Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 14 Feb, 2024

Highlights

Venture capital flows into fintechs dropped 42% year over year to $35 billion in 2023, according to S&P Global Market Intelligence data.

By region, North America and APAC each dropped 27% to register investments of $17 billion and $9 billion, respectively. Funding in EMEA and Latin America plunged 62% and 71% respectively to $8 billion and $1 billion, respectively.

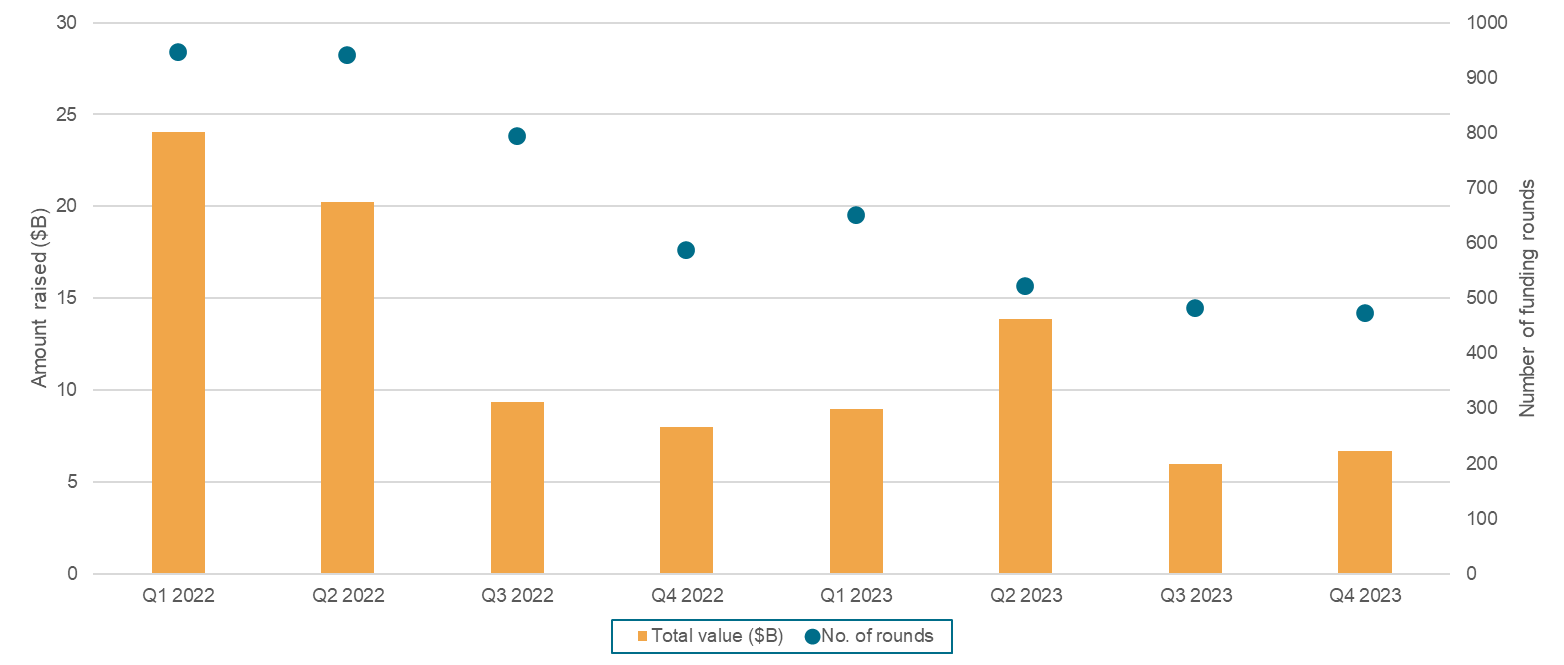

However, funding pressures are easing as the deal count and values are stabilizing on a sequential basis. Q4 2023 saw 472 rounds yielding $6.67 billion, compared to 481 rounds worth $5.98 billion in the previous quarter.

