New York—November 10, 2021—The U.S. energy transition will continue apace into 2022 with record-levels of wind and solar generation additions expected to come online, according to the newly released 2022 Electric, Natural Gas and Water Utilities Outlook Report from S&P Global Market Intelligence. The report finds that as this build out occurs, utilities and the wider energy industry continue to find ways to finance, build and operate the necessary infrastructure to support these assets and address those that get left behind

Published by S&P Global Market Intelligence's Energy Research team, the report spotlights trends in renewable energy growth, grid transformation, utility regulation and capital expenditure expansion.

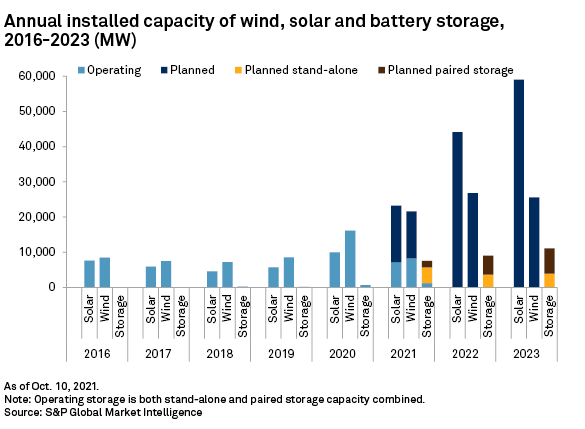

“It’s going to be a record year for renewable energy development in the U.S. in 2022, with 44 GW of solar and 27 GW of wind power set to be installed alongside more than 8 GW of battery storage,” said Richard Sansom, Head of Commodities Research at S&P Global Market Intelligence. “As the momentum of the energy transition continues to build, this report looks at how regulators and utilities are adapting to state and federal carbon reduction policies and dealing with the costs of the assets that get left behind.”

Key highlights from the report include:

- As much as 44 GW of solar and 27 GW of wind is planned to be installed in 2022 along with over 8 GW of battery storage, facilitated by the creation of dedicated programs such as virtual power purchase agreements and green tariffs.

- Early plant retirement costs due to the energy transition will present challenges for utilities and state regulators with 29 GW of coal retirements planned for 2020 through 2025.

- US utility capex is expected to remain on the upswing, with investments in upgrading and modernizing the country’s aging energy and water infrastructure reaching $63 billion and utility renewables spending surpassing $14 billion in 2022.

- With the U.S. economy challenged by fallout from the COVID-19 pandemic, the averages of the state-authorized electric, gas and water utility ROEs fell to their lowest levels on record in 2020 and are likely to remain near that level for 2021 and 2022, despite potential rising interest rates and the spectre of inflation.

- Water and wastewater utility M&A has increased in 2021, and is expected to accelerate in 2022, as investor-owned companies target municipal system acquisition targets.

The S&P Global Market Intelligence 2022 Electric, Natural Gas and Water Utilities Outlook Report is part of a “Big Picture Outlook” series published by the division’s research group that provides a look ahead of key strategic trends and opportunities. To learn more about this “Big Picture Outlook” research series, please visit here.

To request a copy of the report, please contact pressinquiries.mi@spglobal.com.

S&P Global Market Intelligence’s Energy Research team offers comprehensive coverage on U.S. power, gas and water utilities as well 20-year price projections for wholesale power and coal markets. The Energy offering complements S&P Global Market Intelligence’s broad universe of research sector coverage including enterprise technology, financial institutions, metals & mining and TMT (Technology, Media and Telecom).

S&P Global Market Intelligence’s opinions, quotes, and credit-related and other analyses are statements of opinion as of the date they are expressed and not statements of fact or recommendation to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security.

# # #

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. We integrate financial and industry data, research and news into tools that help track performance, generate alpha, identify investment ideas, perform valuations and assess credit risk. Investment professionals, government agencies, corporations and universities around the world use this essential intelligence to make business and financial decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI), the world’s foremost provider of credit ratings, benchmarks and analytics in the global capital and commodity markets, offering ESG solutions, deep data and insights on critical business factors. S&P Global has been providing essential intelligence that unlocks opportunity, fosters growth and accelerates progress for more than 160 years. For more information, visit www.spglobal.com/marketintelligence.

CONTACT:

Amanda Oey

P. +1 212-438-1904

E. amanda.oey@spglobal.com

Subscribe to Press Releases

Submitting your email above means you agree to the Terms and have read and understood the Privacy Policy