S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Blog — 7 Apr, 2023

By Scott Robson

Highlights

We estimate that US TV and streaming sports media rights payments will likely total $25.57 billion in 2023 across broadcast, cable, RSNs and streaming services

The digital trend seems to be here to stay as streaming has become a more acceptable way of reaching sports audiences.

There is no denying the importance of sports programming to TV networks and operators alike. Sports content is the last bastion of the linear TV ecosystem, with live events like the Super Bowl and the NCAA's March Madness accounting for over 95% of the most-watched programs in 2022. However, a shift to streaming is underway as direct-to-consumer services increasingly edge into live sports broadcasting. As sports fan consumption patterns change, media rights deals and network economic models are adapting to the new digital age.

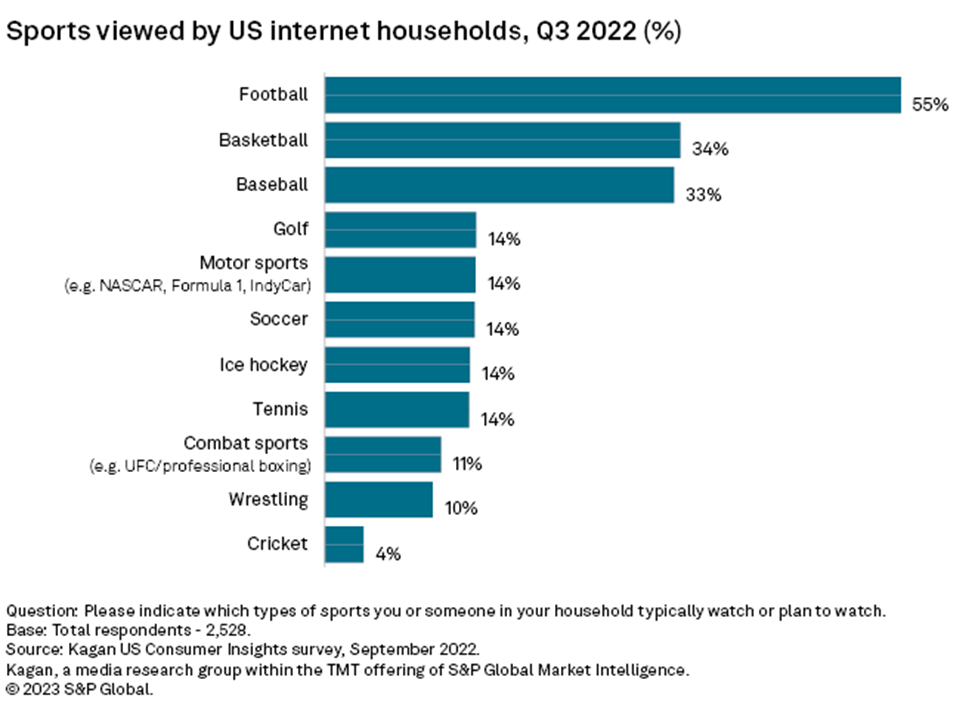

Let's look at the popularity of sports in the US. Kagan's US Consumer Insights survey, conducted in September 2022, of 2,528 adults who use the internet highlights the important role that live sports plays for the American consumer. Over half of US internet households surveyed said they typically watch football, and about one-third of households tune into basketball and baseball games. While not as popular, a host of other sports — including motorsports, golf, soccer and tennis — reach a healthy slice of US households.

Sports networks continue to invest in premier live sports programming despite viewership declines, a contracting subscriber base in the traditional cable bundle and a growing list of alternative pay TV services that appeal to cost-conscious consumers. We estimate that US TV and streaming sports media rights payments will likely total $25.57 billion in 2023 across broadcast, cable, RSNs and streaming services. This has risen from an estimated $14.64 billion in 2015 and is expected to grow to more than $30 billion in 2025 as new deals are forged. Our forecast shows even years rising faster than odd years due to spending on the Summer and Winter Olympics, with 2021 being an outlier as the 2020 Summer Olympics were held in 2021.

Live viewers and large audiences are part of the appeal of sports for many TV networks and streamers. Competition for rights has helped drive up pricing, particularly in a world where viewers seek linear channels at a declining rate. The pandemic played a role in the shift to online video and likely helped sports move in the same direction. The digital trend seems to be here to stay as streaming has become a more acceptable way of reaching sports audiences.

If ever there was an event signifying the changing TV landscape, the renewed NFL deal revealed March 18, 2021, which incorporates a night of football on a digital platform, would be a good candidate. The NFL announced an exclusive pact with Amazon.com Inc. for "Thursday Night Football" at an average cost of $1.1 billion per season from 2023 to 2032. Previously, Amazon had streaming rights for Thursday night games, but it did not have exclusivity.

Another piece of the NFL distribution model is shifting online as out-of-market regular season games were purchased by Alphabet Inc.'s YouTube in a deal announced at the end of 2022. YouTube will be offering the NFL Sunday Ticket to subscribers to its YouTube TV virtual multichannel service as well as its YouTube Primetime Channels offering.

Lucrative deals for the linear distribution of live sports programming have prevented Netflix Inc. and other pure-play streaming services from encroaching too deeply into sports programming, but that dynamic continues slowly shifting. Amazon, Alphabet and Apple have established footholds in streaming sports, and big media firms including Comcast, Disney, Paramount Global and Warner Bros. Discovery are sprinkling live sports into their respective general entertainment streaming services.

Other than Netflix, most major US streaming services now offer at least some live sports although availability is generally limited with the focus still on linear distribution. Paramount+ and Peacock offer the widest range of sports, including football, baseball, soccer, golf, tennis, motorsports and wrestling. Meanwhile, Amazon (NFL), Apple TV+ (MLB), HBO Max (US men's and women's national team soccer) and Hulu (NHL) have more limited offerings that are primarily focused on a single sport.

RESEARCH

RESEARCH