Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 01, 2015

Equities week ahead: most shorted & dividends

A review of how short sellers are positioning themselves in stocks and which companies are expected to cut dividends in earnings announcements in the coming week.

- Short sellers continue to target oil & gas firms in North America

- 25% spike in short interest in Herbalife ahead of earnings

- Japanese retailers feature strongly in Apac shorts ahead of earnings

North America

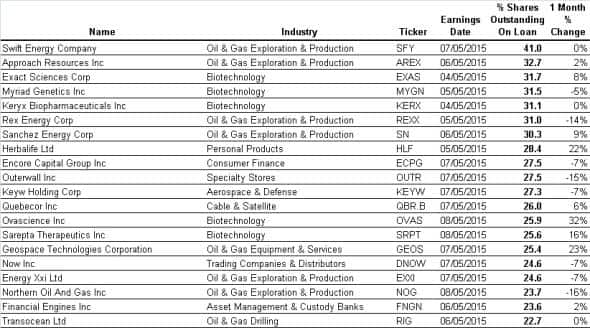

Oil & gas firms continue to dominate the most shorted stocks ahead of earnings in North America, with eight manes among the most shorted ahead of earnings. Shale oil & gas plays Swift energy and Approach Resources see the highest short interest within that group with 41% and 33% of shares outstanding on loan respectively.

The most expensive or in demand short in North America ahead of earnings this week is gulf of Mexico oil & gas producer Energy XXI, whose to borrow cost stands nearly 40% after short sellers borrowed over 75% of the available lending supply.

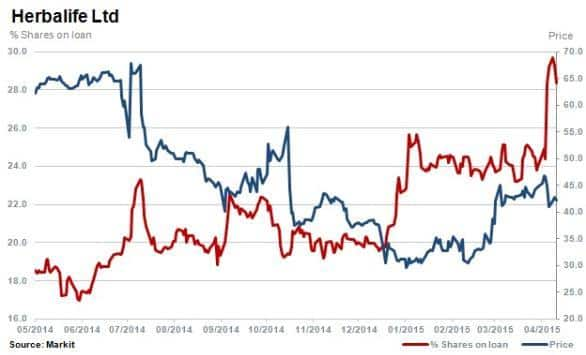

Looking beyond the energy space, controversial short target Herbalife has seen a 25% jump in shares outstanding on loan over the last month. The proportion of HLF shares out on loan has increased to 28.4%, just shy of the all-time high achieved in early 2013.

This “philanthropic” short has been part of an active short selling campaign by Bill Ackman, who seems to have come out on the right side of the trade despite against heavy opposition from George Soros and Carl Icahn who took opposing positions in August 2014.

Western Europe

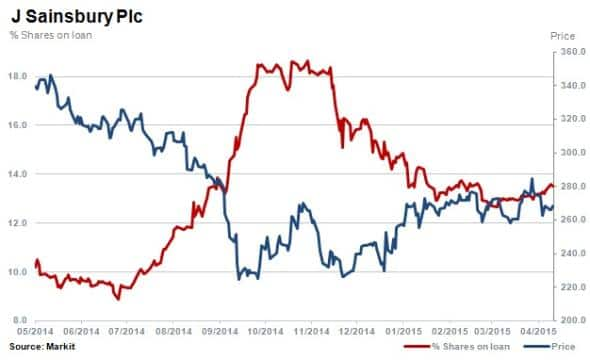

Sainsbury’s remains among the most shorted stocks in Western Europe, even outside of those expected to release earnings in the coming week. However the stock has seen demand and the cost to borrow stock fall in recent months, with shares outstanding on loan moderating from November highs of 18.5% to 13.5% currently.

Markit’s dividend team is forecasting Sainsbury’s to cut its final dividend by 40%. While the trailing yield stands at a 6.4%, our forecasts for the coming year expect this figure to stand at just 3.9%.

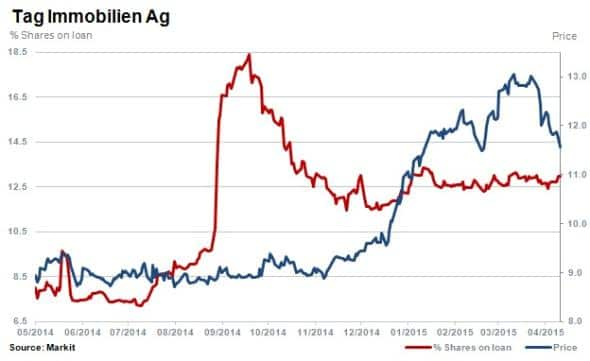

Short sellers are holding their ground in German residential property group TAG. Shares out on loan have remained relatively flat at ~13% year to date while the share price has rallied and subsequently receded in the last few weeks.

