Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Feb 06, 2024

By Chris Fenske

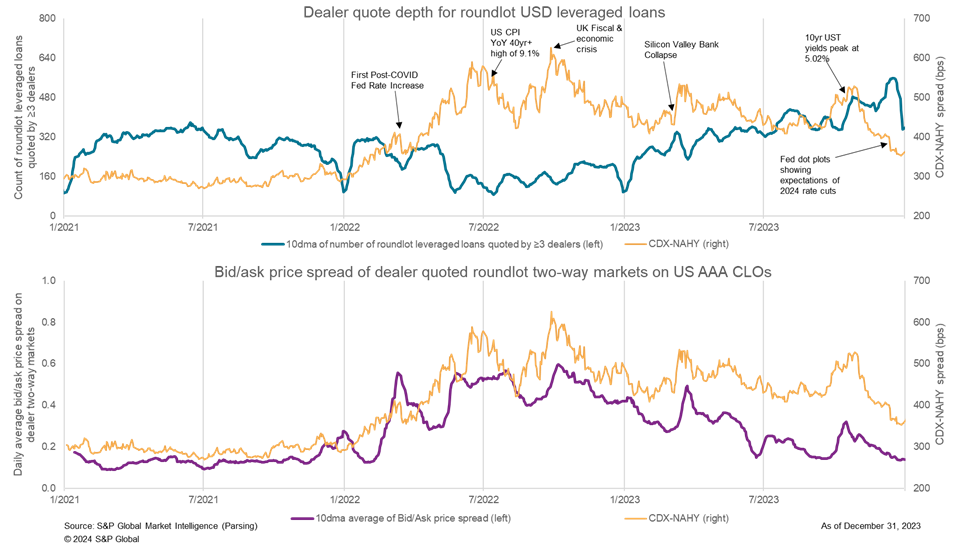

Leveraged loan liquidity ended 2023 on a high note, according to dealer quote data from S&P Global Market Intelligence's Parsing platform. We reviewed 1.7 million daily US leveraged loan dealer quotes and 460,000 AAA collateralized loan obligations (CLOs) dealer quotes from 2021-2023 alongside CDX-NAHY spreads to identify major market events that impacted liquidity. We focused on the 10-day moving averages of the daily number of round lot size loans quoted by three or more dealers (top chart) and the average bid/ask price spread of AAA CLO two-way dealer markets (bottom chart), as each provides different leveraged loan liquidity insights.

When three or more dealers quote a higher number of loans, it indicates increased liquidity and is an almost real-time indicator of market activity, as it is particularly sensitive to sudden declines in dealer trading appetite during major holidays and market distress. On the other hand, a lower AAA CLO bid/ask spread is a core indicator of sector liquidity. It is less impacted by holiday slowdowns in trading activity but more influenced by major positive or negative credit events.

The data in both charts indicates that the historically low rates, stable credit spreads, and record capital market new issue activity during most of 2021 resulted in elevated levels of loan dealer quote depth and very tight (low) AAA CLO bid/asks spreads until a slight deterioration in both metrics starting in mid-November that year. Liquidity rapidly deteriorated at the beginning of 2022 in reaction to the start of the Fed's tightening cycle in March, which was necessary to counteract the uptick in inflation that became a concern in 2021. The number of highly quoted loans declined from 318 on February 11 2022 to 188 on March 17 2022. AAA CLO bid/ask price spreads increased 0.15 to 0.50 during the same period. The June 2022 US CPI came in at the highest level in over 40 years at 9.1% YoY on the July 13 release date, which resulted in an average of only 86 loans being quoted on July 14 and a AAA CLO bid/ask spread of 0.54. The fiscal and economic crisis in the UK that followed the election of a new Prime Minister in September 2022 had a direct impact on UK pension funds' ability to invest in CLOs, which drove AAA CLO bid ask spreads as wide as 0.60 on October 7.

Leveraged loan liquidity conditions were showing steady signs of improvement from the October 2022 nadir through early-March 2023, but quickly deteriorated on the collapse of Silicon Valley Bank and the domino effect it had on US regional banks and some European banks. There was an average of 339 highly quoted loans on March 10 that declined to 234 on March 24, while bid/ask spreads increased from 0.30 to 0.50 during that period. In late-September 2023, AAA CLO spreads widened, while the number of highly quoted loans increased, with bid/ask spreads at 0.15 on September 27 and 0.31 on October 17, in contrast to highly quoted loans increasing from 379 to 409 during those same dates. Both metrics reached their best levels of the year the week before the December holiday slowdown, with the number of highly quoted loans peaking at 550 on December 20 and the bid/ask compressing to 0.14 that same day.

Preliminary readings of both loan quote depth and AAA CLO bid/ask spreads indicate a strong start to the first three trading weeks of 2024, with both metrics already exceeding the best-reported levels of 2023. The resilience of US employment combined with real wage growth is boosting consumer optimism and gradually improving inflation. This should benefit leveraged loan liquidity, unless there are signs of an economic slowdown that could negatively impact credit conditions.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.