NEW YORK, NY, Aug. 13 2021 — U.S. broadband gains illustrated durable demand for wireline connections in the second quarter, allaying fears of a 2021 hangover, according to Kagan, a media research group within S&P Global Market Intelligence. While the 945,000 new broadband subs in second quarter 2021 fall short of the year-ago boom, the jump far exceeds the second-quarter 2019 figure that cable operators have been pointing to as a more likely template for current-year success.

The combined residential cable, telco and satellite broadband subscribers topped 109.2 million at the end of the second quarter, up 4.3% annually with nearly 4.5 million net adds year over year, according to Kagan's full industry estimates.

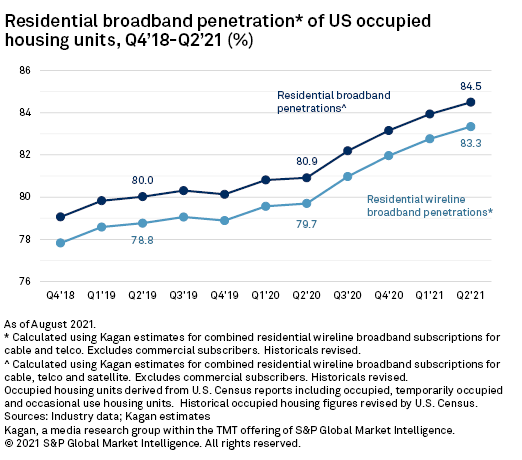

Consumer appetites pushed wireline broadband residential penetrations to more than 83%. Including satellite broadband services, residential penetration reached 84.5%

Additional takeaways from Kagan’s Q2 2021 report:

- Cable subscriber growth in the first half was down from the outsized gains of the pandemic-boosted demand for connectivity. But with 1.9 million residential and commercial net adds year-to-date, cable accounted for 96% of broadband customer gains across the U.S. cable, telco and satellite segments in the first six months of 2021.

- The surging enthusiasm for FTTH upgrades is boosting telco wireline broadband net adds, albeit at relative magnitudes. While the segment's residential net adds in the second quarter pale in comparison to cable's growth, it represents a dramatic improvement over the second quarter track record since 2016.

- Combined, the established satellite broadband providers lost 24,000 U.S. subscribers while Starlink begins to establish early momentum.

S&P Global Market Intelligence’s Kagan research team provides in-depth coverage and deep analyses of the global technology, media and telecommunications sectors (TMT). This TMT research offering complements S&P Global Market Intelligence’s broad universe of research sector coverage including energy, enterprise technology, financial institutions groups, leveraged loans, and metals & mining.

S&P Global Market Intelligence’s opinions, quotes, and credit-related and other analyses are statements of opinion as of the date they are expressed and not statements of fact or recommendation to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security.

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. We integrate financial and industry data, research and news into tools that help track performance, generate alpha, identify investment ideas, perform valuations and assess credit risk. Investment professionals, government agencies, corporations and universities around the world use this essential intelligence to make business and financial decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI), the world’s foremost provider of credit ratings, benchmarks and analytics in the global capital and commodity markets, offering ESG solutions, deep data and insights on critical business factors. S&P Global has been providing essential intelligence that unlocks opportunity, fosters growth and accelerates progress for more than 160 years. For more information, visit www.spglobal.com/marketintelligence.

Media Contacts

Amanda Oey, S&P Global Market Intelligence

P. 212-438-1904

E. amanda.oey@spglobal.com

Subscribe to Press Releases

Submitting your email above means you agree to the Terms and have read and understood the Privacy Policy