Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 7 Jul, 2023

By Jason Sappor

In its monthly Nickel Commodity Briefing Service (CBS) report, S&P Global Commodity Insights discusses the nickel market within the broader macroeconomic environment and provides rolling five-year supply, demand and price forecasts.

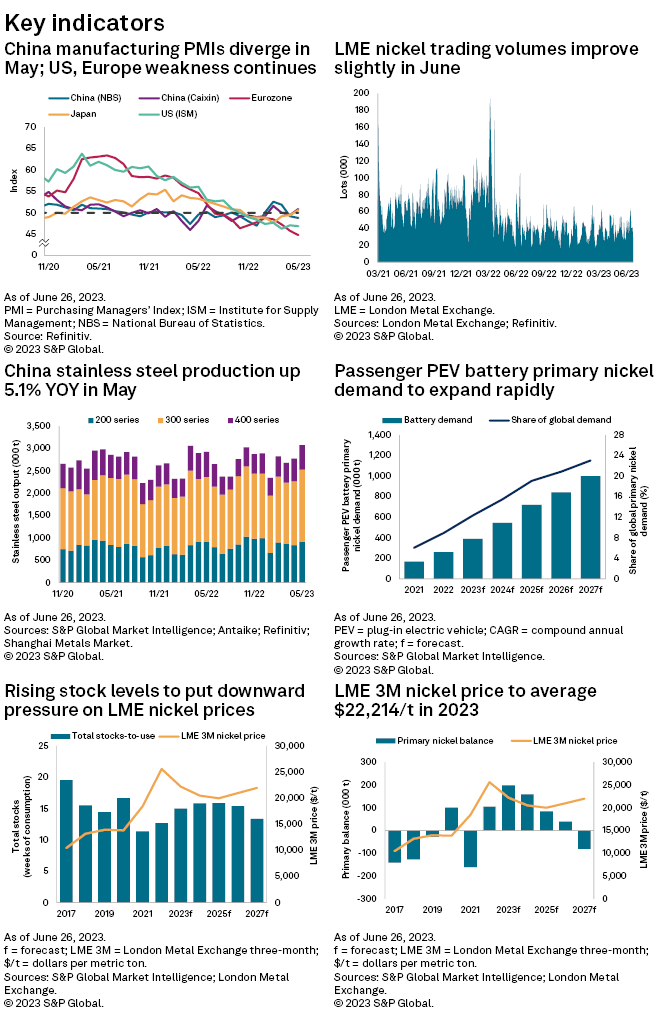

➤ With the market disappointed by China's latest stimulus measures, the London Metal Exchange three-month (LME 3M) nickel closing price dropped to $20,056 per metric ton June 28, a new 2023 low but still a premium over China battery-grade nickel sulfate prices.

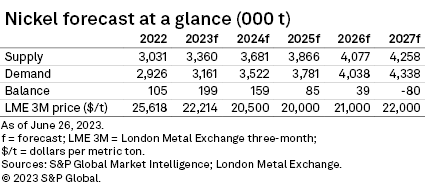

➤ We have downgraded our average LME 3M nickel price forecast for the second half to $20,000/t from $22,000/t on expectations that rising primary nickel production in Indonesia and China will overpower improving consumption in China.

➤ Considering our expectations that total primary nickel stocks will rise over our forecast horizon, we have also downgraded our average LME 3M nickel price forecast by an average of $5,625/t per year across 2024 and 2027, with the price expected to average $22,000/t in 2027.

➤ We continue to expect LME nickel prices to remain historically elevated over this period due to the impacts of the March 2022 short squeeze and the growing influence of the battery sector on the global nickel market.

Analyst comment

Following a short-lived price rally, the LME 3M nickel price fell to a new 2023 low in June yet still held a premium over China battery-grade nickel sulfate prices.

