Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Feb 08, 2024

By James Irwin and Sarah Wagner

As we set a course for what promises to be a busy year, it's important to reflect on the trends, challenges, and successes of the past 12 months. This first installment of the 2024 Loan Settlement blog series looks at global loan market volume and performance, the continued development of automation, and offers a glimpse at the year ahead.

2024 leveraged loan market outlook

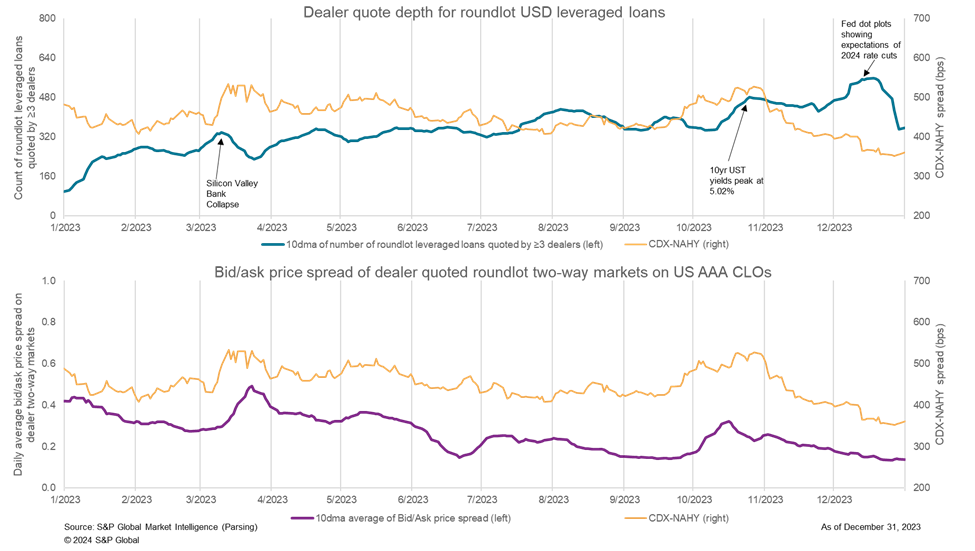

Leveraged loan liquidity conditions were showing steady signs of improvement from the October 2022 nadir through early March 2023, but quickly deteriorated following the collapse of Silicon Valley Bank and the domino effect it had on US regional banks and some European banks. There was an average of 339 loans highly quoted by dealers on March 10 that declined to 234 on March 24, while bid/ask spreads on AAA collateralized loan obligations (CLOs) increased from 0.30 to 0.50 during those dates. In late September 2023, AAA CLO spreads widened, while the number of highly quoted loans increased with bid/ask spreads at 0.15 on September 27 and 0.31 on October 17, in contrast to highly quoted loans increasing from 379 to 409 during those same dates. Both metrics reached their best levels of the year the week before the December holiday slowdown, with the number of highly quoted loans peaking at 550 on December 20 and the bid/ask compressing to 0.14 that same day.

Review the full S&P Global Market Intelligence Leveraged Loan 2023 Liquidity Review here.

Trade volume and trends

In 2023, the combined primary and secondary notional for settled trades in ClearPar was $1.35 trillion, a 9% decline when compared to 2022, but on par with figures seen during 2019 and 2020. Despite the decline in notional traded, the total number of settled trade allocations in 2023 (1.67 million) was only 3% lower in comparison to 2022, but higher than all previous years before that - this includes 2021 which was a record year for traded notional and primary issuance. In fact, over the last 5 years, we have seen overall trade volumes continue to grow despite notional remaining consistent (a 25% increase in trade numbers since 2019). Much of this can be attributed to a more active and liquid secondary market, despite reduced primary issuance since the highs of 2021. Global secondary volumes overall remain consistently buoyant, with 2023's volume still 30% higher than in 2021.

Despite disparities in overall volumes, there are regular consistencies by region. The increasingly active secondary market in the US (LSTA), has continued an upward growth trajectory over the last 5 years - with today's volumes 28% higher than in 2019. Secondary trade volumes did though fall by 6% in 2023 compared to the prior year. Primary volumes remained consistent with those seen in 2022 but were still subdued. The EMEA (LMA) market saw similar trends in primary activity when benchmarked against 2021, although slightly up year on year in 2023 thanks to a more promising second half. The biggest growth area was secondary activity, with the largest on-record LMA trade volumes, 8% higher than in 2022.

Over 90% of all settled trades had trade documentation packs automatically delivered to a Custodian/Trustee upon settlement, while close to a quarter of trades had real-time trade data sent to these providers via the Custodian Messaging solution to help facilitate downstream automation such as SWIFT payment automations.

Settlement times improving

Settlement times are of increasing importance for institutions to support greater market liquidity and risk reduction. And it's not just Lenders who are prioritizing performance, as Agents continue to put more focus on their ability to settle more loans, faster. Sharing market T+ insights with our clients allows institutions to benchmark and compare their settlement performance, while the ClearPar T+ Recognition Award has further allowed the Buyside to view their performance against immediate peers, contributing to reducing settlement times in the market as they strive to achieve improved positions each year.

This was certainly apparent in the LMA market in 2023, as settlement times for Secondary Par fell by 22% despite the increase in trade volumes. The market average has returned to the pre-pandemic mid T+ 40s after some years of volatility and change. While this figure will be seen as high by many, it is important to highlight that trade volumes are now double those of 2019. This is a hugely positive sign and shows that market participants have been able to adapt and support this through a combination of resources and technology, providing much needed efficiencies.

In the LSTA there was also a fall in T+ as the market average settlement time shortened to 19.5 days, a 7% change compared to 2021 and 2022. Given the trading activity, this is also increasingly positive.

The use of electronic trade messaging integrations to eliminate dual keying, automating access to lender of record position data via Loan Reconciliation, and digitizing SSI workflow to eliminate the pain-staking process of receiving callbacks to validate payment wires have all been contributors to greater efficiencies market wide.

2023 achievements and observations

Contrary to popular belief, there is a high degree of automation and digitization across loan trades - and not just in terms of trade documents and execution. 2023 was a landmark year for ClearPar and our associated product suite, with a record number of significant platform enhancements delivered through our new ClearPar user interface. Additionally, key adoption milestones with ADFlow and the delivery of real-time trade messaging to Custodians and Trustees were achieved.

A new ClearPar user experience on the consolidated Loan Platforms site was made available to all our Dealers and Agents clients, in addition to Buyside institutions. This revolutionary new experience not only offers revamped functionality and workflows, but also enables access to trades, position data, agent servicing activity/notices, loan reference data and digital ADF management all in one single platform.

During 2023 there were various adoption landmarks for key solutions and industry initiatives. Some highlights are as follows.

For a more detailed overview of key Loan Platforms product enhancements and new solutions, please watch the 2023 Year in Review video (log in required).

In the year ahead, our Loan Platforms network can expect to see some exciting developments. We are increasingly focused on bringing even greater scale to our clients to support the market if volumes were to further grow at pace, while putting equal weight to facilitating the more complex trade types and markets with legacy practices. Highlights to be on the lookout include ClearPar integrations with S&P Global Tax and KYC solutions for centralized and automated validations and the next stage of our secondary settlement automation using Loan Reconciliation position data.

For now, we wish everyone a happy and prosperous 2024.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.