Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 22 Feb, 2024

Highlights

The GSMA Open Gateway initiative represents an important milestone in the evolution of the CPaaS market.

The initiative provides an opportunity for mobile network operators to launch new services and monetize 5G network infrastructure investments.

Deployment of the GSMA Open Gateway initiative framework could enable MNOs to reposition within the value chain and become a primary growth engine for CPaaS over the next five years.

Introduction

The need to accelerate the digitization of the employee experience (EX) and customer experience (CX) during the COVID-19 lockdown led to a surge in demand for real-time embedded communications. 451 Research's CPaaS Market Monitor and Forecast shows this segment grew nearly 50% in 2020 and 2021.

While maintaining the momentum with double-digit growth, the communications platform as a service (CPaaS) market experienced a slowdown in 2022 and 2023, stemming from global macroeconomic conditions and a shift in vendor strategy from "grow at any cost" to a stronger focus on profitability. The ongoing digitization of the CX and the adoption of the GSMA Open Gateway initiative framework by mobile network operators (MNOs) point to a strong rebound for CPaaS in 2024.

The Take

Our CPaaS Market Monitor and Forecast is regularly updated to include new vendors and product offerings, highlighting a dynamic and evolving space. Until recently, CPaaS enablement and communication service providers (CSPs) represented a small group within the larger CPaaS space, but these categories saw increased activity with new players entering the space over the past two years.

Context

CPaaS enablement now comprises a wide range of players, including technology firms that are well entrenched in the telco space, such as Ericsson, Mavenir and Radisys; emerging players like Braidio, Enabld, EnableX and Wazo; CPaaS vendors like Infobip and Sinch; and cloud Hyperscaler Microsoft Corp. Meanwhile, the list of CSPs launching communication API-based services continues to grow and includes AT&T Inc., Claro Brasil, e& (formerly Etisalat), Telefonica Spain, Orange Spain, Deutsche Telekom AG, TIM Brasil, Vodafone Spain, Verizon Communications Inc. and Vivo (Telefonica Brasil).

