New York – January 27, 2023 – Rising funding costs and growing liquidity pressures at community banks will begin to stand in the way of additional net interest margin expansions in 2023, according to S&P Global Market Intelligence’s latest quarterly community banking outlook report. The newly published report, Liquidity pressures put funding in the crosshairs at community banks, is available on S&P Capital IQ Pro, a trusted source for community banking data.

Developed by the company’s Financial Institutions Research team, the report utilizes S&P Global Market Intelligence's deep data on bank financials, M&A and interest rate monitoring to produce insightful content that examines and forecasts trends for community banks. The S&P Capital IQ Pro platform also offers community banks a wide variety of other solutions, including commercial prospecting tools, demographic data, mapping capabilities, branch-level data and news on the sector to help with market analysis, peer benchmarking, regulatory and board reporting, risk management and business development workflows.

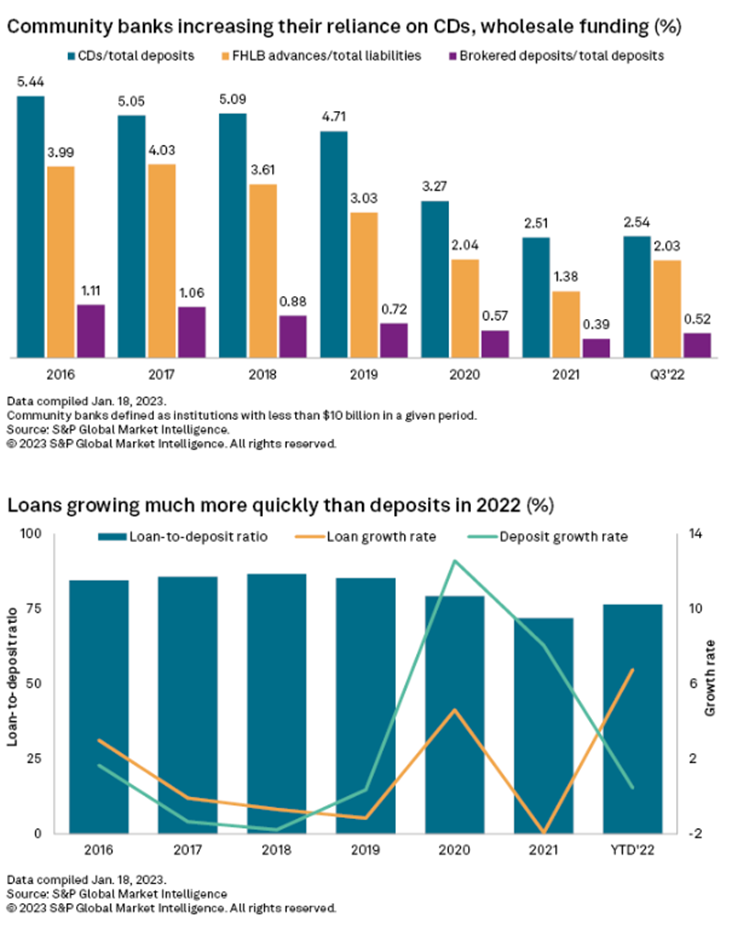

“Healthy loan growth, higher interest rates and modest increases in deposit costs have resulted in far stronger community bank margins in 2022. However, liquidity pressures have begun to emerge and will likely cause community banks to record notably higher funding costs in 2023 as institutions increase their reliance on more expensive wholesale funding and certificates of deposit (CDs),” said Nathan Stovall, director of financial institutions research at S&P Global Market Intelligence. “Credit costs will also likely rise off historically low levels serving as a headwind to earnings but are expected to fall short of losses witnessed during a severe downturn.”

Key highlights from the report include:

- CD balances and borrowings from the Federal Home Loan Banks (FHLB) are expected to steadily grow in 2023 as community banks seek to fulfill their liquidity needs, translating into notably higher deposit costs for the group. Earning-asset yields will also reprice higher but will fail to expand at the same rate as funding costs in 2023, causing margin expansion to stall for community banks.

- Community banks are projected to record a deposit beta, or the percentage change that banks pass on to all depositors, of 10% for the full year 2022, up from 6% through the first nine months of 2022. We expect the group to record a beta of 28% in 2023, leading to a cumulative beta of 22% by the end of 2023.

- Net charge-offs are expected to jump in 2023 off a historically low base to 0.19% of average loans.

- Provisions are expected to rise to 11.8% of net revenue in 2023, up from just 6.4% in 2022. From 2013 to 2019, community banks' provisions equated to 9.6% of net revenue on average.

To request a copy of the Liquidity pressures put funding in the crosshairs at community banks, please contact pressinquiries.mi@spglobal.com.

Scope and methodology

S&P Global Market Intelligence analyzed nearly 10,000 banking subsidiaries, covering the core U.S. banking industry from 2004 through the third quarter of 2022. The analysis includes all commercial and savings banks and savings and loan associations, including historical institutions, as long as they were still considered current at the end of a given year. It excludes several hundred institutions that hold bank charters but do not principally engage in banking activities, among them industrial banks, nondepository trusts and cooperative banks.

The outlook is based on management commentary, discussions with industry sources, regression analysis, and asset and liability repricing data disclosed in banks' quarterly call reports. While taking into consideration historical growth rates, the analysis often excludes the significant volatility experienced in the years around the credit crisis.

The outlook is subject to change, perhaps materially, based on adjustments to the consensus expectations for interest rates, unemployment and economic growth. The projections can be updated or revised at any time as developments warrant, particularly when material changes occur.

S&P Global Market Intelligence’s opinions, quotes, and credit-related and other analyses are statements of opinion as of the date they are expressed and not statements of fact or recommendation to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security.

# # #

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. Our team of experts delivers unrivaled insights and leading data and technology solutions, partnering with customers to expand their perspective, operate with confidence, and make decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). S&P Global is the world’s foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help many of the world’s leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/marketintelligence.

Media Contact:

Kate Smith, S&P Global Market Intelligence

P. +1 781 301 9311

E. katherine.smith@spglobal.com