Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 26 Dec, 2022

By Alice Yu

S&P Global Commodity Insights discusses the lithium and cobalt markets within the broader macroeconomic environment and provides five-year supply, demand and price forecasts.

Key findings

China dropped its zero-COVID policy at the start of December. The much-awaited move brings positivity to the global economy, and to an auto sector that is increasingly being affected by affordability challenges.

In the short term, however, China's reopening is adding pessimism to the already weak outlook on PEV sales in the March 2023 quarter as the national-level subsidy ends.

The upstream PEV supply chain is already experiencing lower demand, and expectations of further price falls have scaled back procurement demand for lithium and cobalt. We expect a surge in COVID-19 infections in China to depress PEV sales, and production disruptions in the PEV supply chain could follow as infections spread. Chinese epidemiologists are expecting three waves this winter. Growth in income and spending will nevertheless follow as the short-term challenges pass, as China redirects its focus toward economic growth again.

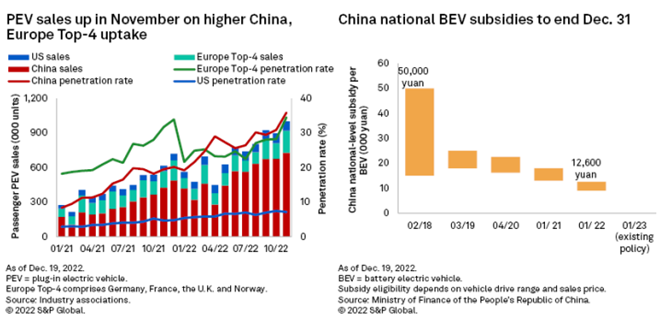

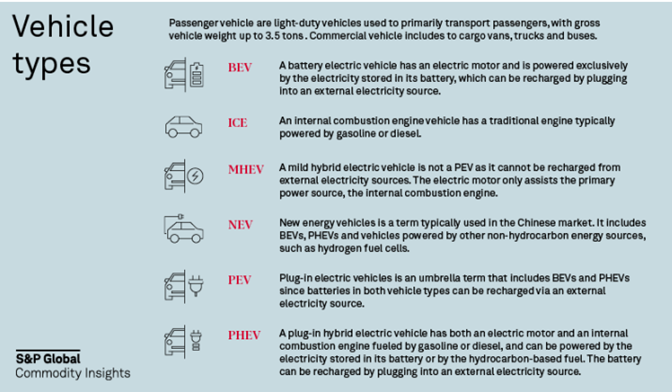

Plug-in electric vehicles

Rising PEV sales in China in October and November were capped by weaker-than-expected overall auto sales as lockdowns extended to more of the key auto-buying provinces. Passenger PEV sales rose 7.9% month over month in November, lower than the 17.9% increase a year ago. The December window for a strong sales catch-up is hindered by surging cases as the country drops its zero-COVID approach. We previously anticipated an even stronger December quarter in China, with PEV sales being pulled forward from 2023 as consumers make the most of the national subsidies before they expire at year-end. The headline national subsidy for pure battery EVs is set to experience the biggest drop since 2019, declining 12,600 yuan to zero Jan. 1, 2023, more than double the drop of 5,400 yuan in 2022 and 4,500 yuan in 2021.

The surge in COVID-19 infections in China is likely to further depress PEV sales and affect supply chains over the next few months — Chinese epidemiologists are expecting three waves this winter. We nonetheless expect improvements in the country's macroeconomic prospects after as short-term disruptions pass, supporting the PEV and consumer electronics sectors and ensuring a more resilient supply chain as lockdowns end and people come to terms with the new normal in the post-COVID-19 world.

