October 22, 2015 - Weekly Pricing Pulse

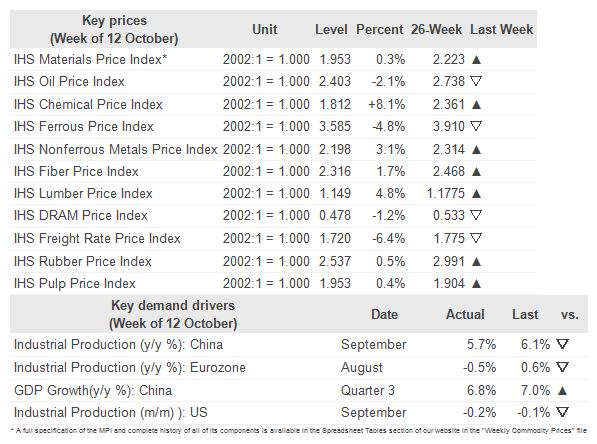

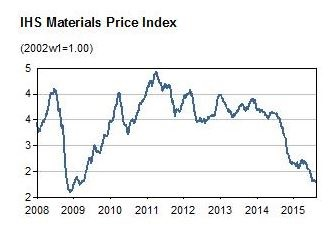

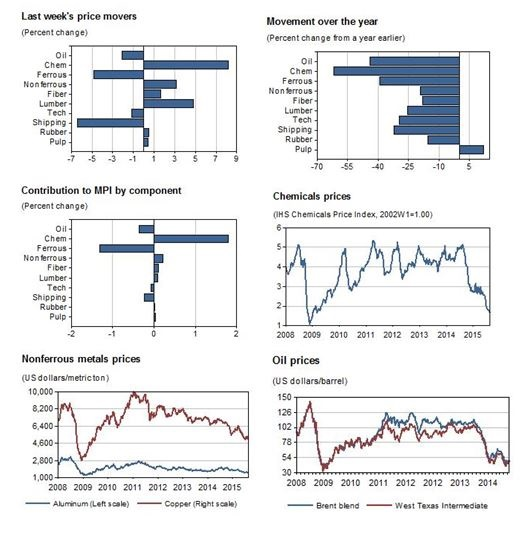

The Materials Price Index (MPI) inched up again last week, rising 0.3%. Support came from chemicals, which rose a strong 8.1% in a lagged reaction to recent oil trends. Nonferrous metals also saw gains with chatter around LME Week confirming more positive sentiment regarding zinc and copper. Steel still looks weak, however, with the ferrous index in the MPI down by almost 5%.

UK steel capacity reductions in Teesside and Scunthorpe were announced, although this will not lift prices from current lows. Otherwise, oil prices were back down slightly after the prior week's boost, while lumber rose 4.8%, momentum that could be related to expectations that a US interest rate hike could be postponed to early 2016.

Looking forward, commodities may get an added lift from better-than-expected Chinese third-quarter GDP growth, which came in slightly above expectations at 6.9%. Recent Eurozone deflation worries may also spur on more quantitative easing (QE) from the European Central Bank (ECB)- a development that could further discourage the Federal Reserve from raising rates this year, thus providing commodity support. For the coming week we expect a slight 0.3% decline in the MPI; early trends are certainly on the downside.

Industrial Materials: Prices - Week of 22 October 2015

Key Prices & Demand Drivers