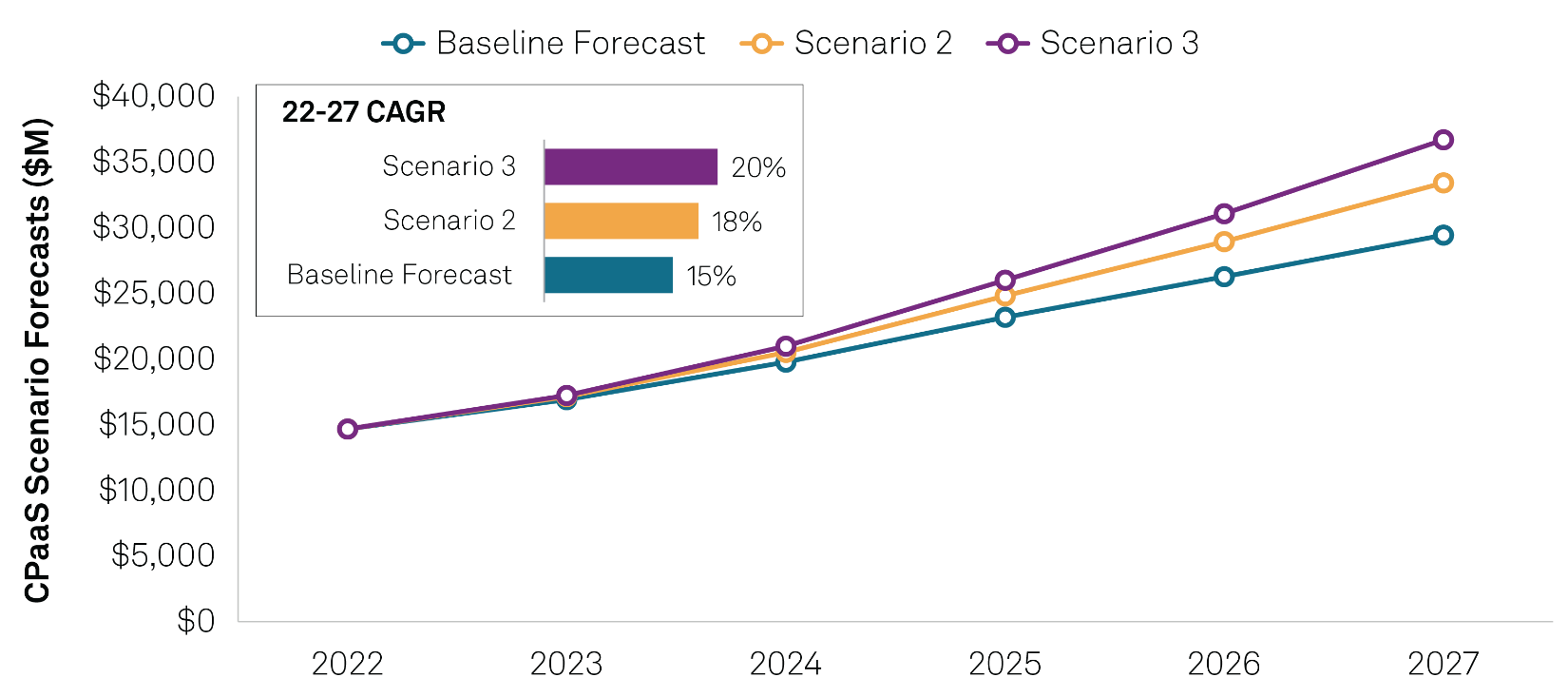

Given the dynamics of the space, our CPaaS Market Monitor and Forecast includes a scenario analysis showing the impact that accelerated adoption of the GSMA Open Gateway initiative framework could have. Besides enabling MNOs to capture a larger share of the CPaaS market and providing new ways to monetize their 5G infrastructure investments, the framework could result in an uplift for the overall CPaaS market benefitting the entire ecosystem — including MNOs, CPaaS pure-play vendors and CPaaS enablement vendors, as well as enterprise organizations.

CPaaS is set for a strong rebound in 2024

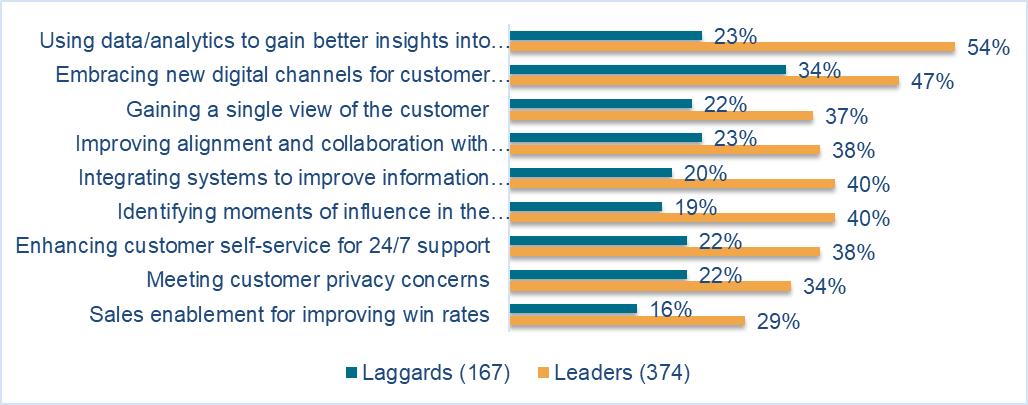

Several factors point to a strong rebound for CPaaS in 2024. These include ongoing investments in the digitization of the CX and EX and a growing demand for real-time embedded communications. According to our Customer Experience & Commerce, Budgets & Organizational Dynamics 2023 survey, organizations are investing in customer engagement technologies, with digital channels for customer engagement among the top priorities that digital-driven organizations are pursuing (Figure 1).

Figure 1: Fraud remains a widespread issue and a major concern for digital merchants.

