S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — 13 Jul, 2023

Introduction

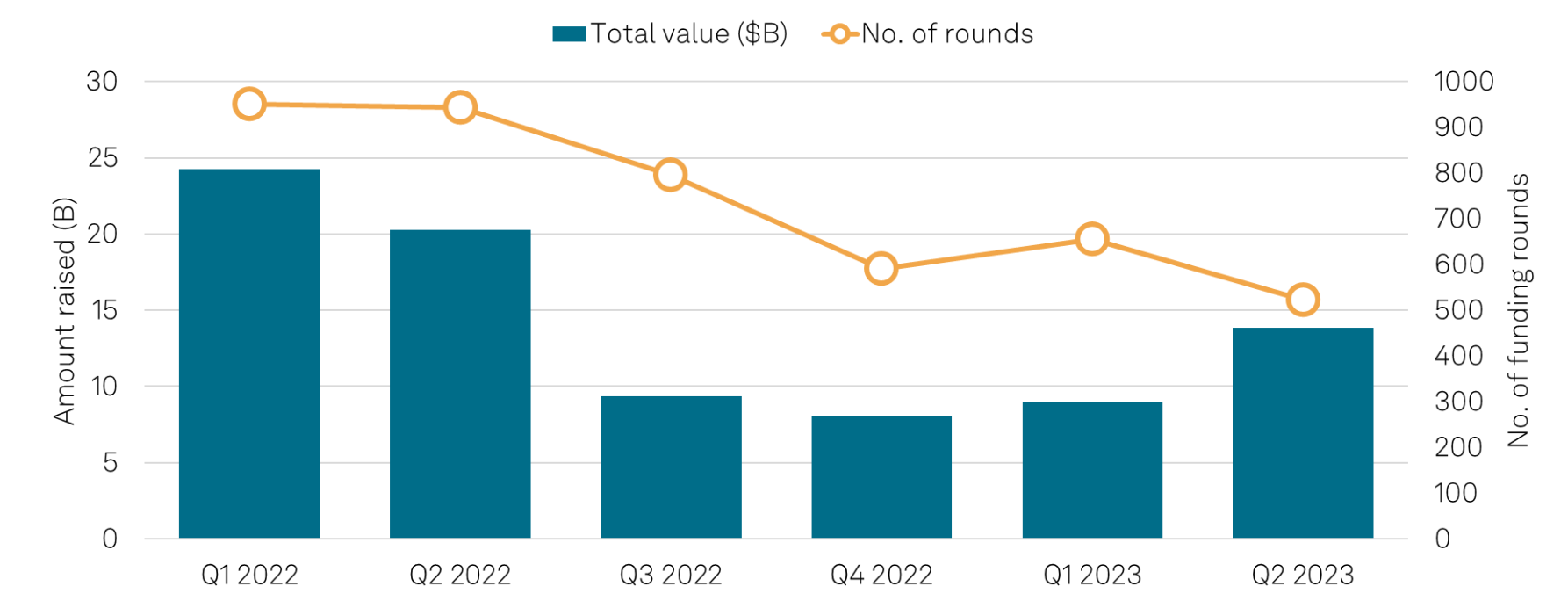

Venture capital funding of fintech startups has plunged globally by 49% year over year to $23 billion in the first half of 2023 amid an economic downturn, according to our analysis of S&P Global Market Intelligence data. However, it is worth noting that the slide in aggregate funding value started during the second half of 2022. Compared with H2 2022, fintech funding values have been ascending, having registered $9 billion and $14 billion in Q1 and Q2, respectively, in 2023, compared with $9 billion in Q3 and $8 billion in Q4 2022. Nonetheless, the rebound may not yet represent a turnaround for the industry as a handful of billion-dollar rounds have propped up the funding value.

The Take

A trio of big-ticket (about $1 billion) deals, including Stripe's $6.87 billion round, masked the deterioration in the fintech funding environment in the first half of 2023. However, for a sustained rebound in aggregate funding amount, there needs to be an uptick in deal volume. A recovery in public market valuations of tech stocks, stabilization in interest rates and a pickup in M&A activity could arrest further decline in VC investments in the second half of 2023. Underlying digital trends in financial services continue to be robust, and the long-term growth story of fintechs remains intact.

The examples of large deals in H1 2023 underscore pockets of resilience in the current climate as investors appear to consolidate around established firms with dominant market positions. Funding activity in the four largest markets — the US, the UK, India and Singapore — should continue to have an outsize impact on global fintech funding values. Across verticals, VCs remain hot on fintechs with AI-led models.

Global analysis

Perhaps the most worrying sign for fintech venture funding is the continued drop in the deal count. Fintech funding rounds in the first half of the year totaled 1,178, registering a 64% drop from H1 2022. The mid-March failure of Silicon Valley Bank further dampened investor risk appetite as the deal count shifted downward to 522 rounds in Q2 2023 (versus 656 rounds in Q1 2023 and 944 rounds in Q2 2022), making it the slowest quarter on record over the past 2.5 years. Furthermore, mega funding rounds (over $100 million) have been scarce, with only nine in Q2 2023, down from 23 in Q1 2023 and 55 in Q2 2022.

