Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 16 Feb, 2021

By Alice Yu and Mitzi Sumangil

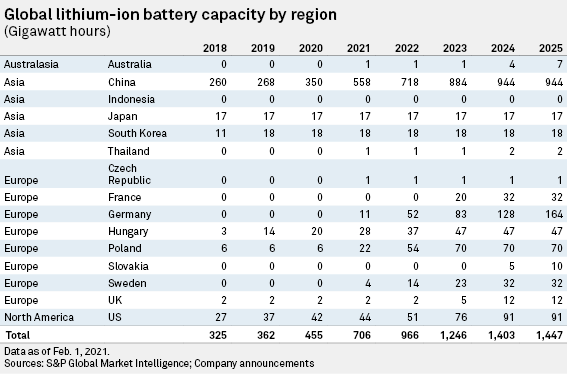

We expect global LIB production capacity to increase from 455 GWh in 2020 to 1,447 GWh in 2025, at a CAGR of 26%. China and Europe will be the largest contributors to LIB capacity increases, just as the two regions will also become the biggest drivers of global passenger PEV sales.

Plug-in electric vehicle sales

PEV promotion falls under a region's broader decarbonization and energy efficiency agenda. Pure battery electric vehicles, or BEV, in particular, generate no tailpipe emissions and convert energy to power the vehicle motion more efficiently than conventional gasoline vehicles, according to the U.S. Department of Energy.

Policy incentives have been critical to driving PEV sales growth. They typically include consumer subsidies to encourage PEV purchases, combined with producer penalties for carbon emissions or the production of internal combustion engines in cars.

Our Lithium and Cobalt CBS January 2021 forecast global passenger PEV sales to increase from 2.9 million units in 2020 to 9.5 million units in 2025. In 2020, Europe overtook China as the largest contributor to PEV sales growth, which will propel the continent — including the EU27, Norway and the U.K. — to become the largest passenger PEV market from 2021 onward.

We forecast U.S. PEV sales to increase from 0.28 million units to 1.05 million units between 2020 and 2025, led by the 12 states that have adopted the zero-emissions electric vehicle program, and from the upside potential of President Joe Biden fulfilling election promises of reaching carbon neutrality by 2035, replacing the government's fleet with electric vehicles and investing in 500,000 EV charging stations, all of which could increase PEV production and uptake.

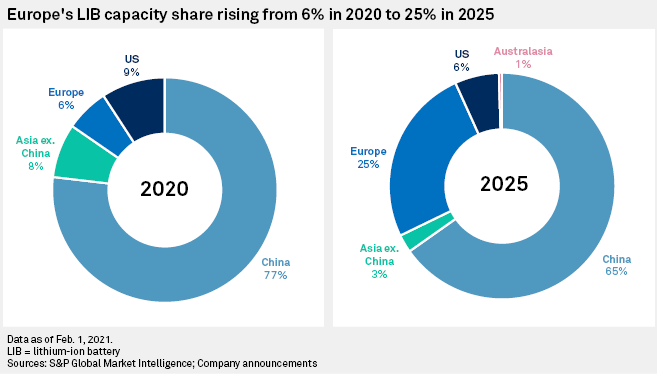

China dominates current lithium-ion battery capacity

China currently dominates global LIB capacity, accounting for 77% in 2020. We nevertheless expect greater geographic diversification as more countries become LIB producers, especially in Europe. We forecast Europe's share of LIB capacity to increase from 6% in 2020 to 25% in 2025, lowering China's forecast share to 65%.

Rising investment increased China's LIB capacity more than fivefold between 2015 and 2018 in order to meet a demand increase from subsidy-driven PEV sales growth. Product quality varied substantially between LIB manufacturers, however, with supply tightness for high-quality products, as leading producers could not expand capacity and production fast enough; conversely, there was severe excess LIB capacity at the low-quality end.

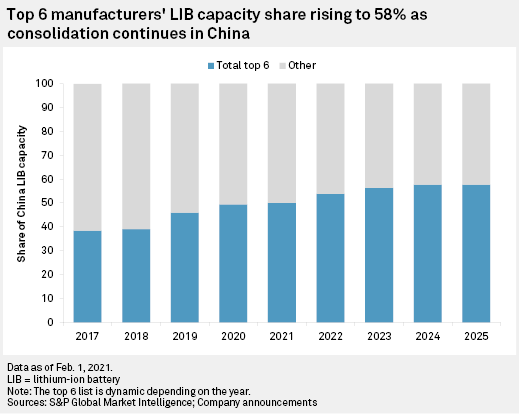

Prior to 2019, subsidies were only applicable to PEVs equipped with LIBs made by Chinese battery makers, which ruled out foreign manufacturers such as LG Chem Ltd., Panasonic Corp. and Samsung SDI Co. Ltd. Since 2019, China's LIB industry has been in a consolidation phase, with noncompetitive firms exiting the market, while Korean manufacturers in particular have firmed up investments in China on a more level playing field.

Consolidation increased the top six manufacturers' share of China's LIB capacity from 38% in 2017 to 49% in 2020, which we expect to increase further to 58% in 2025. The companies in the top six grouping will evolve from all-China-headquartered manufacturers to include LG Chem from 2021 onward.

