Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 5 Sep, 2024

By Sean DeCoff

Highlights

New major copper discoveries sparse amid shift away from early-stage exploration

Expert insights powered by S&P Capital IQ Pro

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

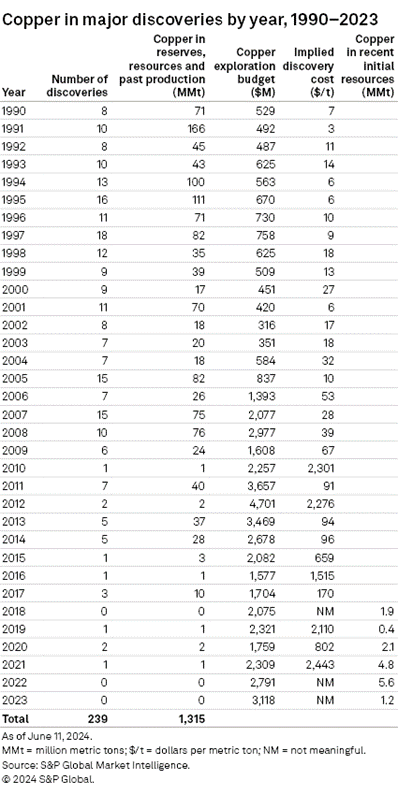

Our annual analysis of major copper discoveries has identified 239 copper deposits discovered between 1990 and 2023, containing 1.315 billion metric tons of copper in reserves, resources and past production. We have backfilled six discoveries that now meet our threshold of having at least 500,000 metric tons of contained copper. We have also removed one discovery that dropped below this threshold according to an updated resource report, yielding a net gain of five discoveries on this year's list.

The volume of discovered copper increased by 4%, or 61 million metric tons, in this year's analysis. Most of the increase is due to expansion at older discoveries, with deposits found during the 1990s accounting for 70%, or 43 MMt, of the total growth. Despite exploration budgets climbing 12% in 2023, we have recorded only four discoveries from the past five years (2019–2023), totaling 4.2 MMt of copper, which underscores the downward trend in the rate and size of major discoveries over the past decade.

The discoveries dataset prepared by S&P Global Commodity Insights includes all deposits containing at least 500,000 metric tons of copper in reserves, resources and past production. The year of discovery corresponds with the year of the initial drill program that identified potentially economic mineralization, eventually resulting in a definition of copper in reserves and resources that meets or surpasses our major discovery threshold criterion.

Focus remains on older, known deposits

The trend of declining major new copper discoveries continued in 2023. Discoveries from the past decade account for just 14 of the 239 deposits included in the analysis. The contained volume of these discoveries makes up only 46.2 MMt, or 3.5%, of all copper in major discoveries since 1990. As new assets naturally require more time to develop, this volume may well increase over the next few years, and several discoveries will likely grow past our threshold to qualify as major discoveries. Recent discoveries, however, will most certainly not match the 1990s in size or abundance.

The dearth of recent discoveries is a direct result of the industry's continued focus on brownfield assets — extending known deposits and assets — rather than the generative exploration that could yield brand-new discoveries. Grassroots' share of the copper exploration budget in the 1990s and early 2000s typically ranged between 50% and 60%. In the 2023 CES survey, early-stage exploration registered just 28% — the lowest on record. Until there is a reversal in exploration trends, the trend of fewer significant discoveries is likely to persist.

Exacerbating the issue, copper exploration budgets, in dollar terms, have remained well below decade-ago levels, despite a strong copper price. The 2023 copper exploration budget was 34% lower than the peak of 2012. Adjusted for inflation, the disparity is even greater.

Our initial resource database gives a sense of what is to come, showing 15.9 MMt of new copper from initial resource announcements in the past six years. These deposits did not meet our major discovery threshold but may soon qualify as the projects develop their reserves and resources.