Source: 451 Research's Voice of the Enterprise: Customer Experience & Commerce, Budgets & Organizational Dynamics 2023.

Q. Which of the following initiatives is your organization actively pursuing to improve customer experience? (Check all that apply).

Base: All respondents (n=705).

© 2024 S&P Global.

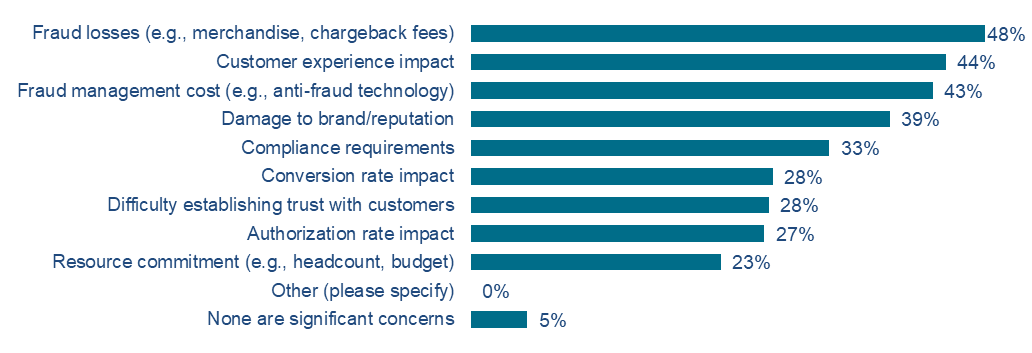

Trusted communications is also emerging as a key driver for CPaaS in 2024. The growing use of digital channels for customer engagement resulted in an increase in robocalls, spam SMS (short message service) and online fraud transaction volume in recent years. According to our Voice of the Enterprise: Customer Experience & Commerce, Merchant Study 2023 study, 22% of surveyed businesses experienced a significant increase in the volume of fraudulent online transactions, compared with 37% of respondents in our 2021 survey.

Even though the growth rate for fraudulent transactions declined post-pandemic, fraud remains a widespread issue and a major concern for digital merchants. A majority (58%) of survey respondents are still reporting an increase in fraud volume overall, with their top concerns including fraud losses (48%), customer experience impact (44%) and fraud management costs (43%).

Figure 2: Fraud remains a widespread issue and a major concern for digital merchants.

Q. Which of the following are significant concerns as they relate to the impact of fraud on your business? Please select all that apply.

Base: All respondents (n=250).

Source: 451 Research's Voice of the Enterprise: Customer Experience & Commerce, Merchant Study 2023.

Security and fraud prevention have always been a priority for digital merchants. However, the explosive growth in the volume of fraudulent online transactions in the wake of COVID-19 elevated the urgency for deploying trusted communications to enable safe interactions between businesses and consumers. We expect this need for trusted communications, to strengthen a safe and secure CX, will drive enterprise CPaaS adoption in the coming year.

The GSMA Open Gateway initiative

Launched in February 2023 at MWC in Barcelona, the GSMA Open Gateway initiative is a framework of network APIs that provide universal access to operator networks, helping developers and cloud providers deploy services across operator networks. The initiative launched with eight network APIs: SIM Swap, Quality on Demand, Device Status, Number Verification, Simple Edge Discovery, One Time Password SMS, Carrier Billing-Check Out and Device Location. There are plans to launch additional APIs throughout 2024. The first live Open Gateway APIs were deployed in Q3 2023, with additional launches in late 2023 and early 2024.

In September 2023, Ericsson announced a partnership with Deutsche Telekom to power its MagentaBusiness API portal and network API offerings. MagentaBusiness API users will have access to Vonage Communications APIs, which will enable developers to program intelligent communications into their products, applications and workflows, and open network APIs to enable quality on demand, device status and device location capabilities.

In December 2023, Infobip announced a partnership with Brazilian network operators Claro, TIM Brasil and Vivo to offer number verify, SIM swap and device location APIs. In February, Spanish MNOs Orange SA, Telefonica SA and Vodafone announced the launch of two network API digital security services that aim to help developers tackle online fraud and protect the digital identities of mobile customers: Number Verification and SIM Swap.

