Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 01, 2016

Yields up but carmakers emit fewer dividends

Amid sector divergence, aggregate dividend payments from European car makers are set to skid in 2016 despite some strong underlying performances in a tough operating environment.

- Aggregate dividends for European carmakers set to fall 11.3% in 2016

- "2bn cut in combined payments from Volkswagen and Porsche as forecast to stall 80%

- Indiscriminate sector selloff pushes yields attractively higher as investors weigh risks

Markit Dividend Forecastinghas released a report highlighting dividend expectations for European carmakers in 2016. To access the full report, please contact us.

European production sees traction in 2015

European car sales grew by 9.3% in 2015 reaching 13.7m units. This compares to peak levels of 15.5m reached almost ten years ago in 2007. The strong sales growth is not set to continue however as the European Automobile Manufacturers Association (ACEA) expects modest sales in 2016 with growth forecast to be a fifth of that registered in 2015.

The more sombre outlook has been impacted by the prolonged emerging markets selloff; lead by weaker demand as slowing Chinese growth impacts global demand from commodity prices to vehicles. Additionally, European manufacturers are still reeling from the emissions scandal in 2015.

Volkswagen misfires

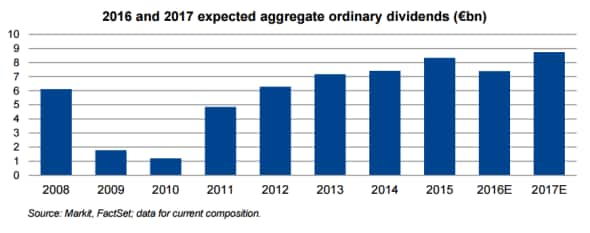

For the first time since 2010 aggregate dividends from European carmakers are expected to decline, falling 11.3% from "8.3bn to "7.4bn. Cuts from Volkswagen and Porche are set to offset increases expected from an otherwise resilient sector.

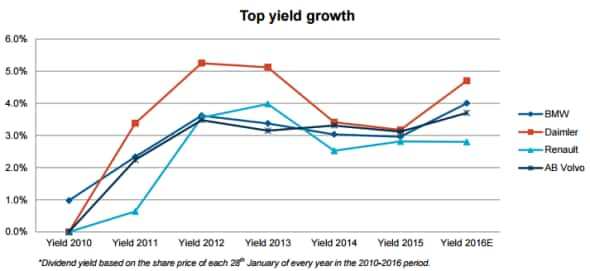

Daimler, BMW and Renault are expected to be the largest payers in 2016 (representing around 80% of total auto payments). Daimler is expected to hike its payment by 25% on stronger earnings with potential for an even larger increase if the firm strictly sticks to its 40% pay-out target. Further highlighting the dividend divergence in the sector is the positive 9% growth expected from BMW.

While some strong dividend growth is expected from key names, the share prices of automakers have not fared well on average due to emission-contagion fears and concerns around continued weakness in emerging markets and China specifically.

The pullback in prices against some healthy operational results has created attractive looking yields that currently exist across the European automakers.

Daimler leads in terms of current yield, nearing an attractive 5% yield. This is followed by BMW, Volvo and Renault which are all above the sector average yield for the region of 2.4%.

Emission contagion, contained

Fears that Renault had been dragged into the cloud of VW's emission scandal sent shares falling over 10% this month when the company announced it had recalled more than 15,000 vehicles. However the fault has been deemed 'negligible' in comparison, with no intentional 'wrong doing' and shares have since recovered. Notably, shares fell less than during the peak of VW's emissions scandal in September and October of 2015.

Short sellers switch French cars

Short sellers have covered almost 75% of positions in Renault since October 2015 with shares outstanding on loan declining to 1% currently. This may indicate that there is less risk to the firm's currently expected 2.9% dividend yield.

Meanwhile, with no future dividends forecast for 2016, Peugeot has seen shorts add to positions. Shares outstanding on loan have increased to 8.8%, doubling in the last 12 months and reaching the highest levels seen since September 2015, making Peugeot the most short sold carmaker in Europe currently.

Peugeot's exposure to Russia and China could be fuelling short seller's motives, as well as the stocks impressive 59% rally seen in 2015. 2015's rally has already been tempered with the stock falling 16% year to date.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01022016-equities-yields-up-but-carmakers-emit-fewer-dividends.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01022016-equities-yields-up-but-carmakers-emit-fewer-dividends.html&text=Yields+up+but+carmakers+emit+fewer+dividends","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01022016-equities-yields-up-but-carmakers-emit-fewer-dividends.html","enabled":true},{"name":"email","url":"?subject=Yields up but carmakers emit fewer dividends&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01022016-equities-yields-up-but-carmakers-emit-fewer-dividends.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Yields+up+but+carmakers+emit+fewer+dividends http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01022016-equities-yields-up-but-carmakers-emit-fewer-dividends.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}