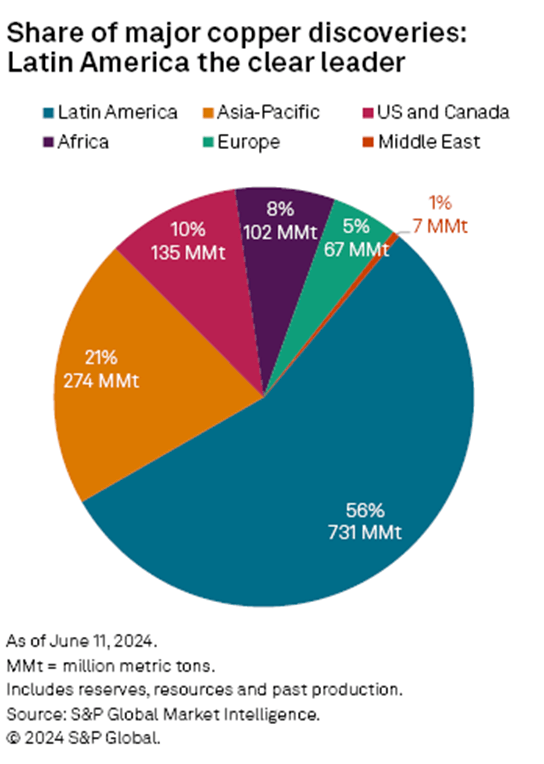

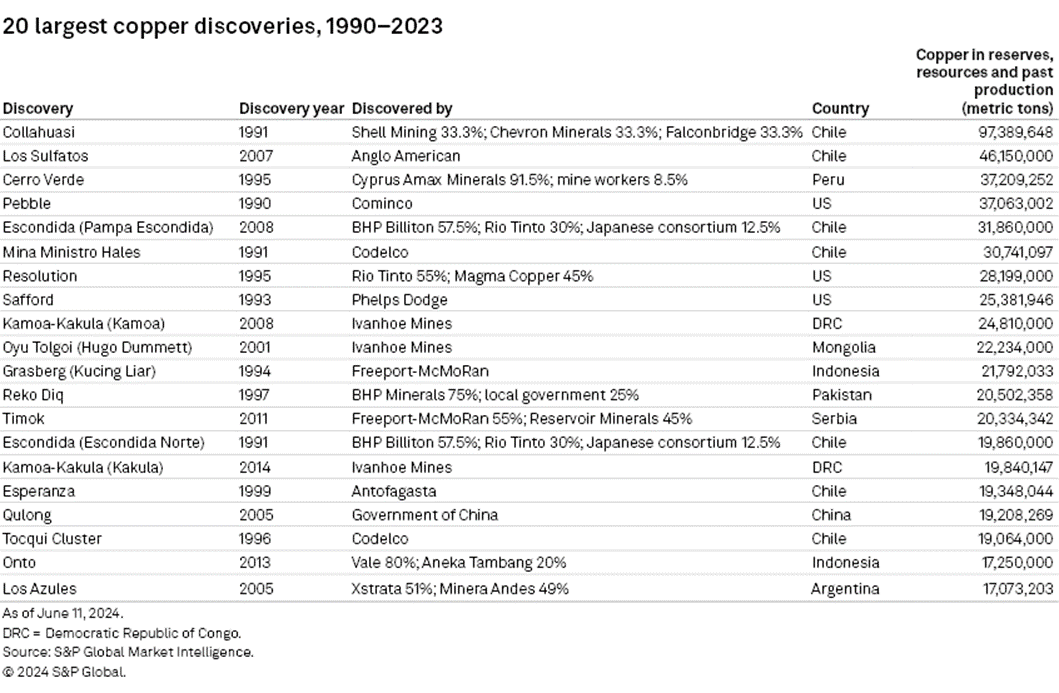

Latin America remains top region for discoveries

Given that Latin America hosts some of the world's largest copper mines and accounts for nearly 40% of global mine production, it is no surprise that most of the discovered copper has been found in the region. In terms of tonnage, 55.6%, or 730.9 MMt, of the discovered copper from our dataset was discovered Latin America. The region is the primary location for copper exploration globally, attracting more than one-third of copper budgets over the past two decades. Exploration has mostly been directed toward Chile and Peru, and the two countries combined account for 573.9 MMt, or 78.5%, of the copper discovered within Latin America. The top three largest discoveries on our list come from Chile (Collahuasi and Los Bronces Underground) and Peru (Cerro Verde).

Asia-Pacific ranked second with 21% of global discovered copper thanks to several tier-one assets, such as Oyu Tolgoi (Hugo Dummett) in Mongolia, Grasberg (Kucing Liar) in Indonesia and, more recently, Reko Diq in Pakistan.

The US and Canada ranked third with 10% of discovered copper. Top-tier assets like Resolution and Safford account for significant volume in our list. However, the largest discovery in the region, Pebble, has been stymied by regulatory issues and public opposition, making its prospects uncertain. Seabridge Gold Inc.'s KSM (Mitchell) and KSM (Iron Cap) in BC face a similar predicament.