Introduction

Venture capital flows into financial technology companies fell for the second year, dropping 42% year over year to $35.45 billion in 2023, according to our analysis of S&P Global Market Intelligence data. Funding deal volumes dropped 35% to 2,124 as venture capitalists retreated from deploying capital amid a tightened funding environment. In 2022, fintech funding came in at over $62 billion, down 32% from $91 billion in 2021.

However, the long drawn-out bearish cycle for startup funding may be showing signs of a bottom. To the industry's relief, the most recent quarter registered a slowdown in declines across most fintech segments and geographies after several quarters of high double-digit declines. The fourth quarter of 2023 saw 472 rounds yielding $6.67 billion, compared with 481 rounds worth $5.98 billion in the previous quarter and 587 rounds worth $8 billion in the year-ago period. As was the case in the third quarter of 2023, late-stage rounds partially offset the paucity of dealmaking at earlier stages in the fourth quarter.

The Take

The VC market for fintechs appears to have lost some of its bearishness. Macro signs point to a less pessimistic outlook for 2024 as valuations of listed fintechs bounced back. The S&P Kensho Future Payments Index generated a one-year return of 24% as of Jan. 3. VC dry powder swelled to $567 billion at year-end, and a portion of that will likely be directed toward fintechs over the next couple of years. At the current pace, it will be a tough ask for fintech funding to register growth in the first half of 2024, but a rebound in the second half seems plausible. The reset in valuations and improved market dynamics provide VCs with opportunities to add alpha to returns.

Global analysis: Prolonged funding winter

Quarterly funding activity progressively worsened since the beginning of H2 2022. The aggregate funding value surpassed $10 billion only once over the past 18 months. The pace of dealmaking slowed with every quarter, with fewer than 500 funding rounds in both Q3 and Q4. However, funding pressures may be easing as the deal count and values stabilized in H2 2023.

