Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 8 Jun, 2023

Introduction

Communications PaaS (CPaaS) — a segment comprising vendors that provide APIs, software-development kits, and libraries intended to allow developers to integrate voice, video, chat and messaging communications into their web and mobile applications — could grow at a CAGR of 21% through 2026, according to 451 Research's CPaaS Market Monitor 2023. Despite macroeconomic headwinds, this segment will likely continue to drive the digital economy, supporting ongoing digital transformation initiatives for large organizations and, increasingly, SMEs.

Here, we provide an overview of CPaaS enablement and profile 15 vendors focused on helping telcos and CSPs address this opportunity with a platform-based approach.

The Take

The competitive landscape for programmable communications is largely defined by how CSPs, cloud infrastructure providers and CPaaS vendors choose to position themselves in the value chain. We expect vendors across these three groups would continue to work in tandem, enabling access to global communication networks for developers and large organizations. However, CSPs and cloud infrastructure providers seem well positioned to address the growing demand for embedded, real-time communications from SMEs — this represents an important opportunity that could enable telcos to monetize their network infrastructure investments.

CPaaS ecosystem

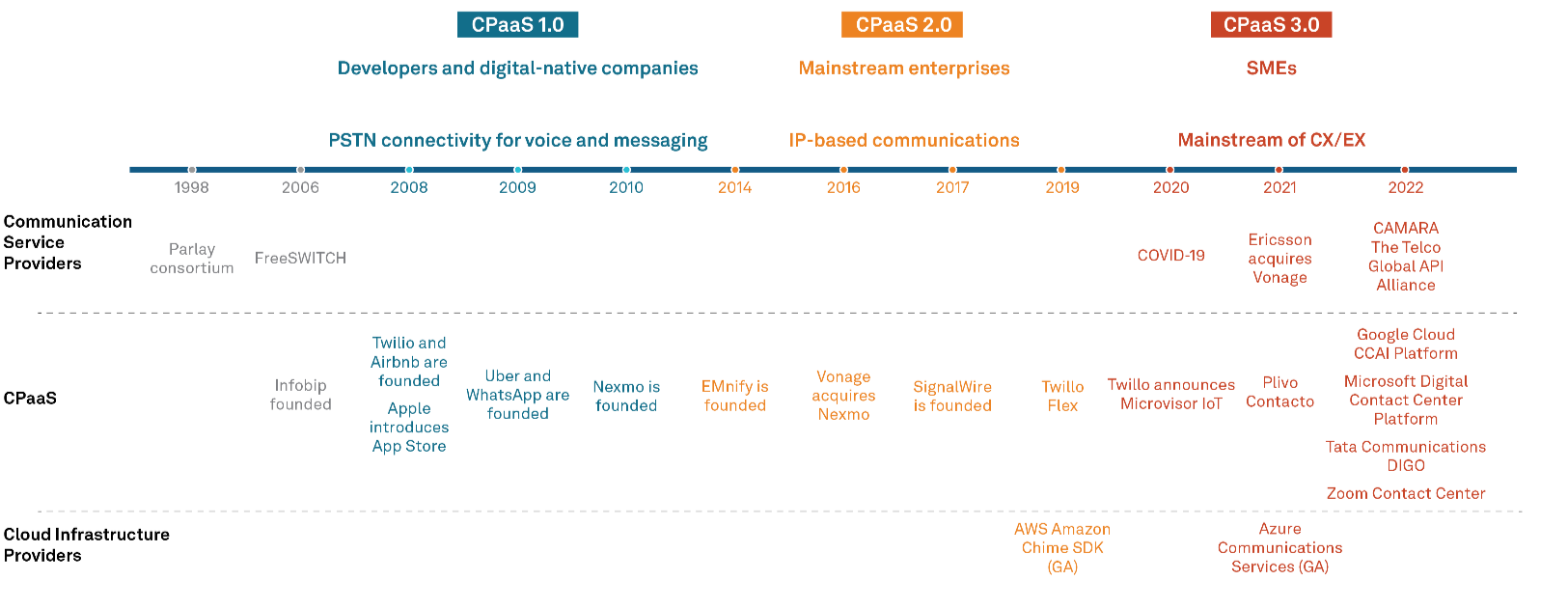

CPaaS initially emerged with developer-focused platforms providing access to the public switched telephone network (PSTN) and cloud-based services, enabling them to embed real-time communications in their applications. While CSPs and cloud infrastructure providers have largely remained behind the scenes, these players are increasingly stepping to the forefront, partnering with CPaaS enablement providers to launch API-based services. Examples of the latter include Amazon Web Services (AWS) and Microsoft Corp., two cloud hyperscalers that, given their size and global reach, could significantly affect the competitive landscape (see Figure 1 below). At re:Invent 2019, AWS announced the general availability of its Amazon Chime SDK, which allows customers to embed audio calling, video calling and screen-sharing capabilities into their own applications without the need to deploy, monitor and scale real-time infrastructure. At Ignite 2020, Microsoft launched Azure Communication Services (ACS), a set of cloud-based capabilities aimed at enabling developers to add real-time communication services to their web and mobile applications.