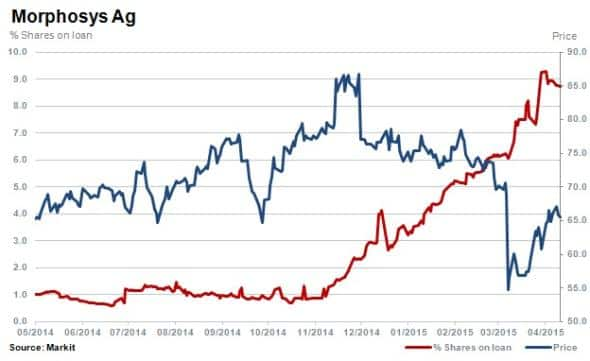

Short sellers have also been staying the course in German firm Morphosys despite its recent rally. Demand to borrow has climbed from ~1% last November to the current 8.7% as the biotech firm ended a development deal with American firm Celgene which sent its shares down sharply.

Asia Pacific

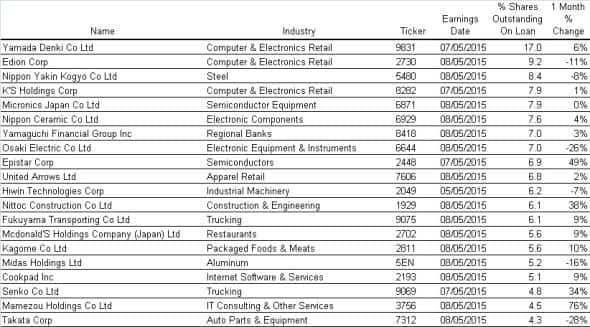

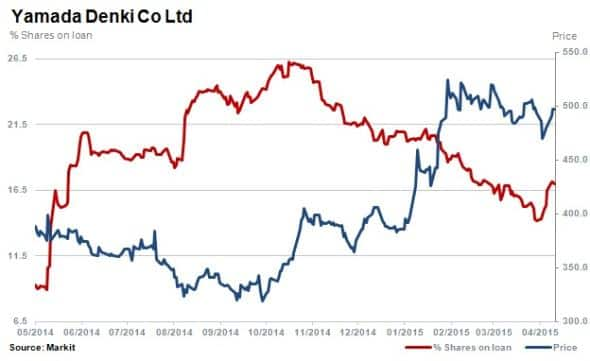

Japanese retailing firms feature predominantly this week among the most shorted ahead of earnings in Apac. Consumer technology retailer Yamada Denki is at the top of the list with 17% of shares outstanding on loan. Short sellers have covered positions since November 2014 as the stock continued to climb.

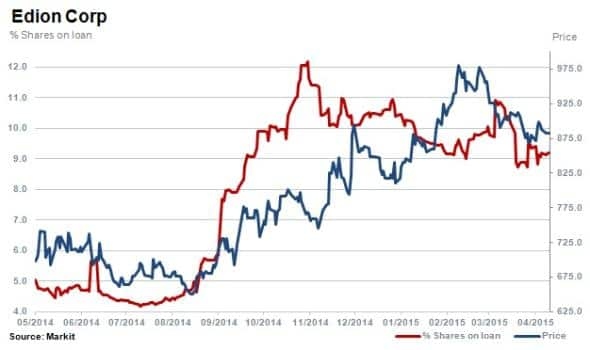

With almost half of available shares to short out on loan, Edion is the second most shorted in Apac ahead of earnings with a total of 9.2% of shares outstanding on loan.

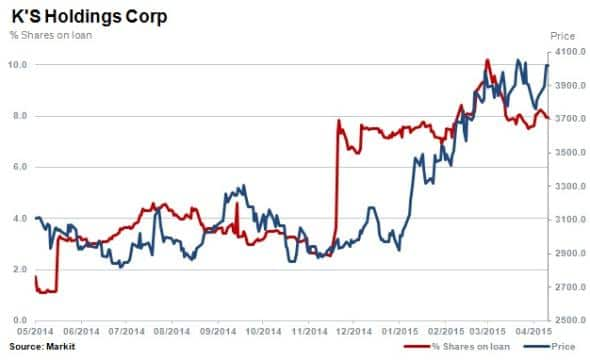

Rounding out the top three in Japan is consumer electronics retailer K’S Holdings which has 9.2% of shares outstanding on ahead of earnings.

Relte Stephen Schutte, Analyst at Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01052015-equities-equities-week-ahead-most-shorted-dividends.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01052015-equities-equities-week-ahead-most-shorted-dividends.html&text=Equities+week+ahead%3a+most+shorted+%26+dividends","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01052015-equities-equities-week-ahead-most-shorted-dividends.html","enabled":true},{"name":"email","url":"?subject=Equities week ahead: most shorted & dividends&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01052015-equities-equities-week-ahead-most-shorted-dividends.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Equities+week+ahead%3a+most+shorted+%26+dividends http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01052015-equities-equities-week-ahead-most-shorted-dividends.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}