Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 1 Mar, 2023

While esports content distribution spans both digital and traditional TV platforms, the industry is still exploring the best way to monetize growing popularity within the video ecosystem. Specialist platforms, such as Amazon.com Inc.-owned Twitch, offer live streams and social interactivity options for gaming fanatics, while traditional broadcast production values and diverse audiences are valued by esports publishers looking for audience growth and higher income from rights licensing. Traditional TV must differentiate itself from digital platforms, leveraging its strengths as a communication medium to grow a strong and mutual relationship with esports rights owners.

The traditional TV sector holds significant value for esports stakeholders: providing access to a large, diverse audience for influencers, teams, game publishers, competitions and gaming brands. Collaboration between traditional broadcasters and esports partners has the potential to benefit both parties. Esports partners gain access to traditional TV viewers in potentially large numbers. Meanwhile, traditional broadcasters and their advertisers gain credibility with a younger digital-native demographic by showcasing esports content.

Esports continues to grow

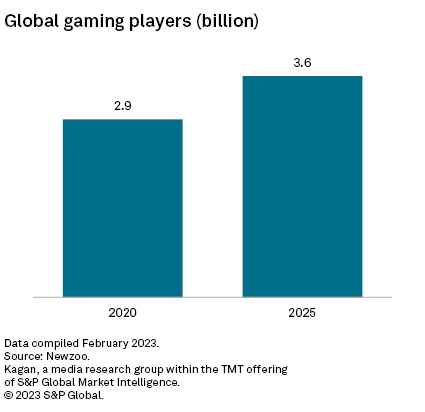

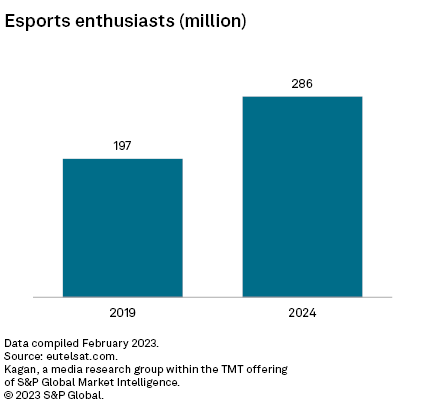

The esports and gaming market continues to grow globally; gaming fans numbered 2.9 billion players in 2020 and are expected to grow to 3.6 billion by 2025. Looking at esports specifically, esports enthusiasts are expected to increase from 197 million in 2019 to 286 million worldwide by 2024. The games market is estimated to have produced revenue of $184.4 billion in 2022.

TV rights are major sources of revenue for major sports leagues. It is doubtful that esports will be able to attract valuations similar to the major global leagues such as the NFL and the Premier League, but there is a clear argument that TV rights values for esports competitions are far from fulfilling their potential.

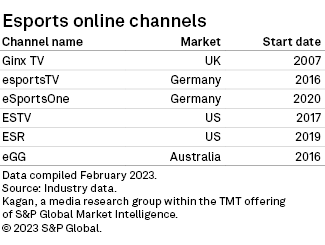

Esports has been shown on platforms like Twitch, Meta Platforms Inc.owned Facebook and Alphabet Inc.'s YouTube LLC, delivering a huge choice of content and breaking down discovery barriers for less informed viewers. There are dedicated esports channels like Ginx TV Ltd. in the U.K.; however, the viewing figures and revenues from these platforms are substantially below mainstream sports. For this reason, esports content owners should also consider opportunities with general channels that offer larger audiences. It is likely that roundup shows or highlights packages rather than live rights would be of greater interest to generalist channels due to time constraints.

Current esports platforms

While platforms like Twitch are renowned as home to esports content, established TV channels are also dedicated to the sport. These include Ginx TV, established in 2007 in the U.K. and backed by ITV PLC and Comcast Corp.-owned Sky TV. The channel, which is expanding its content coverage on its current U.K. platform, creates its original content, carries esports news and features coverage of live events.

Esports TV, based in Germany and backed by ESL Gaming GmbH and Modern Times Group MTG A/S, organizes tournaments and produces content and competitions. ESportsOne is also based in Germany and is backed by the sports channel SPORT1. Its content is also available in markets such as Belgium, the Netherlands, Czechia and Slovakia via the M7 platforms TV Vlaanderen, CanalDigitaal and Skylink.

Estv Ltd. operates a full 24-hour TV schedule based around esports and actively supports school and university esports leagues. ESR produces original esports content including "Kills, Thrills and Chills" and is available on 18 platforms including Roku Inc., Apple Inc.'s Apple TV, and Pluto TV. Australia channel eGG (Every Good Game) features coverage of tournaments, highlight reels and game reviews, coverage of conventions, and talk show-style content.

Esports on linear TV

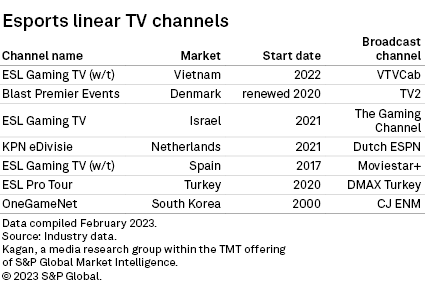

Compared to the leading sports like soccer, linear TV coverage of esports is sparse. There are dedicated channels in the gaming heartland of Asia and in Denmark, home to one of the most successful esports teams, Og Esports A/S. Access our report discussing holdings in esports teams and how it is driving multiple investor strategies.

As the popularity of esports grows globally, more major channels are showing coverage. ESL Gaming recently announced a deal to provide esports content for the North American network G4. It has also signed content deals in Israel, Spain and the Netherlands and has appeared on the Walt Disney Co. network, Fox Sports 1 LLC and the British Broadcasting Corp.

Distribution challenges facing esports

One of the challenges for esports is how can it present itself as workable for a packed linear TV schedule. Traditional sports are confined to a predefined time slot. A soccer match is 90 minutes, while an NBA basketball match has a 48-minute duration but will be longer with timeouts. Esports tournaments are estimated to run for seven or eight hours, but individual games can be 30 minutes on average, and it takes many games to find a winner. From a TV visual point of view, esports players are static, while players in other sports are running, jumping and interacting with each other, which is arguably more compelling to watch. These might make it challenging to fit esports into a competitive linear TV schedule.

Despite these challenges, the esports world could make a case to say that it does not need to fight for space on linear TV. At the 2019 Fortnite World Cup, more than 19,000 fans watched the event live in the arena, while the 2022 League of Legends finals was streamed by just over 5 million people. These viewing figures should not be dismissed as they are significant and deliver a demographic sought by advertisers.

A mutually beneficial solution could be that both sides collaborate with each other to produce a pathway that works for all parties. Esports brings a unique, digitally aware audience to linear TV, one that has been deserting traditional broadcasting. This would be extremely attractive to linear TV and presents a valuable audience demographic for advertisers. Linear esports content production could be hosted by a polished presenter who could demystify esports for a new audience. Interestingly, there is an esports team where every player is over 60; the Silver Snipers shows that esports is not just for a younger audience. With esports involved in the production, the content can be authentic, and broadcasters can bring their experience to bear to make content that works on TV.

The emergence of the metaverse presents an even greater opportunity for esports and as a digitally based sport. It is an ideal platform for it to flourish. This new virtual environment presents the chance for gamers to communicate and interact more deeply with each other and with gaming companies and esports teams. For game owners and advertisers, this will give them the ability to commercialize their products globally in a whole new way.

Economics of Internet is a regular feature from Kagan, a media research group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.