Two-thirds of corporations foresee US Presidential Election to trigger operational changes while ESG topics and workplace flexibility are reprioritized in a new post-pandemic world

New York, NY , Oct. 21 2020 — S&P Global Market Intelligence’s quarterly COVID-19 flash survey found that a post-pandemic corporate environment will include key changes made to global corporations’ operational conditions and the reprioritization of environmental, social and governance-related (ESG) topics and workplace flexibility.

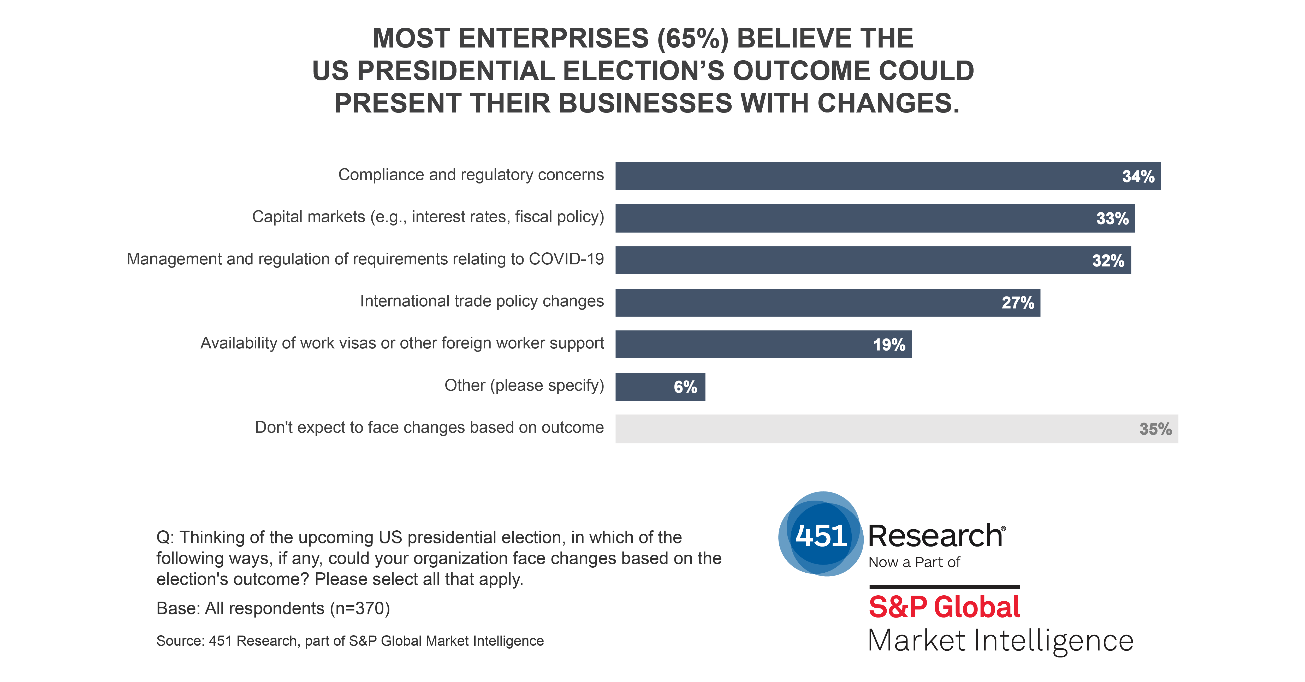

Conducted by 451 Research, the emerging technology research unit of S&P Global Market Intelligence, two-thirds (65%) of corporations feel the outcome of the US presidential election in November could bring changes to their operating conditions. The survey also found corporations are placing more priority on environmental sustainability and social responsibility and three-quarters (77%) of those surveyed will be extending new workplace flexibility considerations to their employees.

“Organizations are continually adapting to a new post-pandemic normal that includes high-impact government events such as the US presidential elections,” said Liam Eagle, Head of Voice of the Enterprise Research at 451 Research, part of S&P Global Market Intelligence. “Our flash survey capabilities and access to corporate leaders gives us timely data and insights into executive sentiment that can help organizations and market participants make informed business decisions during these uncertain times.”

Among the findings on impact to operating conditions, the survey also sheds light on COVID-19 and the US presidential election’s impact to the future of work. It surfaces some of the enterprise-wide changes that companies have and/or are looking to implement with topics including operational impacts & organization changes, workplace & workforce practices, and corporate priorities & spending.

The survey features responses collected between September 24 to October 9 from approximately 400 corporate decision-makers across a range of industries.

Additional highlights from the survey include:

- Operational impacts and organization changes:

- Compliance and regulatory requirements (34%), capital markets (33%) and management of policy and requirements related to COVID-19 (32%) are changes corporations are expecting to see resulting from the US presidential election.

- The expected timeline is shifting for a return to normal as 44% of enterprises (compared to 18% in June) are expecting the altered working conditions to last until 2021.

- Dealing with a pandemic has led to positive organizational change for many as more than three-quarters of enterprises (80%) agree the demands of dealing with COVID-19 provide an opportunity to make procedural or operational changes that will benefit the business in the long run.

- Workplace and workforce priorities

- Nearly two-thirds of organizations (64%) say a significant increase in remote working is a permanent change they have made due to COVID-19. One-third (33%) point to a corresponding permanent reduction in office footprint while two-thirds of organizations (69%) indicate that at least 75% of their workforce can work effectively remotely.

- As students return to school (virtually or in person), two-thirds of organizations (69%) expect some portion of their workforce to require additional considerations. Three-quarters (77%) are or will be extending new considerations to staff, most commonly additional flexibility in working hours and locations (66%) and additional support for managers dealing with the need for flexibility (30%).

- Corporate priorities and spending

- ESG-related topics such as environmental sustainability and social responsibility were cited as potential greater priorities by digital leaders (organizations actively executing on digital transformation strategies) compared to laggards (17% to 6% and 30% to 13%, respectively).

- More than half of enterprises (60%) agree that inefficiencies exposed by COVID-19 will drive technology investments at their organizations well into the future.

S&P Global Market Intelligence will be hosting a YouTube livestream discussing these survey results today at 11:00 am ET. To access the event, please click here.

The latest survey is a follow-up to the COVID-19 Flash Survey published in June, which assessed the operational changes enterprises are expected to make in light of the global COVID-19 pandemic. The recent survey conducted in late September through early October included questions specifically relating to the impact of the U.S. presidential election.

To access the full report, please contact pressinquiries.mi@spglobal.com.

In addition, S&P Global Market Intelligence recently launched a dedicated newsletter highlighting analyses and research focusing on the potential market impact from the US presidential election. To sign-up for S&P Global Market Intelligence’s US presidential election newsletter, please click here.

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. We integrate financial and industry data, research and news into tools that help track performance, generate alpha, identify investment ideas, perform valuations and assess credit risk. Investment professionals, government agencies, corporations and universities around the world use this essential intelligence to make business and financial decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI), the world’s foremost provider of credit ratings, benchmarks and analytics in the global capital and commodity markets, offering ESG solutions, deep data and insights on critical business factors. S&P Global has been providing essential intelligence that unlocks opportunity, fosters growth and accelerates progress for more than 160 years. For more information, visit www.spglobal.com/marketintelligence.

Learn more about Market Intelligence

Request DemoMedia Contact

Amanda Oey, S&P Global Market Intelligence

P. +1 212-438-1904

E. amanda.oey@spglobal.com

Subscribe to Press Releases

Submitting your email above means you agree to the Terms and have read and understood the Privacy Policy