The GSMA Open Gateway initiative

We believe GSMA Open Gateway has the potential to drive further growth for CPaaS, with MNOs bringing to market new and innovative digital services. Furthermore, as the number of deployments continues to increase, we expect MNOs will reposition within the value chain to become a primary growth engine for CPaaS, expanding the overall market opportunity.

The CPaaS market has long been dominated by CPaaS pure-play providers such as Infobip, Twilio and Sinch, with telcos choosing to remain largely behind the scenes. There are reasons to believe the status quo will remain unchanged, given that numerous initiatives, while promising, have not delivered on their potential. These include previous telco API initiatives that faltered, such as the Parlay consortium, going back to 1998. Other examples include Rich Communication Services, which will require full MNO coverage in addition to iOS compatibility to effectively replace multimedia messaging service and SMS.

Nonetheless, several factors paint a positive outlook for the GSMA Open Gateway in 2024. The number of CPaaS enablement vendors (i.e., those focused on helping telcos deliver API-based communication services) continues to grow, including technology firms that are well entrenched in the telco space, such as Ericsson ADR, Mavenir, Nokia Corp. and Radisys Corp.; emerging players such as Braidio, Enabld, EnableX and Wazo; CPaaS providers such as 2600Hz (recently acquired by Ooma), Infobip, Prudent Technologies and Tata Communications Ltd.; and cloud hyperscalers such as Microsoft. Furthermore, these vendors report a growing pipeline with tier 1 telcos across different regions, signaling the potential for accelerated adoption of the framework in 2024.

The complexities related to digital security and online fraud transactions require a multipronged approach including industry regulators, enterprise organizations, MNOs and device manufacturers. This presents an opportunity for MNOs to adopt the GSMA Open Gateway framework to deliver digital security and fraud prevention services, such as confirmation of whether the device is roaming and which country it is in (device status) or authentication of the mobile device by the mobile network (number verification), to name a few examples. These functionalities could enable MNOs to position as trusted communications providers, helping enterprise organizations enable a secure CX.

CPaaS Scenario Analysis

Our CPaaS Market Monitor and Forecast includes a scenario analysis (Figure 3) showing the potential impact that the accelerated adoption of the GSMA Open Gateway by MNOs could have for the overall CPaaS ecosystem, as well as for players across three distinct categories. These categories are defined by vendor product, business strategy and the market opportunity.

Stand-alone CPaaS vendors offer developer platforms providing APIs, SDKs (software developer kits) and libraries allowing developers to integrate voice, video, chat and messaging communications into their web and mobile applications. These vendors primarily target enterprise organizations, digital-native organizations and independent developers. Our scenario forecasts project these vendors will maintain the larger market share, with ongoing investments in digital transformation and CX resulting in this segment bouncing back from a weak 2023.

Communication service providers offer telecommunications services or a combination of information and media services, content, entertainment, and application services leveraging their network infrastructure. CSPs have been part of the CPaaS value chain since its early days, but have mostly played a supporting role. Our scenarios project that, as CSPs reposition within the CPaaS value chain and take a more prominent role, they will become a primary growth engine within CPaaS, resulting in an uptick in CSP revenue in 2024, with more material expansion in 2025.

CPaaS enablement comprises vendors that target CSPs and telcos, enabling them to deliver embeddable voice, video, chat and messaging communications leveraging their own core infrastructure. CPaaS enablement vendors play a key role, helping CSPs deliver programmable communication services. With CSPs taking a more prominent role within the CPaaS value chain, CPaaS enablement is likely to also bounce back from a weak 2023.

Our scenario analysis assumptions include:

Figure 3: CPaaS global revenue forecast ($M) and CAGR scenario analysis

Source: 451 Research, S&P Global Market Intelligence, :CPaaS Market Monitor (December 2023)

RESEARCH

RESEARCH