Figure 1: Funding winter may be nearing as deal count, values stablizing

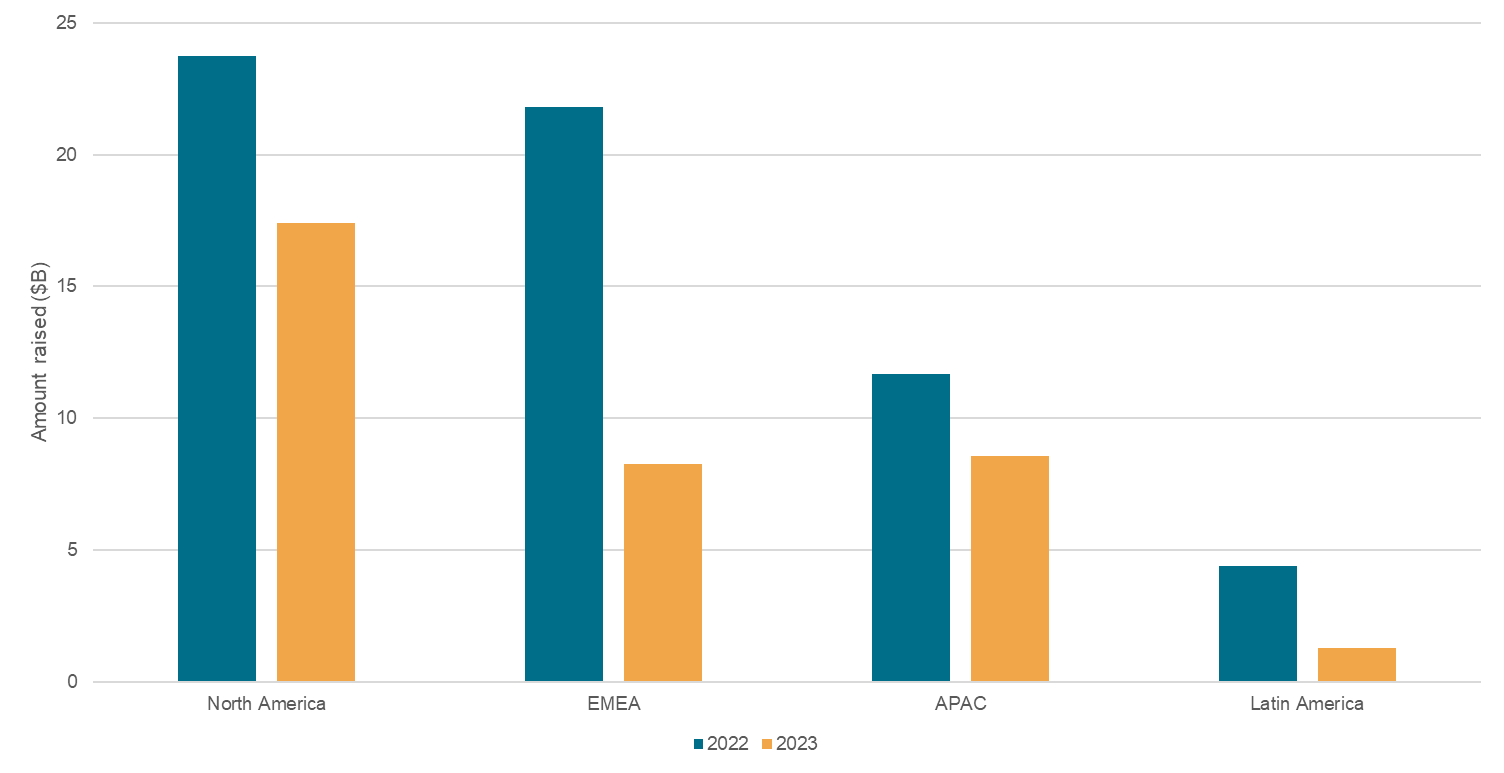

Regional analysis: Late surge in the Middle East

Funding activity fell across regions in 2023, but Latin America endured the highest decline. North America and Asia-Pacific each dropped 27% to register investments of $17 billion and $9 billion, respectively. Funding values in Europe, Middle East and Africa, and Latin America plunged 62% and 71% to $8 billion and $1 billion, respectively. In terms of deal count, North America, EMEA, Asia-Pacific and Latin America saw fintech rounds of 701, 812, 482 and 128, representing declines of 42%, 26%, 23% and 61%, respectively, from the year-ago quarter.

Funding rounds are now stabilizing or falling at a slower pace in all regions barring Latin America. However, the recovery is uneven within these regions. For instance, EMEA's funding values in the most recent quarter were propped up by a stellar show in the Middle East, while Europe has not seen signs of a slowdown.

Figure 2: EMEA, Latin America bore the brunt of the downturn

In the Middle East, there were a couple of $100 million-plus funding rounds in the buy now, pay later (BNPL) space in Q4 2023.

Tamara, a Saudi Arabia-based BNPL firm, raised $340 million in what was the largest fintech funding round globally in Q4, attracting a valuation of $1 billion. The fintech operates across the Gulf region and has over 10 million users. Tabby, another Saudi Arabian fintech, raised $250 million in its last equity funding round before its IPO. The funding fetched a valuation of $1.5 billion, and the proceeds will be used to expand its financial services and shopping products for its 10 million consumers and 30,000 retailers.

Together, Tamara and Tabby propelled the Middle East to register its highest ever quarterly funding value of $800 million. The region may see continued momentum in 2024, partly aided by the support of sovereign wealth management and government-backed VC funds. In 2023, the region saw the launch of at least two fintech-focused VC funds, Oraseya Capital (launched by the Dubai Integrated Economic Zones Authority) and Investment in Fintech VC Funds (launched by Saudi Venture Capital Company), with mandates to invest in fintechs in the United Arab Emirates and Saudi Arabia.

