Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 2 Dec, 2022

By Kevin Murphy

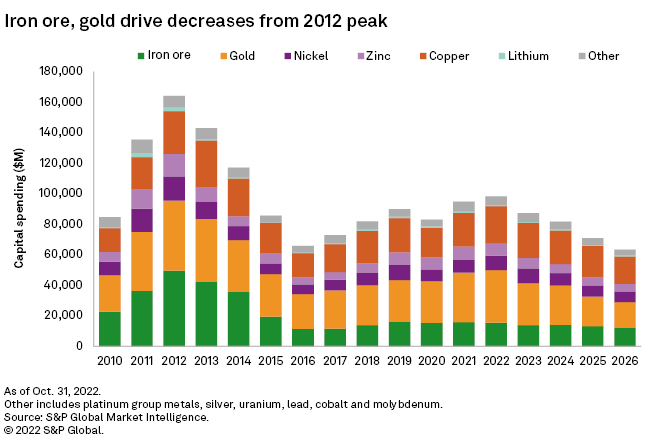

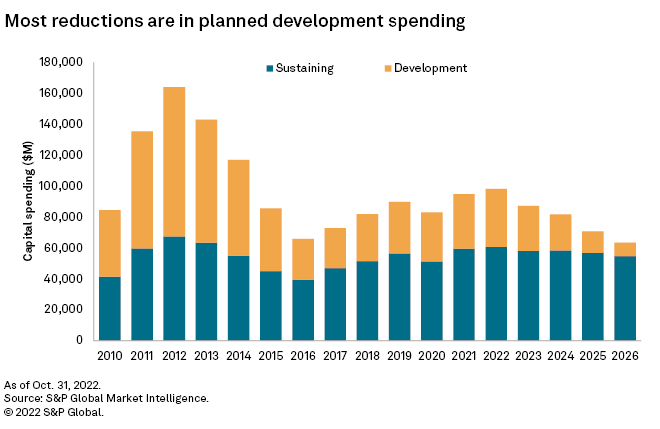

Total capital expenditure in the mining industry across 13 different commodities will fall by $11 billion in 2023, primarily driven by declines in development capex for iron ore and gold projects. Year-over-year reductions due to projects moving from the construction phase to production will outweigh increases coming through from earlier stages of the project pipeline, due to a lack of approved and financed new projects. Capital spending will fall further over the longer term, with current forecasts showing a nearly one-third decrease in capital spending from 2022 to 2026.

Our data, derived from the mine economics product and supplemented with reasonable estimates, shows that capital spending peaked in 2012 at $164.1 billion, due to extremely high spending on iron ore and gold assets, which together accounted for 58% of the year's total spend. Capital spending fell to a recent low of $65.8 billion in 2016, with the total reduction for iron ore and gold accounting for almost two-thirds of the annual decrease. Spending gradually recovered to the $98.3 billion forecast for 2022 — an eight-year high but 40% below the 2012 peak.

The forecast 11% year-over-year decrease in 2023 is driven by slower spending on gold and iron ore development. Spending on large mining projects for both metals is starting to wind down, with no new developments of similar sizes expected to take their place. For gold, completion of Barrick Gold Corp.'s Pueblo Viejo expansion project in the Dominican Republic will remove nearly $1 billion of spending in 2023, with construction finishing in late 2022 and commissioning in early 2023. For iron ore, completion of Fortescue Metals Group Ltd.'s Iron Bridge mine in Australia in late 2022 will reduce 2023 development spending by more than $300 million.

The current outlook to 2026 is for a gradual reduction in capital expenditure. While the reduction is more broadly based across commodities than the change between 2022 and 2023, iron ore and gold will continue to decline, with copper spending also forecast to decrease as major near-term capital projects wind down. That lithium mining is a relatively young industry is readily evident in a substantially larger amount allocated to development than to sustaining expenditure. This will change by 2026 as more projects enter production and require capital expenditure on sustaining operations. These trends will likely evolve, however, as miners decide to finance new projects and expansions based on market conditions.

S&P Global Commodity Insights, like many companies that track supply and demand trends, is forecasting for the copper market to shift to a deficit by around 2026. This meshes with the expected reductions in capex spending in our dataset, and is the most concerning of the forecast declines, given that copper is essential for not only industry generally but also the global rollout of renewable energy and electric vehicles. Reduced spending on copper is not limited to development, however. In our research into discovery of new deposits, we have found that copper suffers from longer-term challenges to exploration and discovery that will need to be resolved prior to future development spending to meet growing demand.

S&P Global Commodity Insights and S&P Global Market Intelligence are owned by S&P Global Inc.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

Campaign

Blog

Blog