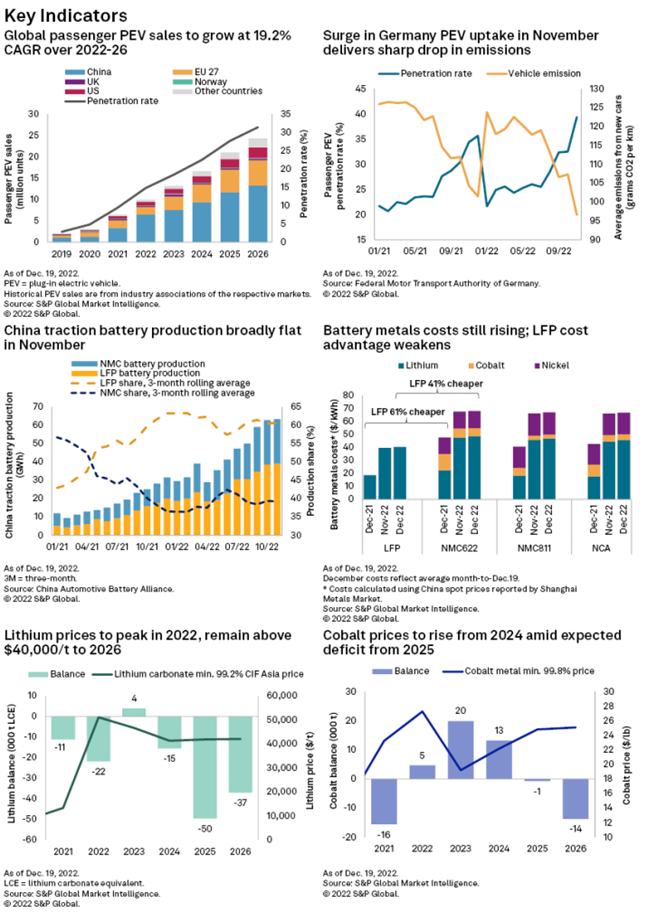

In Europe, passenger PEV sales benefited from a bounce-back in the overall car market in November as supply chain challenges eased, and from a jump in the penetration rate. Germany led the sales increase in the Europe Top-4 markets as consumers leveraged the higher environmental bonuses before they drop in 2023. The rise in uptake resulted in the largest month-over-month emissions reduction from new car sales since December 2020, when automakers pushed PEV sales to avoid hefty emissions penalties in the first year of implementation.

The U.S. Treasury has delayed providing more details on the sourcing thresholds required to qualify for the revamped EV tax credits. The thresholds were supposed to take effect Jan. 1, 2023, and are now pushed back to March. The delay comes as policymakers across Europe and in South Korea expressed discontent that the subsidies will put their companies at a disadvantage. A number of U.S. automakers have also warned that the sourcing thresholds could hurt PEV sales due to the difficulties in shifting the supply chain in the short term to become eligible for the tax credits. We expect the Inflation Reduction Act to boost development in North American lithium and cobalt supply chains, with most of the upstream investments materializing into production from mid-decade onward.

Lithium

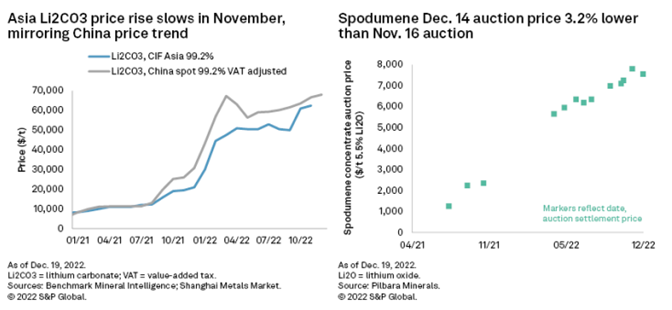

The monthly lithium carbonate CIF Asia price increase slowed to 2.5% month over month in November to reach $62,500 per tonne, after a staggering 22.0% spike in October. In December, the daily Chinese battery-grade lithium carbonate price drop gathered pace; prices fell 14,500 yuan/t month-to-Dec. 19, compared with the 1,000 yuan/t dip over Nov. 22-30, after prices peaked at an all-time high of 567,500 yuan/t Nov. 9-21.

The price declines highlight the dominating impact of reduced demand, despite lithium supply disruptions. China's brine output typically scales back during the cold months, and a number of lithium refineries in Jiangxi province temporarily halted production earlier this month amid pollution probes into their operations by the authorities.

Pilbara Minerals Ltd.'s latest spodumene auction settlement price fell 3.2% Dec. 14, from the previous auction Nov. 16, and reaffirms the lithium chemical price correction from weakening cost support. The auction price implies a lithium carbonate production cost of 533,361 yuan/t for battery-grade material — below the Chinese price of 560,000 yuan/t that day.

Cobalt

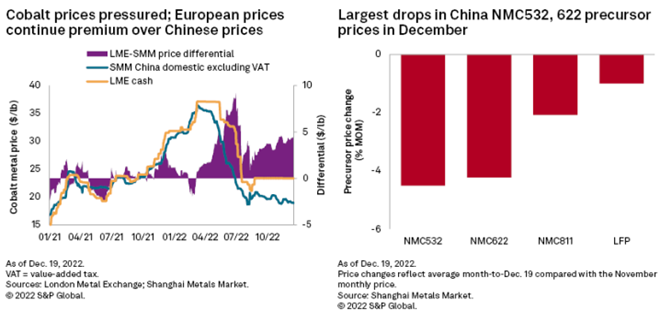

The London Metal Exchange cobalt price edged down by a marginal 1 cent per pound to $23.35/lb month-to-Dec. 19, but China's cobalt metal price decline gathered pace in December due to a drop in NMC battery demand.