Similarly, CSPs are also stepping to the forefront, with some players looking to provide communication API-based services directly to enterprises and SMEs. Examples include tier 1 telcos such as AT&T Inc. (U.S.), KPN NV (Netherlands) and Proximus Group PLC (Belgium), which have launched CPaaS initiatives in partnership with CPaaS enablement vendors including Braidio, Kandy and Soprano Design. Another key player is the United Arab Emirates' telco services provider Etisalat Group, which in February 2022 launched a new brand identity called e& and announced the establishment of its consumer digital and enterprise digital business units.

Figure 1: Evolution of Programmable Communications, 1998-2022

Source: 451 Research, Communications Platform as a Service Market Map 2023

CPaaS enablement vendor landscape

Our Communications Platform as a Service Market Map 2023 defines CPaaS enablement as a category comprising CPaaS technology vendors whose go-to-market strategy is based on partnering with CSPs, enabling them to deliver programmable, real-time person-to-person (P2P) and application-to-person (A2P) communication services, leveraging their own core infrastructure.

Below, we profile 15 technology vendors focused on CPaaS enablement. While the vendor list is representative of the market, it is not meant to be exhaustive. The inclusion of vendors is intended solely to exemplify this category and does not imply that they are identified as market leaders. A more comprehensive list of vendors, including additional categories within the CPaaS space, is included in our CPaaS Market Map 2023 and our CPaaS Market Monitor reports.

Highlights:

Figure 2: CPaaS Enablement Vendor Landscape

|

Company |

Founded |

Headquarters |

Status |

Focus |

|

2600Hz |

2010 |

Henderson, NV, U.S. |

Private |

In addition to enterprise organizations, the company's go-to-market approach comprises white-label solutions aimed at enabling CSPs to deliver API-based business communications. |

|

Braidio |

2012 |

San Francisco, CA, U.S. |

Private |

The company initially emerged as an early CPaaS enabler for healthcare in partnership with AT&T. It has since expanded partnerships and segments to become a global CPaaS enabler for CSPs and ISVs including e& and Vonage/Ericsson for SMEs and enterprises in sectors such as retail, finance, pet wellness and field services. |

|

Enabld |

2021 |

U.S. |

Private |

The company provides a CPaaS enablement platform focused on helping CSPs deploy new communications solutions. |

|

EnableX |

2017 |

Singapore |

Private |

The CPaaS platform offers all channels of communication — video, voice, SMS and WhatsApp — with multiple deployment and white-label capabilities. It already works with a wide range of customers in Europe, Latin America, North America and Southeast Asia, including CSPs. |