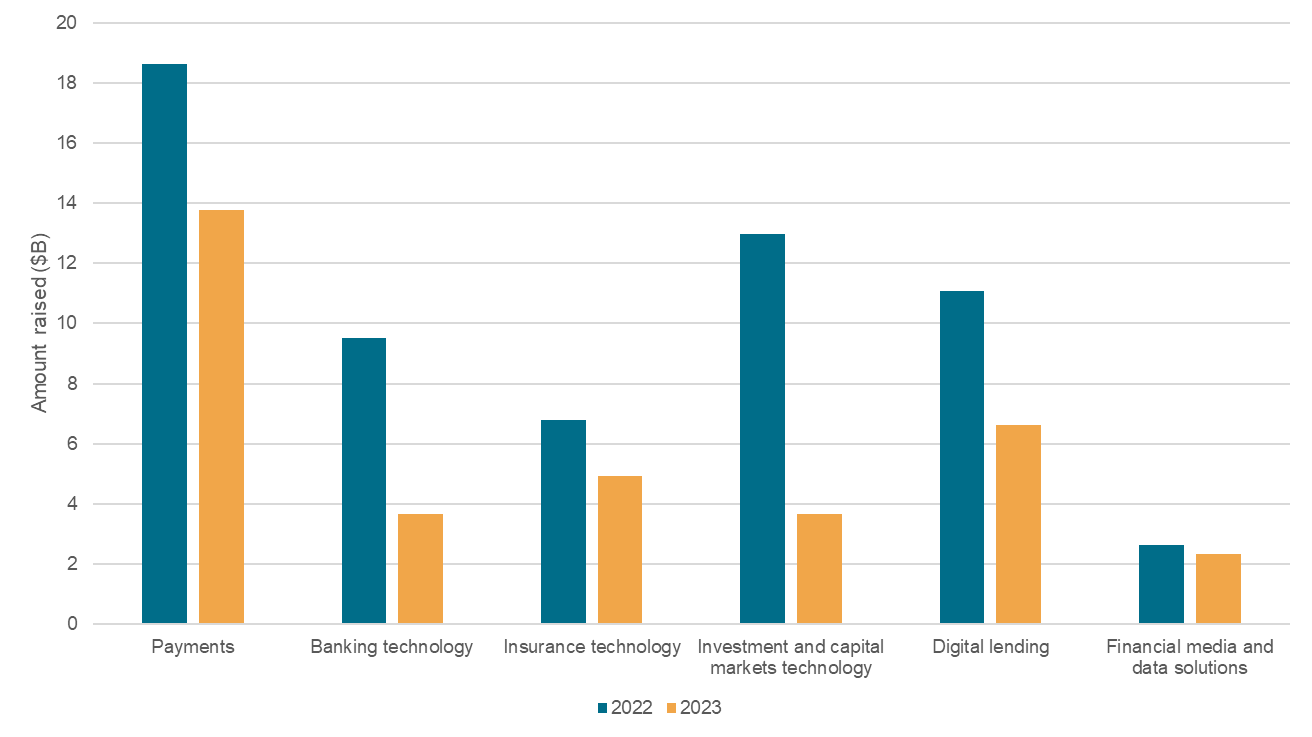

Segment-wise analysis: Large deals masked deterioration in payments

By segment, payments remained the largest destination for VCs, drawing $14 billion of investment, down 26% from $19 billion in 2022. A trio of roughly $1 billion deals, including Stripe's $6.87 billion round, masked the deterioration in the payments segment. Excluding the Stripe round, the year-over-year decline would have been over 60%. Cross-border payment companies and payment orchestration and modernization companies continue to attract investors.

Investment and capital markets suffered the most in 2023, dropping 72% to $4 billion. Investing apps and digital asset exchanges struggled to raise money. The collapse of crypto-friendly banks made it difficult for crypto startups to accept dollar deposits in exchange for tokens. Conversely, startups adding a security layer and fostering confidence in the crypto industry appeared to be gaining investor support.

The banking technology segment fell 62% to $4 billion, despite the return of several large digital-only banks to the capital markets after making progress in reducing cash burn.

Figure 3: Downturn takes a heavy toll on banking, investment tech segments

The insurance technology segment suffered less than others as funding declines slowed to single digits toward year-end. Overall, the sector saw a drop of 27% in 2023, registering value of $5 billion.