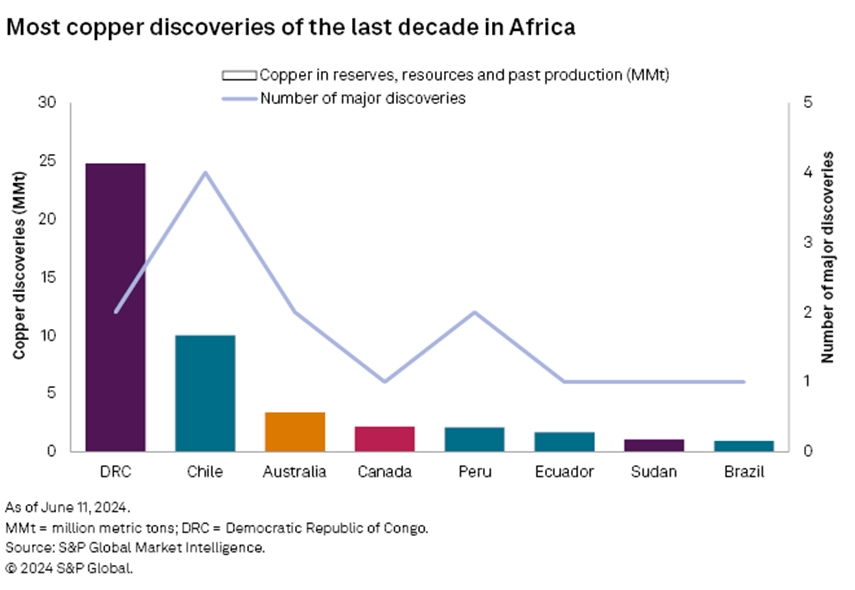

Africa dominating past decade

While Latin America accounts for the lion's share of copper discoveries on our list, the majority, by both volume and number of discoveries, occurred in the 1990s and 2000s. Looking at the last decade, the clear leader has been Africa, which accounts for 56% of the discovered copper during the period — nearly twice as much as Latin America. This is primarily due to Ivanhoe Mines Ltd.'s discoveries of the Kamoa-Kakula deposit and the Western Foreland in the Democratic Republic of Congo in 2014 and 2017, respectively.

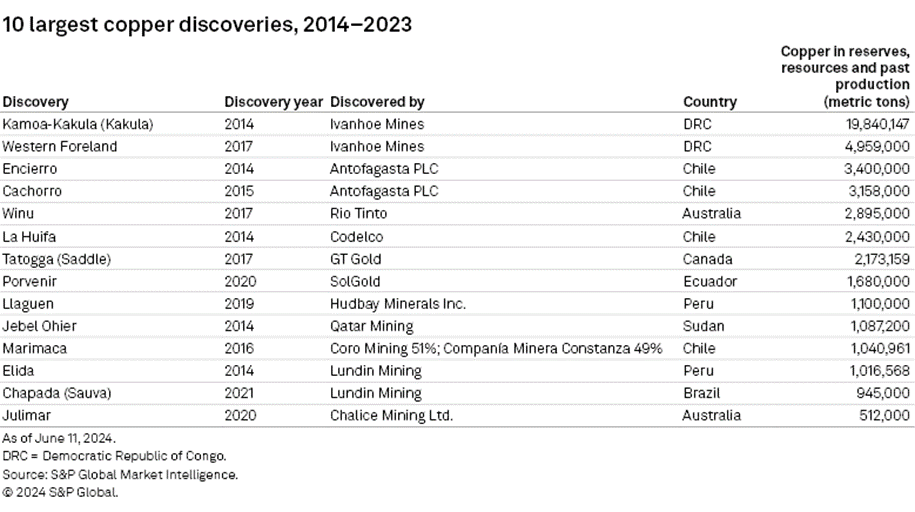

Looking at the top 10 list of discoveries from the last decade, only a few have the potential to supply a meaningful amount of copper to global markets. Kakula is by far the largest discovery over the past decade, hosting 19.8 MMt of copper, and it boasts one of the highest grades among all discoveries since 1990 at 2.58%.

