S&P Global Market Intelligence report highlights the global nonferrous exploration budget decreasing for the first time since late 2016

- Estimated global nonferrous exploration budget falls 3% year over year to US$9.8 billion from US$10.1 billion in 2019

- Merger & acquisition activity key driver of budget reductions

- Base metals outpace gold as explorers decrease their gold budget by US$559 million year over year to US$4.29 billion — the largest decrease for any commodity

- Australia attracts largest budget increase, to surpass Canadian budget for the first time since 2001

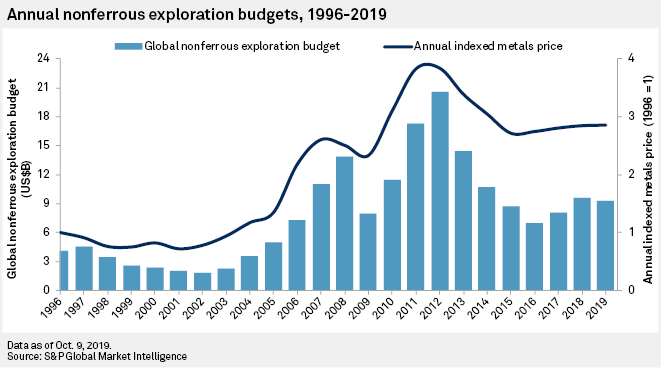

New York, NY, Oct. 15 2019 — Newly released 2019 global exploration budget data from S&P Global Market Intelligence's Corporate Exploration Strategies series reveals that the industry recovery, which began in late 2016, has faltered this year. The global nonferrous exploration budget is down by 3% year over year to US$9.8 billion in 2019 from US$10.1 billion in 2018. The total comprises US$9.29 billion in aggregate company budgets plus an estimated total for companies spending less than US$100,000 and private companies that do not report their data.

Mark Ferguson, Associate Director of Metals & Mining Research at S&P Global Market Intelligence, says, "Difficult market conditions and high-profile M&A activity have unsurprisingly impacted budgets the most, as the amount of money being raised by companies dropped sharply from November 2018 through February of this year. We are encouraged, however, by some positive signs, such as the rising number of active companies, and copper recording a year-over-year increase."

"As the market remains volatile, we anticipate exploration budgets remaining relatively flat in 2020, as any increase to gold budgets will likely be offset by lower allocations to other commodities," Ferguson added.

M&A activity key driver of budget reductions

M&A activity among major companies has played a critical role in lowering planned spending as exploration budgets by the combined entities are much lower than the collective amounts allocated premerger by the individual companies. The Newmont-Goldcorp and Barrick Gold-Randgold mergers earlier this year are the most notable, as the post-merger Newmont Goldcorp and Barrick Gold have allocated about US$48 million and US$54 million less, respectively, than the totals budgeted by the pairs of separate companies in 2018.

Gold plunges while base metals edge upwards

Gold explorers have lowered their budget by US$559 million to US$4.29 billion in 2019, the largest decrease for any commodity, while allocations for base metals have increased by US$191 million to US$3.23 billion. The rise in base metals has been driven primarily by copper, which increased by US$245 million to US$2.32 billion. Nickel budgets have also increased, by US$54 million to US$351.6 million, while zinc allocations have fallen by US$108 million to US$564 million. Allocations to most other commodities have decreased slightly, with the exception of diamonds, which has posted its first increase in six years.

Australian allocations move above Canadian

Comparing budgets by the regions hosting targeted projects, Australia’s nonferrous allocations have increased the most, by US$199 million to US$1.53 billion, surpassing Canada for the first time since 2001. Canada has slid by US$134 million to fourth place with US$1.31 billion. Latin America remains the top region for exploration despite its US$2.62 billion being US$117 million less than in 2018. In third place is our diverse "Rest of World" region, which includes Europe and mainland Asia. Allocations to the latter have fallen by US$241 million to US$1.44 billion in 2019, placing it behind Australia for the first time since 2003.

Additional data, commentary and access to the full report is available to members of the media; please contact amanda.oey@spglobal.com.

Notes to Editors

* Nonferrous exploration budgets refer to planned spending in the search for precious and base metals, diamonds, uranium and some industrial minerals; it specifically excludes exploration for iron ore, aluminum, coal, and oil and gas.

** Given their size and importance to the industry, Canada, Australia and the United States are treated as regions for continental-scale comparisons.

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we know that not all information is important — some of it is vital. We integrate financial and industry data, research and news into tools that help clients track performance, generate alpha, identify investment ideas, understand competitive and industry dynamics, perform valuations and assess credit risk. Investment professionals, government agencies, corporations and universities globally can gain the intelligence essential to making business and financial decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). For more information, visit www.spglobal.com.

Learn more about Market Intelligence

Request DemoMedia Contact

Amanda Oey, S&P Global | Market Intelligence

P. +1 (212) 438-1904

E. amanda.oey@spglobal.com

Subscribe to Press Releases

Submitting your email above means you agree to the Terms and have read and understood the Privacy Policy