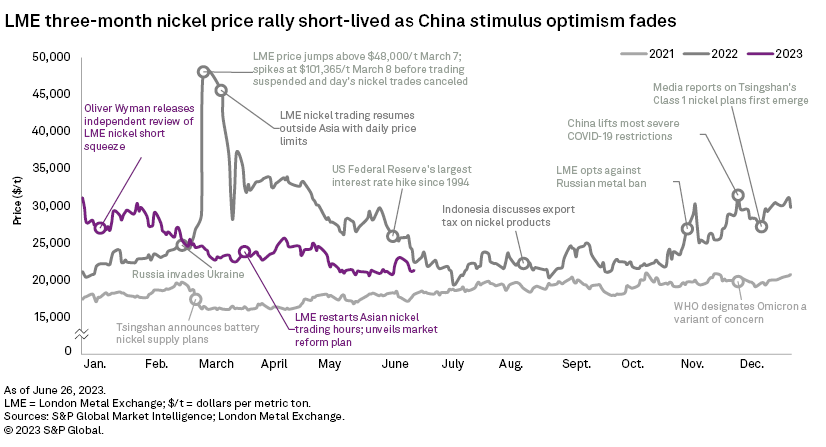

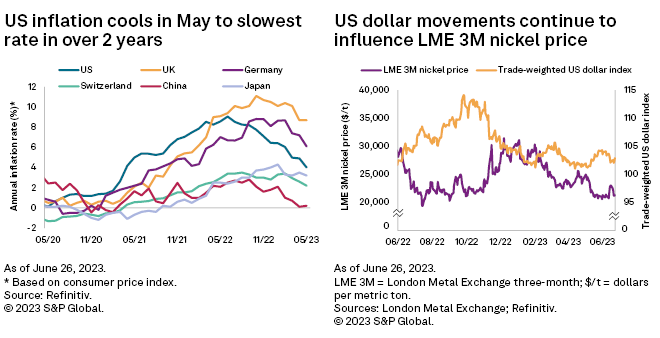

The LME 3M nickel price closed between $20,500/t and $21,500/t from May 18 until June 12, when a surprise short-term interest rate cut by the People's Bank of China created hope that the central bank could implement additional expansionary monetary policy measures to boost flagging metals demand from top consumer China. Metals market sentiment was buoyed further by US dollar weakness after data released June 13 showing a US annual inflation rate of 4% in May, its lowest level since March 2021, pushed the US Federal Reserve to leave its benchmark interest rate unchanged in June. This marked the first time since January 2022 that the US central bank did not raise the rate. These bullish macroeconomic developments helped the LME 3M nickel price rally from $20,755/t June 12 to $23,034/t June 16, its highest level since May 10.

The price recovery proved to be short-lived, however. Market optimism faded after the Chinese central bank followed up its previous short-term interest rate reduction with long-term lending rate cuts June 20, a decision that failed to meet market expectations for more aggressive monetary stimulus. This, combined with a firmer US dollar following hawkish comments regarding the future direction of interest rates from US Federal Reserve Chairman Jerome Powell, caused the LME 3M nickel price to drop to a new 2023 low of $20,056/t June 28.

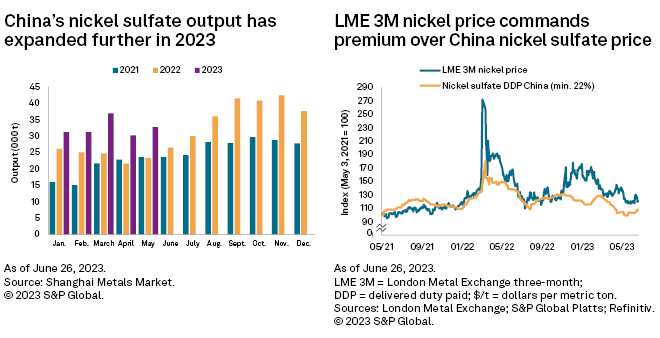

The LME 3M nickel price has fallen 30.8% since the end of 2022 amid bearish primary nickel market and macroeconomic fundamentals. Unsupportive physical nickel market dynamics are further emphasized by a downward trend in China battery-grade nickel sulfate prices over the same period, with the Platts Nickel Sulfate delivered duty paid (DDP) China assessment down from $21,718/t Dec. 30, 2022, to $18,757/t June 26 on a 100% contained nickel basis excluding value-added tax.