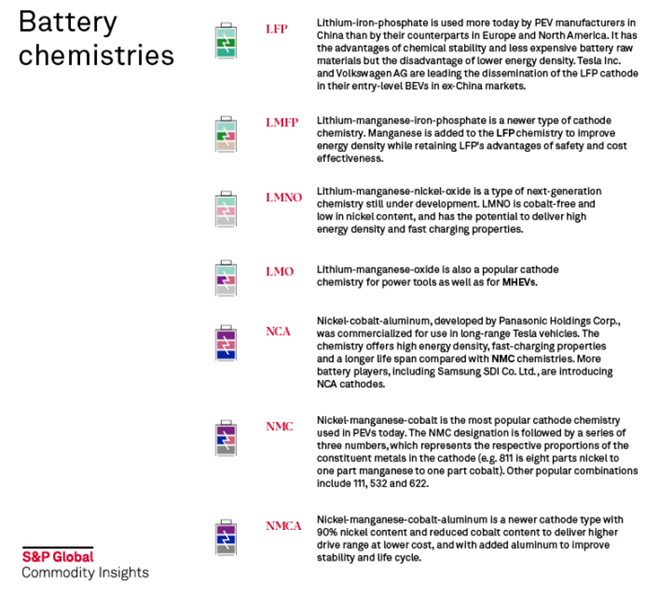

China's traction battery production rose only 0.9% month over month in November, with NMC battery production declining for the second consecutive month, by 0.2%, but offset by rising lithium-iron-phosphate battery, or LFP, production. The decrease in NMC battery production is concentrated particularly in the NMC532 and NMC622 chemistries, which disproportionately affects cobalt demand. The prices of the respective battery precursors, which are used in the manufacturing of the batteries, dropped the most in December compared with LFP and nickel-intensive chemistries. The cobalt metal price has yet to bottom, and the near-term demand weakness suggests prices could fall further.

Historical data points to a shift in the battery chemistry mix after a sharp decline in subsidies. China's market embraced the LFP chemistry for cost advantages after national PEV subsidies halved in 2019. The discontinuation of China's national subsidy next year could also accelerate the shift away from NMC532 and NMC622 chemistries to LFP, though likely smaller in magnitude. The cost competitiveness of LFP batteries has declined as lithium prices have surged, with LFPs 41% cheaper than NMC622 in December on a dollar-per-kilowatt-hour basis, from 61% a year ago.

Outlook

The passenger PEV market is heading for slower but still steady growth in 2023, and we expect sales to increase by 3.3 million units year over year, compared with 3.6 million units in 2022. Demand headwinds include short-term challenges in China. Elsewhere, Europe and U.S. consumers will find it more difficult to gather the upfront capital for PEVs, which still command a retail price premium over internal combustion engine vehicles in these markets.

China's lithium prices have dropped, but they remain at unprecedentedly high levels. We expect the lithium carbonate CIF Asia price to follow the softening trend in Chinese prices in the March 2023 quarter. The robust price environment is encouraging a flurry of development activities, with payback periods on spodumene projects measured in months. The challenges comprise of project developers delivering on their plans, which for lithium supply is further complicated by the building of integrated lithium refineries in jurisdictions with limited prior experience, commercializing new processes such as direct lithium extraction as well as novel types of deposits such as clay.

There is more pronounced unease in the cobalt market, as the end of the PEV subsidy in China could potentially accelerate the shift away from cobalt-intensive NMC532 and NMC622 batteries. A subdued outlook for global growth and affordability challenges will weigh on consumer electronics sales and disproportionately affect PEV sales across Europe and the U.S. where cobalt-containing batteries are more widely used.

China's exit from its zero-COVID policy nevertheless brings optimism for the demand outlook after some short-term disruptions. We expect improvements in broad-based consumption for lithium and cobalt-containing end-products, from greater consumer confidence and reduced disruptions in the absence of lockdowns. China's government touts reviving domestic demand as a top priority, which is much needed given falling demand in the export market. We could see a self-supported economic recovery in China, which will support lithium and cobalt demand in 2023, especially from the second half onward.

Notes

Historical lithium carbonate prices refer to Benchmark Mineral Intelligence's assessments.

Historical cobalt metal prices refer to the London Metal Exchange's cobalt cash prices; historical refined cobalt supply figures draw partly on the work of the Cobalt Institute.

S&P Global Commodity Insights and S&P Global Market Intelligence are owned by S&P Global Inc.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Campaign

Research

Research