturing growth. The PMI edged higher to 52.2 in May, the joint-highest seen over the past year. The weaker euro was cited as a boost to exports, growth of which hit a 13-month high.

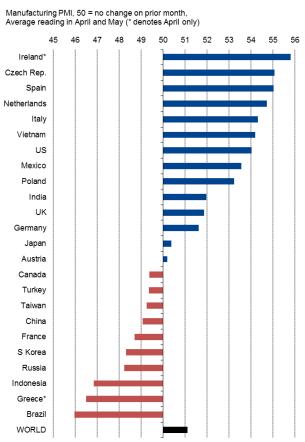

The strength of upturns in Spain, the Netherlands and, to a lesser extent, Italy have been particularly encouraging. So far in the second quarter, eurozone countries have held four of the top five places in the global manufacturing PMI rankings. However, the overall rate of growth signalled by the PMI remained modest rather than impressive, attributable to an ongoing downturn in the French manufacturing economy and only very modest growth in Germany.

Asia and EM malaise lingers

Asia remained the main area of weakness in the global manufacturing economy, with the PMI for the region signalling a third successive monthly downturn in business conditions, led by the steepest drop in exports since August 2013.

Markit's PMI for China signalled the fifth contraction seen over the past six months, with downturns also recorded in Taiwan, South Korea and Indonesia and only meagre growth in Japan as exports remained near-stagnant. Vietnam was Asia's star performer in May, bucking the malaise seen across the region to register the strongest growth recorded in the survey's four-year history.

Other emerging markets also provided plenty to worry about. Downturns intensified in both Brazil and Russia. The former saw the PMI dropping to a near four-year low of 45.9 in May, while the latter's PMI sank to 47.6, the joint-lowest seen over the past six years.

India, in contrast, saw manufacturing growth hit a four-month high. However, at 52.6, the rate of growth signalled remains disappointingly subdued compared to pre-crisis rates of expansion.

Inflation back on the rise

The global PMI survey also showed that inflation looks set to rise again in coming months. Having signalled the steepest decline in manufacturing costs for almost six years at the start of the year, the surveys indicate the strongest rise for eight months in May. Higher oil prices were the main contributor of rising factory running costs. Average prices charged by factories rose as a result. Although only very modest, the rise was significant in being the first recorded since November and the largest since last August.

Q2 manufacturing growth rankings

Sources for all charts: Markit, JPMorgan, HSBC

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062015-Economics-Manufacturing-soft-patch-persists-amid-deteriorating-global-trade-flows.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062015-Economics-Manufacturing-soft-patch-persists-amid-deteriorating-global-trade-flows.html&text=Manufacturing+soft-patch+persists+amid+deteriorating+global+trade+flows","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062015-Economics-Manufacturing-soft-patch-persists-amid-deteriorating-global-trade-flows.html","enabled":true},{"name":"email","url":"?subject=Manufacturing soft-patch persists amid deteriorating global trade flows&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062015-Economics-Manufacturing-soft-patch-persists-amid-deteriorating-global-trade-flows.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Manufacturing+soft-patch+persists+amid+deteriorating+global+trade+flows http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062015-Economics-Manufacturing-soft-patch-persists-amid-deteriorating-global-trade-flows.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}