China nickel sulfate prices have come under downward pressure due to surging domestic output and removal of government subsidies on passenger plug-in electric vehicle sales at the end of 2022. Data from Shanghai Metals Market shows that China's production of battery-grade nickel sulfate totaled 162,200 metric tons of contained nickel in the first five months of 2023, representing a 34.4% year-over-year rise. This trend has been fueled by the arrival of battery-grade nickel sulfate input products, such as nickel matte and mixed hydroxide precipitate (MHP), from top nickel producer Indonesia. MHP has overtaken refined class 1 nickel as the favored battery-grade nickel sulfate input among China's nickel sulfate producers due to its cheaper price. The latest available trade data from S&P Global Market Intelligence Global Trade Analytics Suite shows that Indonesia's exports of MHP have totaled 855,474 metric tons since the country's first high-pressure acid leach plant started operating in May 2021, with 96.5% of the material being shipped to China.

Despite the LME 3M nickel price coming under further downward pressure in June, it continued to command a premium over China nickel sulfate prices, with the price exceeding the Platts Nickel Sulfate DDP China assessment by $1,548/t as of June 26. Given that the LME price is underpinned by refined class 1 nickel products, the current LME premium has encouraged Tsingshan Holding Group Co. Ltd. to shift its nickel production strategy again by building a plant capable of converting nickel matte to refined class 1 nickel in Indonesia. The price gap between LME nickel and China nickel sulfate could narrow if other China-based nickel producers follow Tsingshan's move.

Outlook

Although our projection for the global primary nickel market surplus in 2023 is broadly unchanged from our May CBS report at nearly 200,000 metric tons, we now forecast market fundamentals to worsen in the second half on expectations that rising primary nickel production in Indonesia and China will overpower improving consumption in China during the rest of the year. We have consequently lowered our average LME 3M nickel price forecast for the second half to $20,000/t from $22,000/t. Our average LME 3M nickel price forecast for 2023 therefore stands at $22,214/t, down from our May forecast of $23,237/t.

Global government support of the e-mobility transition and the wider green revolution of the global economy was further highlighted recently by the Chinese government's decision to extend value-added tax exemptions for new energy vehicles by four years to 2027. Such policy support is a factor behind our expectations for global primary nickel consumption from plug-in electric vehicle batteries to expand at a compound annual growth rate of 30.8% between 2022 and 2027. Despite our expectations that rapidly growing battery demand will reduce the global primary nickel market surplus over our forecast horizon, we expect total reported and unreported primary nickel stocks to rise to 15.9 weeks of consumption by 2025. This would be its highest level since 2020, when the COVID-19 pandemic pushed the global primary nickel market into a surplus for the first time since 2015.

Considering the downward pressure that such excess stocks could put on nickel prices, we have downgraded our average LME 3M nickel price forecast by an average of $5,625/t per year across 2024 and 2027. We nevertheless maintain our expectations for the price to stay at historically elevated levels, with the LME 3M nickel price forecast to average $22,000/t in 2027, significantly higher than the average price of $13,727/t over the 10-year period to 2021, the year before the historic LME nickel short squeeze. We continue to attribute such pricing trends to both the impacts of the March 2022 short squeeze and the growing influence of the battery sector on the global nickel market.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

Platts Nickel Sulfate delivered duty paid China assessment is an offering of S&P Global Commodity Insights. S&P Global Commodity Insights is a division of S&P Global Inc.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Research

Research

Campaign