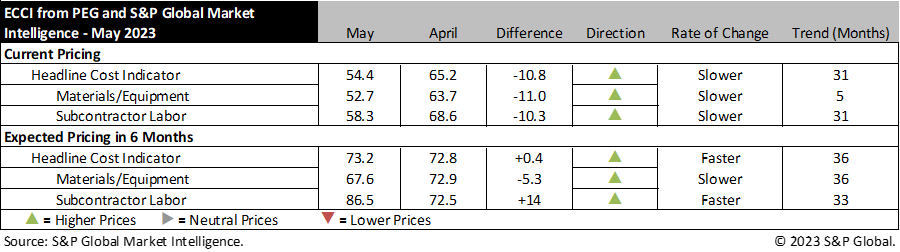

WASHINGTON, D.C. – May 24, 2023 – Engineering and construction costs increased again in May, according to the Engineering and Construction Cost Indicator from PEG and S&P Global Market Intelligence. The headline Engineering and Construction Cost Indicator, a leading indicator measuring wage and material inflation for the engineering, procurement and construction sector, fell to 54.4 this month from 65.2 in April but remained above 50, indicating that price increases were slightly less widespread than last month but prices continued to increase. The sub-indicator for materials and equipment costs fell to 52.7 this month from 63.7 in April; price increases have remained strong since the December sub-50 reading. The sub-indicator for subcontractor labor costs decreased to 58.3 this month, down from 68.6 in April.

The equipment and materials indicator continued to show rising prices, but only 5 of the 12 components posted increases with an additional 2 components staying flat. The categories for carbon steel pipe, alloy steel pipe, and shell and tube heat exchangers all shifted to contractionary territory this month with values between 43.8 and 45.0. Additionally, fabricated structural steel and gas/steam turbines shifted from growth to neutral. All five of these categories saw double digit declines from their April values. Meanwhile, soft global trade activity continues to push ocean freight prices lower. Transformers and electrical equipment components remain high, with supply chain issues and long backlogs maintaining a tight market.

After returning to near 70.0 last month—closer to where it had been since 2021—the sub-indicator for current subcontractor labor costs decreased to 58.3 this month, indicating that the March value was not an outlier, but an indicator that labor cost increases are starting to be less widespread. According to survey responses, labor costs continued to rise in most regions of the United States but were flat in Canada.

“Labor shortages are improving, however hiring conditions will remain tight into 2024 which will keep pressure on labor costs,” said Emily Crowley, Economics Director, S&P Global Market Intelligence. “While residential activity is slowing, projects funded through the Infrastructure Investment and Jobs Act are beginning to break ground, which is increasing demand for skilled trades workers. Across all regions, employers should expect demographics to keep labor markets tight for experienced trades workers for years to come. Weak hiring and layoffs following the Great Recession resulted in a much smaller pool of workers with 10 or more years of experience. This shortage was partially offset by workers staying in the labor force longer, however an uptick in retirements is beginning to expose just how shallow the pool of experienced trades workers is.”

The six-month headline expectations for future construction costs indicator increased by 0.4 points to a reading of 73.2 in May. The six-month expectations indicator for materials and equipment came in at 67.6, 5.3 points lower than last month’s figure. The outlook for most categories is much weaker than last month with the only increases coming in the ocean freight sub-categories and a minor increase in copper-based wire and cable.

The six-month expectations indicator for sub-contractor labor registered 86.5, up significantly from last month’s reading of 72.5 and much closer to the values seen in the last 18 months continuing to indicate that a majority of survey respondents expect higher labor costs in six months. All regions show strong expectations for labor growth, but expectations for all regions in the U.S. are stronger than either Eastern or Western Canada.

Respondents continued to report material shortages in May, particularly for transformers, electrical equipment, and labor. They also reported electrical equipment lead times continue to lengthen with little expectation of improvement in the near term.

To learn more about the Engineering and Construction Cost Indicator or to obtain the latest published insight, please click here.

# # #

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. Our team of experts delivers unrivaled insights and leading data and technology solutions, partnering with customers to expand their perspective, operate with confidence, and make decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). S&P Global is the world’s foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity, and automotive markets. With every one of our offerings, we help many of the world’s leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/marketintelligence.

Media Contact:

Kate Smith, S&P Global Market Intelligence

P. +1 781 301 9311

E. katherine.smith@spglobal.com