Amid deteriorating credit trends and regulatory tightening, digital lending fell 40% to $7 billion. The decline would have been worse if not for the growing support for consumer and SME credit providers in emerging markets and revenue-based financing startups in general.

Stage-wise analysis: Resilience in late-stage investing

Throughout the year, the industry saw "insider rounds" as VCs backed established firms in their portfolios to extend their runways, by writing smaller checks, mostly at valuations of previous rounds. As a result, the number of late-stage rounds remained resilient, registering a growth of over 8% in Q4 2023. However, the average transaction size in 2023 dropped 50% to $31 million, excluding the impact of Stripe's multibillion-dollar round, due to the scarcity of mega funding rounds. In 2023, mega rounds —raising at least $100 million — fell to 55 from 151 in 2022.

The resilience in late-stage investing did not trickle down to earlier stages. The persistent double-digit declines in seed to early-stage rounds could partly be explained as a correction in the market that had become overcrowded during the bull cycle when even PE firms and large investors chased firms at the earliest stage of funding. For firms progressing from series A to series B, compression in round sizes created significant pressure, with average ticket sizes falling by 38% to $35 million for growth rounds.

Figure 4: Stage-wise analysis: Compression in round sizes higher at later stages

Growing dry powder for fintechs

According to S&P Global Market Intelligence and Preqin data, VC dry powder available for investing in startups across sectors, including fintech, soared to $566.61 billion at the end of 2023 from $530.26 billion a year ago. The dry powder swelled amid a tough capital environment largely because sluggish dealmaking limited opportunities for the deployment of uncommitted capital.

Over the years, fintechs have emerged as some of the largest beneficiaries of venture capital, attracting investors across the spectrum, including Silicon Valley-based startup investors such as Sequoia and Andreessen Horowitz, as well as marquee private equity and hedge fund players such as Tiger Global and Coatue.

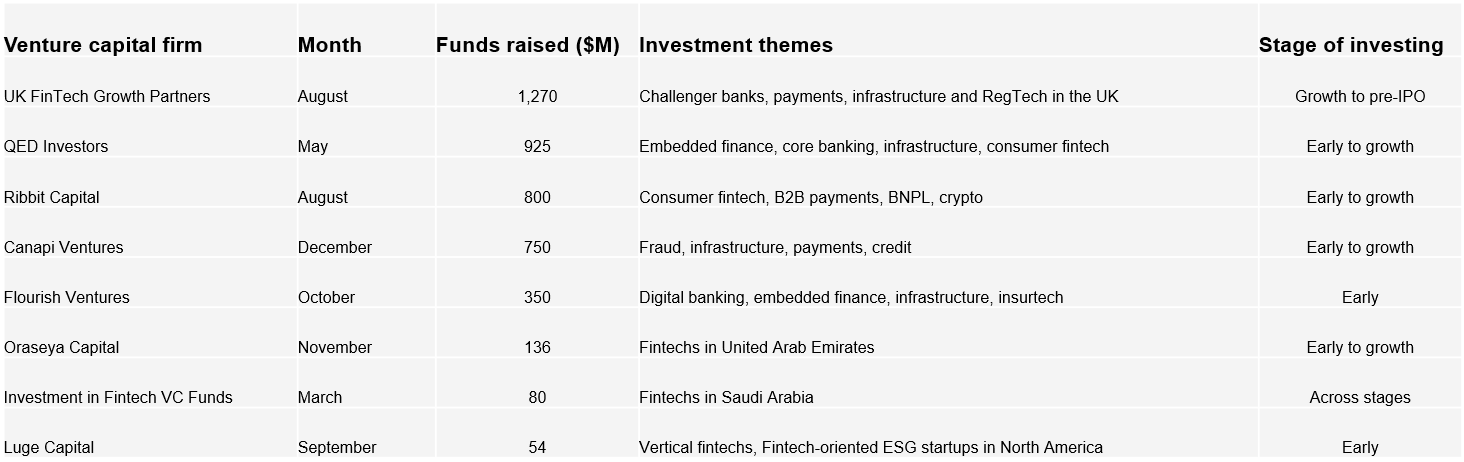

Figure 5: Select large fintech-focused VC raises in 2023

Additionally, a number of VCs are setting up fintech-first funds, building domain expertise in various fintech segments and targeting startups across stages. In 2023, there were at least eight fundraises by VCs worth $4.37 billion, focusing on broad fintech themes such as payments technology, consumer fintech and infrastructure.

