Labor costs continue to see widespread increases across all regions of the United States and Canada

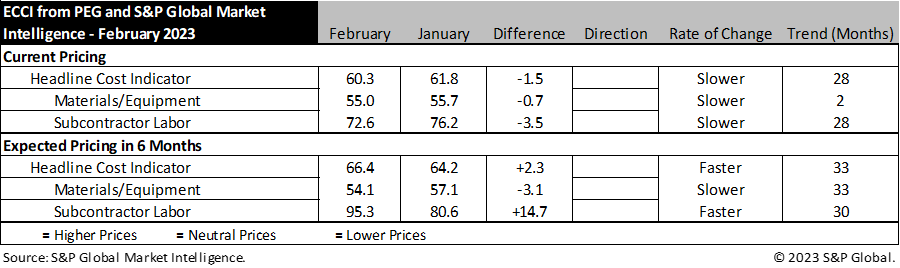

WASHINGTON, D.C. – March 1, 2023 – Engineering and construction costs increased again in February, according to the Engineering and Construction Cost Indicator from PEG and S&P Global Market Intelligence. The headline Engineering and Construction Cost Indicator, a leading indicator measuring wage and material inflation for the engineering, procurement and construction sector, fell to a level of 60.3 this month from 61.8 in January, indicating price increases in February were slightly less widespread than in January. The sub-indicator for materials and equipment costs fell 0.7 points in February to 55.0, remaining moderately above the sub-50 reading from December. The subcontractor labor indicator fell to 72.6, removing 3.5 points in February, but still indicating widespread increases in labor costs.

Despite the 0.7 point drop in the equipment and materials indicator in February, the indicator remained in expansion territory for a second consecutive month after entering contraction territory for the first time in two years in December. Readings for eight of the 12 components indicated increasing prices, with two of the three steel categories and the two freight rates in contractionary territory. Alloy steel pipe increased above 50 this month, indicating a return to increasing pricing. Weak demand has undercut steel pricing, with the well-supplied market shifting leverage to buyers over the last seven months. Meanwhile, soft global trade activity continues to push ocean freight prices lower. The transformers and electrical equipment components remain high, with supply chain issues and long backlogs maintaining a tight market.

The sub-indicator for current subcontractor labor costs came in at 72.6 in February, down from January’s 76.2, though remains well above a reading of 50, indicating increasing prices. According to survey responses, labor costs continued to rise in all regions of the United States and Canada. This indicator has not seen values below 70.0 since October 2021.

“Construction labor markets are still under a significant amount of pressure due to limited availability of workers. While we would typically expect demand for workers to be adversely affected by high interest rates, projects linked to the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA) and renewed oil and gas activity continue to support demand for construction workers,” said Emily Crowley, Associate Director of Economics, S&P Global Market Intelligence. “Additionally, most projects funded under the IIJA will pay prevailing wages, and IRA projects which pay prevailing wages will be eligible for increased tax incentives, lifting the wage floor for construction workers and limiting any downside risk to wages as activity in other construction sectors slows.”

The six-month headline expectations for future construction costs indicator increased by 2.2 points to a reading of 66.4 in February. The six-month expectations indicator for materials and equipment came in at 54.1, 3 points lower than last month’s figure. Additionally, the three steel categories saw increases in their respective indicators, with alloy steel pipe returning to expansion territory. The two ocean freight rates retreated after a large rise in January. The two readings remain at significantly higher levels than seen between November and December, however, suggesting declines in freight rates have become less widespread in early 2023. The six-month outlook readings for copper moved back below 50, suggesting expectations are for more favorable pricing through the near term. The six-month expectations indicator for sub-contractor labor registered 95.3, indicating nearly all survey respondents expect higher labor costs in six months; the subcontractor indicator for every region increased.

Respondents continued to report material shortages in February, particularly for transformers, electrical equipment, and labor.

To learn more about the Engineering and Construction Cost Indicator or to obtain the latest published insight, please click here.

# # #

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. Our team of experts delivers unrivaled insights and leading data and technology solutions, partnering with customers to expand their perspective, operate with confidence, and make decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). S&P Global is the world’s foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity, and automotive markets. With every one of our offerings, we help many of the world’s leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/marketintelligence.

Media Contact

Kate Smith

P. +1 781 301 9311

E. katherine.smith@spglobal.com