Looming near-term deficit

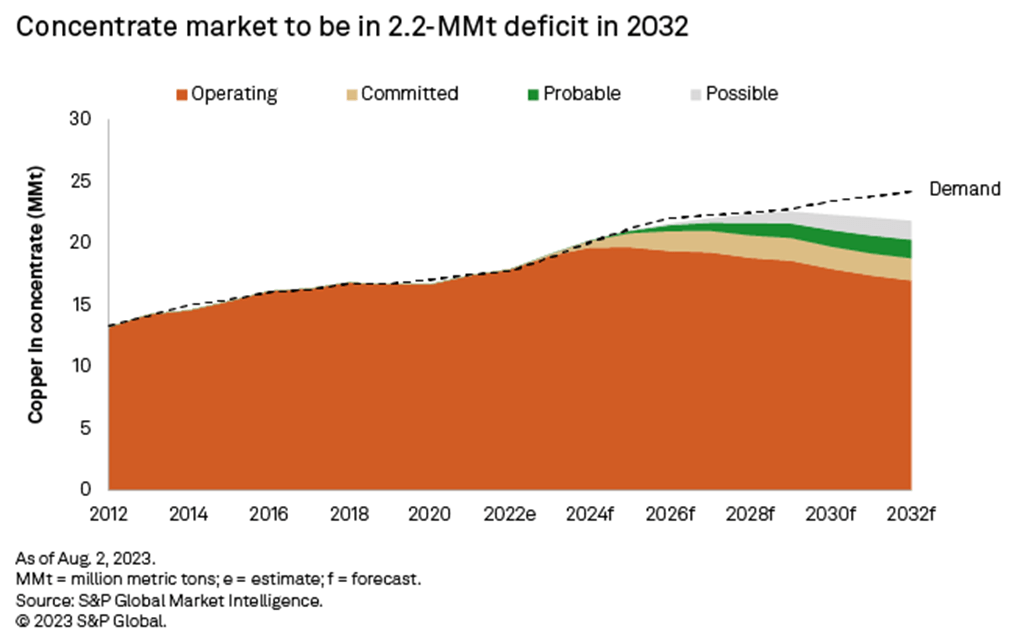

The five-year outlook in our recent Commodity Briefing Service report shows a significant refined copper deficit beginning in 2027. Most pressingly, however, is the concentrate market, which we estimate to currently be in deficit and to remain so for the next five years. Copper prices have reacted to these dynamics, recently pushing above $10,000 per metric ton, and treatment charges have collapsed to record lows. Further out, as noted in our updated report of the Copper project pipeline, we are expecting mine supply to peak in 2029 and forecast a potential concentrate deficit of 2.2 MMt by 2032.

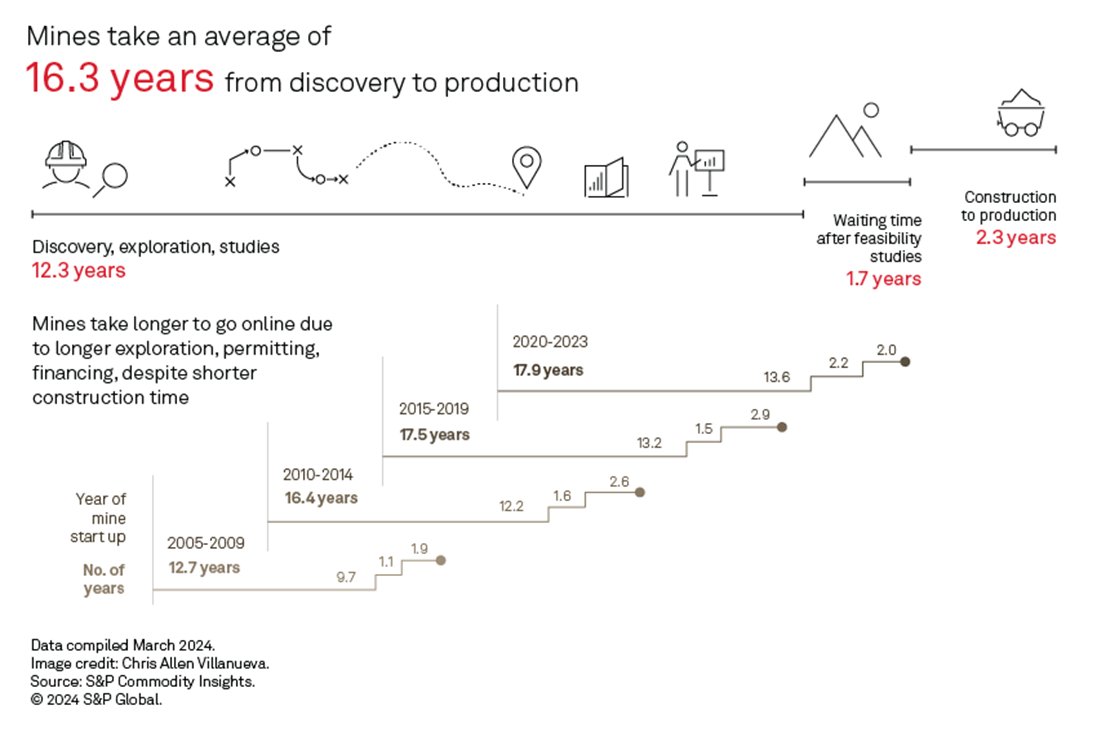

Our recent analysis of lead times suggests that filling this supply gap won't be easy. The average lead time — from discovery to production — for mines that started in the 2005–2009 period was 12.7 years and has grown steadily up to the present. For mines that started production in the 2020–2023 period, the average lead time jumped to 17.9 years, fueled by a longer exploration, permitting and studies phase and a longer period between the end of feasibility studies and the start of construction, which can be attributed to time spent obtaining financing and construction permits.

Of the 239 major discoveries included in the discoveries analysis, 148 are not yet in production, 121 of which have yet to complete feasibility studies. Just 15 have finalized construction plans and begun development. So not only are the size of the new deposits smaller, but the number of shovel-ready discoveries is dwindling. Given the development stage of many of the probable assets, production from these mines may not come to market soon enough to alleviate projected deficits.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.