|

iBasis |

1996 |

Lexington, MA, U.S. |

Private |

In March 2022, the vendor unveiled its Carrier CPaaS offering in partnership with Mavenir featuring voice, messaging and e-commerce, enabling businesses to add capabilities such as real-time chat functionality with one-click calling via an app and push SMS messages for customer engagement. In January 2023, it acquired SMS aggregator Dimoco Messaging, looking to further expand its global footprint. |

|

Infobip |

2006 |

London, U.K. |

Private |

The CPaaS pioneer has evolved into one of the largest global providers, with a comprehensive portfolio that includes enablement offerings for CSPs — such as market development funds, sales training and collateral and co-creation of industry solutions. Infobip also works with telecom partners to embed CPaaS/omnichannel into their own customer comms processes/touchpoints, enabling CSPs to lead by example in the CPaaS space. |

|

Iotum |

2004 |

Toronto, ON, Canada |

Private |

The vendor's primary offering is the Iotum CPaaS platform with offerings for resellers and distributors as well as white-label firms. The platform supports provisioning for a range of communication services including HIPAA-compliant telemedicine and product configurations and workflows for call center and field service applications. |

|

Kandy |

2017 |

Atlanta, GA, U.S. |

Private |

Kandy is a cloud-based CPaaS enablement platform developed by Ribbon Communications and later acquired by AVCtechnologies. Its portfolio includes pre-packaged functionalities that can be inserted into websites or applications. |

|

Mavenir |

2017 |

Richardson, TX, U.S. |

Private |

The network software vendor purchased global CPaaS enablement and application provider Telestax in 2021. |

|

Prudent Technologies |

1997 |

Ernakulam, Kerala, India |

Private |

CPaaS provider targeting telcos and enterprises. It provides a cloud-based, multilayered middleware for CSPs to deliver enterprise solutions across voice, messaging, advanced messaging, security and intelligent services. |

|

Radisys |

1987 |

Hillsboro, OR, U.S. |

Private |

In February 2022, the company introduced Radisys EDP, an open cloud communication platform that combines low-code/no-code applications and solution building blocks enabling CSPs to deliver programmable communications services such as conversational AI applications and video-based customer care. |

|

Sinch AB |

2008 |

Stockholm, Sweden |

Public |

In addition to its enterprise business, Sinch offers a broad set of products and services that help telco operators maximize enterprise revenue, provide interconnect and routing, and help them prepare for evolved 5G networks and use cases. These include messaging interconnect and delivery, 5G SMSF, fraud prevention and security, value-added services for messaging and call completion, and policy and charging. Sinch 4 Marketing further offers telco operators a range of services to help drive engagement with end-to-end campaigns across mobile messaging channels. |

|

Soprano Design |

1994 |

Sydney, Australia |

Private |

Soprano Design counts AT&T, Telstra, BT, Vodafone, Orange, Starhub, Smart/PLDT and Celcom among the telco partners that use its technology to offer CPaaS to their own customers. |

|

Vonage Corp. (Ericsson) |

2001 |

Holmdel, NJ, U.S. |

Public |

Vonage has a long trajectory in CPaaS; its acquisition by Ericsson has the potential to disrupt the market, given Ericsson's trajectory with 5G mobile networks and CSPs. This presents an opportunity for CSPs and telcos to monetize network investments with the Vonage Communications Platform — which include UCaaS, CCaaS, conversational commerce applications and communications APIs — and new network APIs that Ericsson and Vonage plan to offer. |

|

Wazo |

2016 |

Quebec, QC, Canada |

Private |

Communication solution enablement vendor for CSPs and enterprises. Based on its open-source project, Wazo Platform, it delivers programmable and adaptable cloud-native and API-centric solutions to build UCaaS, CCaaS and CPaaS capabilities, including audio, video, chat and conferencing. These solutions can be deployed and scaled on bare metal, virtual machines or containers. |

Source: 451 Research

Research