Despite funding declined, payment companies drove investments

The amount of venture capital raised by financial technology (fintech) companies in the Asia-Pacific region dropped 58.5% consecutively to $1.3 billion in the first quarter, according to the latest report by S&P Global Market Intelligence. India-based companies attracted the most funding, collectively raising 42.9% of total fintech funding in Asia in the same period.

While India surpassed China both in terms of deal value and volume during the first three months, the outlook for fundraising activities in India in the near term is likely to be subdued as it clamps down on foreign investments from neighboring countries.

Meanwhile, as China regains control over the COVID-19 outbreak, the pace of fintech funding appears to be gaining momentum with consistent growth in capital raised across the first quarter.

“Total fintech funding in APAC in the first quarter recorded a significant decline on the back of the ongoing COVID-19 pandemic with investments largely driven by payment companies,” says Celeste Goh, Fintech Analyst at S&P Global Market Intelligence. “Outlook for fundraising activities in the near term will likely continue to be restrained. Nevertheless, investors' continued interest in digital-only banks offers some optimism as regulators across various APAC economies are preparing to open the banking industry to technology players.”

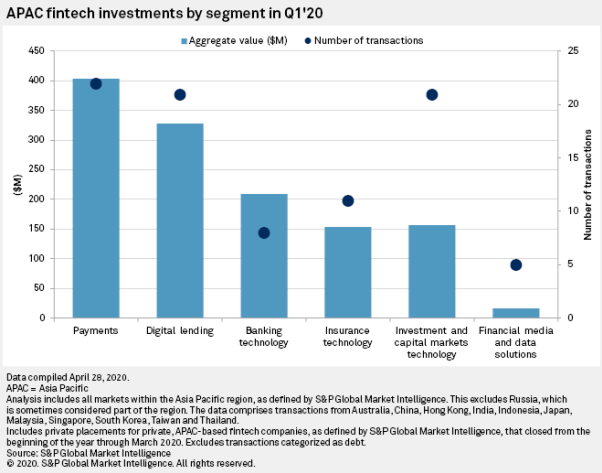

Across the six industry segments tracked by S&P Global Market Intelligence, payment companies were the top-funded fintech segment with $403 million raised across 22 transactions.

Mobile payment apps in particular saw larger funding rounds and accounted for three of the 10 largest transactions in the first quarter. Those capital injections were timely and came just ahead of nationwide lockdowns that are causing consumers and merchants to shift toward digital and contactless payments.

South Korea's NHN PAYCO Corp., India’s PhonePe Private Ltd. and Resilient Innovations Private Ltd. (BharatPe) and Japan's Kyash Inc. each landed a spot among the 10 largest fintech investments for the quarter.

Despite fintech funding slumps in the first quarter, investments in Australian neobanks, which are pure online-only banks, bode well for upcoming digital banks in the region.

Xinja Pty Ltd. had secured a two-year capital injection earlier in March, while Volt Bank Ltd. closed a $70 million series C round in January as part of the pre-IPO process. Both Australian neobanks collectively accounted for 93.5% of the country's total fintech fund raises in the first quarter.

Access to the full report is available to members of the media; please contact: vivian.liu@spglobal.com.

– END –

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we know that not all information is important—some of it is vital. We integrate financial and industry data, research and news into tools that help clients track performance, generate alpha, identify investment ideas, understand competitive and industry dynamics, perform valuations and assess credit risk. Investment professionals, government agencies, corporations and universities globally can gain the intelligence essential to making business and financial decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). For more information, visit www.spglobal.com

Learn more about Market Intelligence

Request DemoMedia Contact

Vivian Liu, S&P Global Market Intelligence

P. +852 9179 1132

E. Vivan.liu@spglobal.com

Subscribe to Press Releases

Submitting your email above means you agree to the Terms and have read and understood the Privacy Policy