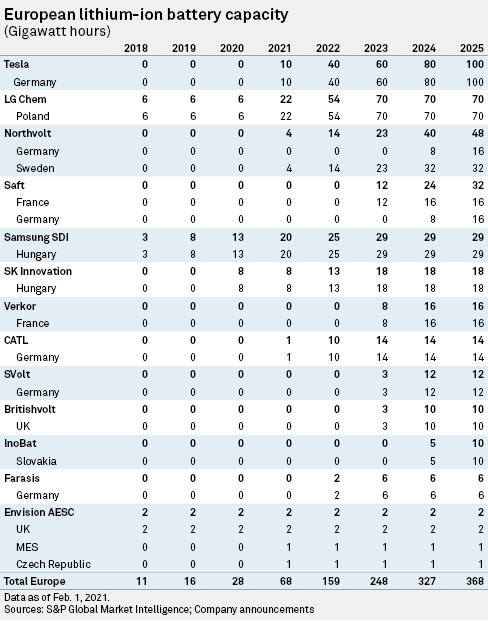

European LIB capacity to rise 13-fold by 2025

Europe's LIB production capacity is forecast to increase from 28 GWh in 2020 to 368 GWh in 2025 under a supportive policy framework, as the region overtakes China in becoming the world's largest PEV market.

According to the European Union, passenger cars are responsible for 12% of the region's carbon dioxide emissions. In 2020, the EU tightened the fleetwide emissions target for new cars by 27% to 95 grams of carbon dioxide per kilometer, and is set to further lower emissions from 2021 levels by 15% in 2025 and 37.5% in 2030. These target roadmaps have led to automakers increasing their regional PEV model offerings and sales to avoid a penalty of 95 euros per gram of excess CO2. Outside the EU, the U.K. and Norway are promoting PEV sales with purchase grants, favorable road tax rates and banning the sale of new internal combustion engine vehicles by 2025 and 2030 respectively.

Europe has a tradition of car manufacturing, with key production hubs across Germany, France, the U.K. and Italy. Consequently, Europe has also seen an influx of battery capacity investment to meet the regional demand for PEV production and sales. Five European countries could join the ranks of LIB producers by 2025 — the Czech Republic, France, Germany, Slovakia and Sweden.

The biggest capacity increases through 2025 include 100 GWh under phase one by Tesla Inc. in Germany, LG Chem in Poland reaching a total capacity of 70 GWh and Northvolt AB in Sweden and Germany totaling 48 GWh.

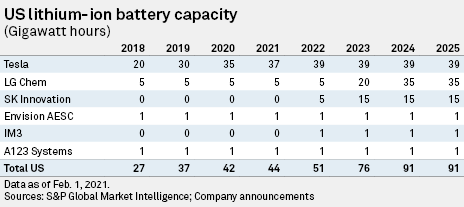

US LIB capacity growth to lag but still more than double by 2025

We anticipate U.S. LIB capacity to more than double from 42 GWh in 2020 to 91 GWh in 2025. The investments are led by LG Chem and SK Innovation Co. Ltd. Tesla has not yet announced a capacity for the Texas Gigafactory project, which remains a "dark horse" and could add significantly more capacity. The LIB investment momentum is, nevertheless, weaker in the U.S. than in Europe or China, as a result of a comparatively weaker policy support framework for PEVs to date. We expect the U.S. share of global capacity to decline from 9% in 2020 to 6% in 2025, as the growth rate in the LIB capacity lags other regions.

Localization of battery manufacturing capacity

LIB battery packs account for 30%-40% of the price of a BEV, making them the costliest component. Automakers are increasingly keeping battery pack production in-house as battery packs are customized to each vehicle model and are costly to ship due to weight. Tesla's Shanghai and Nevada gigafactories use third-party cells to assemble battery modules and packs.

LIB cell production nearby auto and pack production helps minimize supply-chain risk and enables improved collaboration between battery and automakers, while reducing logistics costs and improving safety. In addition, LIBs are classified as dangerous goods because of fire hazards and require additional testing and preparation in accordance with international transportation regulations before shipping.

Battery and automakers are seeking to lower battery cost by taking a holistic approach to battery design, from cells to modules and packs. For example, Contemporary Amperex Technology Co. Ltd.'s cell-to-pack technology and BYD Co. Ltd.'s blade battery technology attempt to eliminate excess space in battery packs, while Tesla is innovating tab-less technology in cell design to reduce cost and improve production efficiency and battery performance.

There is also significant stickiness in the supply relationship between battery makers and automakers, which provides incumbent suppliers with first-mover advantage. Having a single cell supplier for the same battery pack allows greater homogeneity among cells, which is critical in determining battery safety, capacity and longevity. There is also a long qualification period for a new battery supplier, resulting in long-term relationships between battery makers and automakers. Finally, since battery cell manufacturing enjoys economies of scale, larger producers benefit from lower costs.

The benefits of proximate or integrated cell-to-pack production, coupled with supply stickiness and economies of scale, explain the type of capacity investment taking place in Europe and the U.S. They tend to be large-scale projects led by major global battery makers, including CATL and SK Innovation. Many are in collaboration with an automaker partner, such as LG Chem and General Motors Co. in the U.S., Saft AB and PSA Peugeot Citroën SA in France and Germany, and Northvolt with Volkswagen AG and Bayerische Motoren Werke AG in Europe.

While investment in battery manufacturing capacity has been driven by strong regional PEV sales, there has been much slower progress for lithium raw material-producing countries that do not yet have a sizable PEV market to integrate into battery production.

Governments in leading lithium-producing countries, including Chile and Australia, are encouraging greater value-add through developing a localized battery supply chain. Chile had made some progress until a member of the winning battery consortium pulled out due to the country not being able to supply sufficient lithium hydroxide required for higher-nickel-chemistry batteries. Australia has only made partial progress, with Energy Renaissance Pty. Ltd.'s project aiming to start production of energy storage LIBs from mid-2021, beginning with a capacity of 0.066 GWh.

Global LIB capacity is set to increase 218% between 2020 and 2025, with greater regionalization closer to key PEV markets. While this could be seen as an example of deglobalization, it is actually globalization working at its best, where the most competitive and sophisticated battery makers are best located to capture LIB demand growth in the fastest-growing PEV markets.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.