Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 10 Feb, 2023

By Suming Xue

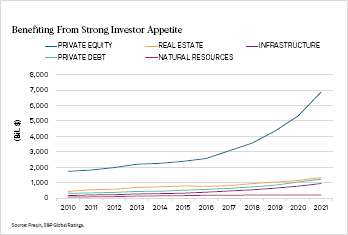

A shallow recession coupled with geopolitical tensions and heightened inflation have created a challenging environment for the traditional asset management sector. European asset managers face even more heightened concerns than their U.S. peers as the ongoing crisis in Ukraine adds uncertainty to the region and interest rate differentials potentially impact the attractiveness of Europe for new investments. Even in the face of elevated volatility in 2022, the volume of alternative assets under management is set to grow further to $23 trillion U.S. by 2026 from approximately $10 trillion in 2019.1

According to S&P Global Ratings, alternative asset managers have seen good investment returns, while average fund sizes have grown and platforms have broadened, including strong growth in private credit.2 Private debt can offer alternative investment funds (AIFs) the opportunity to generate higher returns in certain interest rate environments, while also providing financing to private companies that may not have access to capital from traditional sources. S&P Global Ratings expects demand for alternative investment products and solutions to continue to grow, though the investment landscape remains competitive and institutional investors may be reaching their target allocations to certain alternative products.

Figure 1: Investor Appetite

Source: Asset Management Sector View Is Mixed As Conditions Turn Choppy”, S&P Global Ratings, as of 17 January 2023.

However, as markets remain choppy, growth is expected to slow in 2023, limiting exit opportunities. As exits slow, hold periods will lengthen and distributions to Limited Partners (LPs) will slow, as well. If the market downturn is more protracted or severe than our base case anticipates, weakening performance could affect earnings and asset valuations and, potentially, affect future fundraising.

Despite the positive outlook, there is a risk that further economic turbulence could lead to a surge in defaults and put further pressure on AIFs. As a result, it is important for investors to carefully consider the credit risk associated with AIFs and diversify their investments to minimize exposure to any one asset or sector.

Challenges of assessing AIFs

Investing in unrated assets can offer AIFs the potential for higher returns, as they may be able to access investments that are not available otherwise in the rated universe. However, as stated above, unrated investments also come with higher levels of risk due to a number of factors.

How can S&P Global Market Intelligence’s AIF Scorecard help?

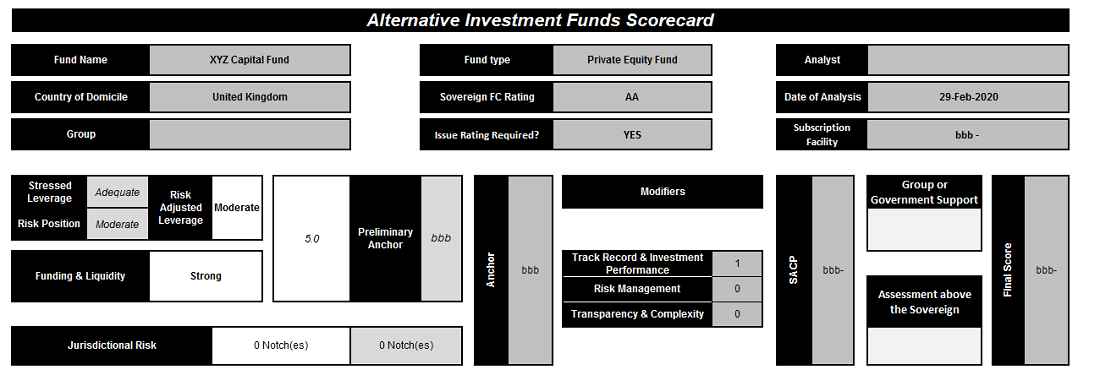

S&P Global Market Intelligence’s Credit Assessment Scorecards provide a valuable framework for assessing credit risk, including access to benchmarks and attribute-driven scoring guidelines. The AIF Scorecard provides an easy-to-use, intuitive structure for financial institutions to evaluate the creditworthiness of funds and conduct an assessment of the credit risk of an AIF’s debt instruments.

As shown in Figure 2, the AIF Scorecard provides a granular and transparent framework for assessing credit risk. It uses measures that can affect the likelihood of default, which are sensitive to changes in an AIF's market conditions. They include:

Figure 2: The AIF Scorecard

Source: S&P Global Market Intelligence. Simplified version for illustrative purposes only. SACP = Stand-alone Credit Profile

To learn more about S&P Global Market Intelligence's AIF Scorecard contact us here.

_________________________

[1]“Difficult Markets Will Test Europe’s Rated Alternative Investment Funds”, S&P Global Ratings, as of 5 December 2022.

[1] “Asset Management Sector View Is Mixed As Conditions Turn Choppy”, S&P Global Ratings, as of 17 January 2023.

Blog

Blog