The global mining and exploration industry remains cautious with concerns over the scale of global economic growth and its effects on commodity prices

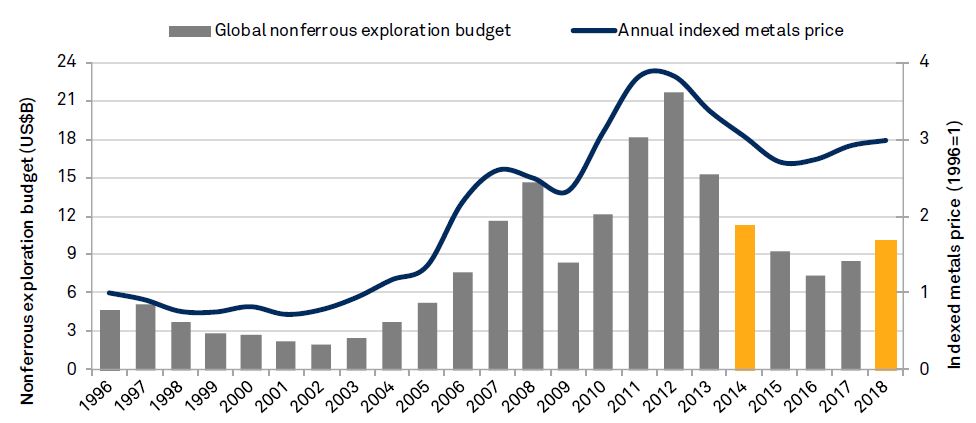

The global exploration budget for nonferrous metals rose to an estimated US$10.1 billion in 2018, representing 19% growth year over year (YOY) compared with US$8.5 billion in 2017, according to the World Exploration Trends 2018 report from S&P Global Market Intelligence, released at this year's Prospectors & Developers Association of Canada (PDAC) International Convention in Toronto.

Mark Ferguson, Associate Research Director at S&P Global Market Intelligence, says, “We expect some volatility to persist in the exploration metrics in 2019 as uncertainty still abounds over the sustainability of economic growth between the U.S. and China. Nevertheless, we should see a general upward trend as the positive underlying fundamentals for most metals encourage increased activity. The industry, however, remains short of critical new discoveries and metals such as copper will see widening deficits without additional investment in exploration for the mines of the future.”

“We expect the global exploration budget to increase in 2019 for a third consecutive year, although by a smaller amount of 5% to 10% — likely again emphasizing late-stage exploration as the industry remains risk-averse.”

According to the report, global aggregate nonferrous budget from surveyed respondents increased 20% YOY to US$9.62 billion in 2018. Total budgets including estimates for private companies and those allocating less than US$100,000 stood at US$10.1 billion.

Global exploration budget still below 2014 levels

Data compiled by S&P Global Market Intelligence as of January 18, 2019. For illustrative purposes only.

The rebound in exploration continues

For the first time since 2012, more companies YOY indicated they had spending plans in 2018 although the total number of exploring companies is still one-third lower than the 2012 peak. Industry remains risk-averse as grassroots budget share of exploration fell to an all-time low in 2018. 1.6% of major miners’ revenue is estimated to have been allocated to spend on exploration in 2018. While it represents a minor improvement compared with 1.4% in 2017, the estimated ratio is still near the historical low. Major miners dominate exploration budgets with US$4.97 billion in 2018, and still outspend junior budgets for grassroots exploration despite the larger percentage increase YOY in junior budgets.

Exploration budgets rebound in most regions

All global regions had higher exploration budget allocations in 2018, except Pacific/Southeast Asia, which recorded an 8% decrease in allocations. Latin America remained the most popular exploration destination, while Canada has the largest aggregate budget of any country in 2018.

Gold dominates but base metals show life

Gold accounted for half of global budgets in 2018 with an increase of 18% YOY. While gold rose the most in absolute dollar terms, base metals, led by copper and zinc, saw a higher percentage increase. On the other hand, lithium exploration budgets reached a new high of US$247.1 million, while cobalt saw the largest percentage increase of any commodity, more than tripling in 2018.

If you would like to receive the full report, please contact pressinquiries.mi@spglobal.com.

Attendees of the PDAC convention on March 3-6 are encouraged to visit the S&P Global Market Intelligence booth #115 on the main trade show floor, for a free copy of the report and additional information.

-- END --

Note to Editors

S&P Global Market Intelligence obtains the data used in its Corporate Exploration Strategies (CES) studies through the participation of more than 3,300 surveyed companies. The individual nonferrous exploration budgets covered by the study include planned spending for gold and silver, base metals, platinum group metals, diamonds, uranium, rare earths and potash. They specifically exclude exploration budgets for iron ore, coal, aluminum, oil and gas, and many industrial minerals.

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we know that not all information is important—some of it is vital. We integrate financial and industry data, research and news into tools that help track performance, generate alpha, identify investment ideas, understand competitive and industry dynamics, perform valuations and assess credit risk. Investment professionals, government agencies, corporations and universities globally can gain the intelligence essential to making business and financial decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). For more information, visit www.spglobal.com.

Learn more about Market Intelligence

Request DemoMedia Contact

Vivian Liu

P. +852 2841 1007

E. Vivian.Liu@spglobal.com

Subscribe to Press Releases

Submitting your email above means you agree to the Terms and have read and understood the Privacy Policy