Inaugural report by S&P Global Market Intelligence looks at the rapidly changing payments landscape in the five largest economies in Southeast Asia.

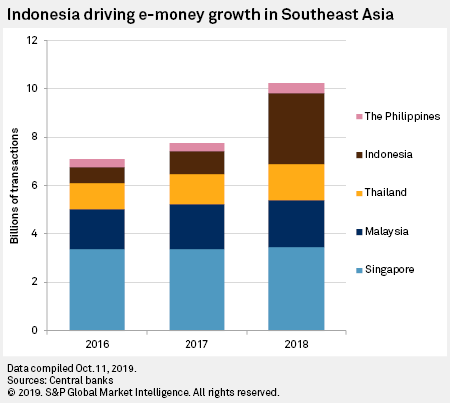

- Number of e-money transactions grew more than 31% in 2018

- Greatest growth potential for nonbank-led e-wallets in Indonesia and the Philippines

- Banks reinforcing dominance in Singapore, Thailand and Malaysia through real-time payments infrastructures

Electronic Money More Popular Than Debit/Credit Cards In Southeast Asia, Exceeding 10 Billion in Aggregate Transactions in 2018

Indonesia, Malaysia, the Philippines, Singapore and Thailand have attracted nonbanks to build regional electronic wallet platforms. According to the inaugural 2019 Southeast Asia E-Money Market Report released by S&P Global Market Intelligence, over 10 billion in aggregate e-money transactions occurred in these countries in 2018, with Singapore leading the region and accounting for 34% of total e-money transactions.

The popularity of nonbank-operated e-money products, such as electronic wallets, for small-value transactions is supporting the rise of ride-hailing and e-commerce companies as financial intermediaries across Southeast Asia.

Payments processed through platforms offered by ride-hailing companies Grab and Go-Jek; TrueMoney, a unit of e-commerce and fintech company Ascend Group; and AirPay, the financial services business of e-commerce and gaming company Sea Ltd. amounted to roughly US$30 billion in aggregate annualized transaction value in 2018, according to S&P Global Market Intelligence estimates.

Sampath Sharma Nariyanuri, CFA, Fintech Analyst at S&P Global Market Intelligence, says, “E-wallets aligned with high frequency and scalable use cases like ride-hailing and e-commerce are likely to grow and garner market share across the region. The volume of transactions processed through e-wallets is gaining steam. For example, we estimate that e-wallets' share of total e-money volumes in Indonesia grew to 36% in 2018 from less than 10% in 2017.”

Nonbanks will continue to register higher growth in regions with a larger percentage of unbanked population and greater fragmentation in payments, according to the report. The growing mismatch between the high availability of smartphones and low banking penetration in cash economies such as Indonesia and the Philippines creates a strong potential for e-wallet uptake.

In less-cash economies such as Singapore, Thailand and Malaysia, banks are reasserting dominance through implementing interoperable systems that enable instant small-value transfers between bank accounts using mobile phones.

Additional data, commentary and access to the full report is available to members of the media; please contact: vivian.liu@spglobal.com

– END –

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we know that not all information is important—some of it is vital. We integrate financial and industry data, research and news into tools that help clients track performance, generate alpha, identify investment ideas, understand competitive and industry dynamics, perform valuations and assess credit risk. Investment professionals, government agencies, corporations and universities globally can gain the intelligence essential to making business and financial decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). For more information, visit www.spglobal.com.

Learn more about Market Intelligence

Request DemoMedia Contact

Vivian Liu, S&P Global | Market Intelligence

P. +852 2841 1007

E. Vivian.Liu@spglobal.com

Subscribe to Press Releases

Submitting your email above means you agree to the Terms and have read and understood the Privacy Policy