The largest fundraise dedicated to investing in fintechs in 2023 was the UK's $1.27 billion investment vehicle, which was created at the behest of the government and gained the support of Mastercard Inc., Barclays PLC and London Stock Exchange. The FinTech Growth Fund plans to invest £10 million to £100 million into UK fintech companies.

While the FinTech Growth Fund's focus is on supporting startups in growth to pre-IPO phases, most sectoral funds are typically structured to provide capital support at earlier stages. Among other notable announcements are QED Investors' May closing of two funds with combined capital commitments of $925 million, Ribbit Capital's $800 million in August, and Canapi Ventures' $750 million raise.

Mounting dry powder does not automatically translate into greater investment activity. Typically, sustained momentum in exit opportunities for investors via IPOs and M&A could spark the revival for VC activity in private markets. Deploying capital at relatively low valuations could lead to higher-performing vintages than in richer valuation environments. Thus, the current environment offers opportunities for VCs targeting fintechs to add alpha to returns.

Top predictions for fintech funding in 2024

Sectoral and geographical rotation in the cards: VC investors tend to rotate between fintech segments and geographies, moving into less crowded parts as they reevaluate their allocations. Consequently, some of the fintech segments and geographies that took a beating in 2023 could put up an improved show. This means investment and capital markets, banking technology, and digital lending are likely candidates for a potential rebound, partly due to the low base effects, although further deterioration in the macro environment for cryptocurrencies and a less benign credit cycle could act as headwinds. In terms of geographies, Latin America and Europe could be up for a revival. Furthermore, mainland China, which has been vastly underrepresented in global fintech funding circles, could also provide an upside.

Recurring revenue models will be rewarded: VCs will likely prioritize fintechs with recurring revenue models above startups with usage-based fintech revenue streams. Some fintechs have a tiered pricing structure, where basic packages have low or no fees and serve as entry points to lure customers. At the same time, their premium versions offering enhanced tools and services may attract a price as high as 10x basic packages. In a challenging environment, fee waivers and discounts on premium versions are commonplace to sustain customer relationships. Because pricing should revert to normal levels with an improved business cycle, fintechs might be able to persuade VCs to factor in revenue forecasts at a more "normalized" rate. Fintechs will remain under pressure to lower marketing spending and improve cost structures.

Focus on safety and stability: VCs will continue to place greater demands on fintechs operating in regulatory gray areas to shore up compliance policies and build risk management capabilities. As regulators continue to figure out the best way to regulate third-party programs of partner banks, VCs may be reluctant to allocate capital to banking-as-a-service vendors connecting banks to end users without greater due diligence. While VCs are not averse to siding with fintechs in credit-starved emerging markets, regulatory concerns around the exponential growth in unsecured consumer lending could cause investors to tread cautiously.

Real-time payments: A considerable chunk of VC will likely be targeted toward fintechs expected to gain from the ongoing implementation of FedNow, the planned modernization of European payments and the current migration toward the ISO 20022 messaging standard. Banks will likely lean into payments-as-a-service providers to modernize core banking systems and implement real-time payments. Besides, fintechs see an opportunity to plug into real-time payment networks around the world to create non-card alternatives for merchants or to build low-cost, instant global networks for cross-border payments.

AI frenzy in fintech: The promise of artificial intelligence has swayed many VCs to pile into fintechs touting their focus on the frontier technology. In 2023, over 188 funding rounds totaling $2.44 billion involved startups claiming to employ AI across fintech verticals. As over 85% of them are operating in seed to growth stages, we will likely see some of these companies knocking on the doors of VCs for bigger checks in the next 12 months.

451 Research is part of S&P Global Market Intelligence.

Research