Figure 1: Deal count on slippery slope, but aggregate values rebounding

Source: S&P Global Market Intelligence 2023.

© 2023 S&P Global.

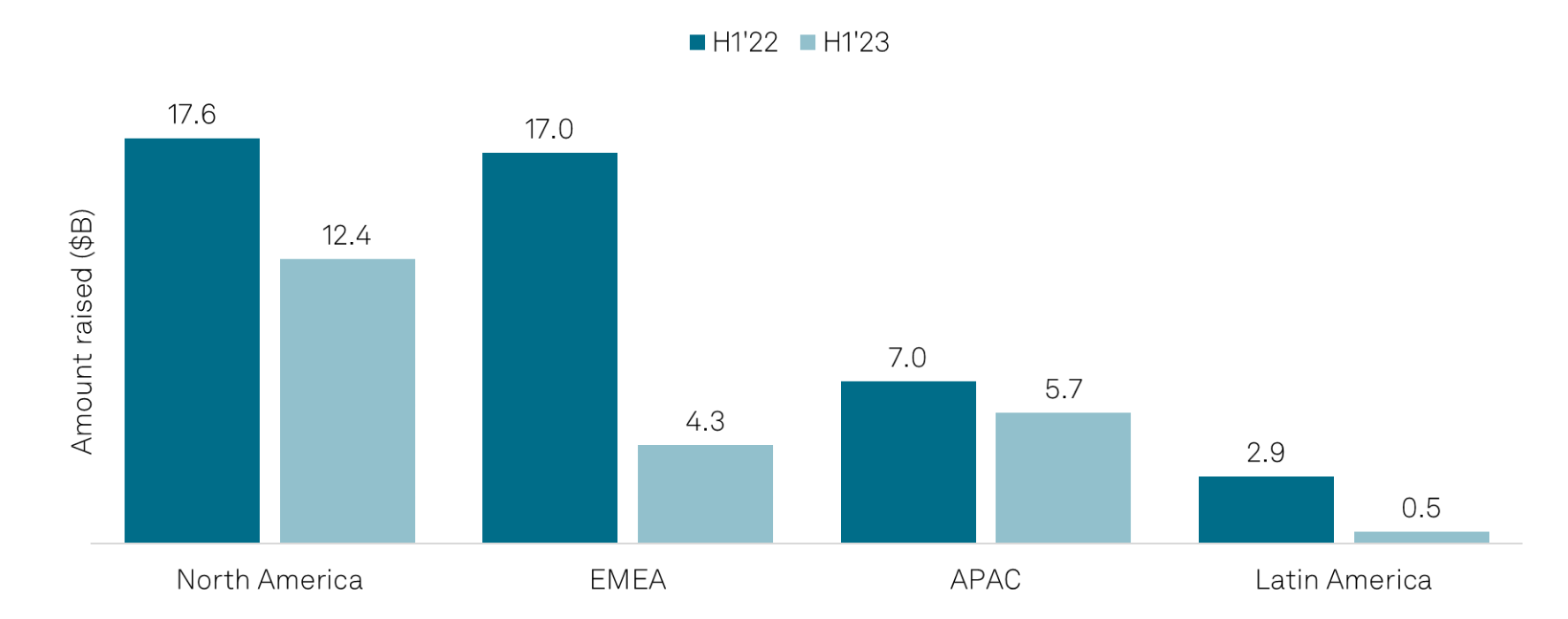

Regional analysis

The global economic slowdown impacted fintech funding trends across all regions, but the impact was relatively severe in Europe, the Middle East and Africa, with investments targeting fintechs dropping by 75% to $4.28 billion. Meanwhile, Asia-Pacific saw only a 19% fall, with funding activity totaling $5.68 billion. North America remained the largest region, registering $12.36 billion, a 30% decline from the year-ago period. Latin America fell far short of the $1 billion mark, posting an 85% drop on a year-over-year basis, with only $514 million in fintech investments.

Figure 2: EMEA saw the biggest impact of fintech funding downturn in H1 2023

Source: S&P Global Market Intelligence 2023.

© 2023 S&P Global.

In terms of individual countries, the US garnered $12.16 billion, down 28% from H1 2022. Without Stripe's $6.87 billion round, it would have failed to surpass the COVID-hit H1 2020 deal volume of $8 billion. The UK saw a sharper decline, with fintech investments falling 83% to $1.47 billion.

Among other leading fintech hubs, India saw fintech investments fall 27% to $1.8 billion, with PhonePe alone accounting for $850 million. The payments company that handles the bulk of India's popular mobile payments will need to raise another $150 million to complete its target of $1 billion for its ongoing financing round. Fintech investments in Singapore fell 43% to $895 million.

Germany and mainland China were the only large markets to have dodged the slowdown, aided by large deals that made up more than half of the aggregate funding values. Insurtech Wefox's $510 million round in May took Germany's fintech funding total to $820 million, up 21% year over year. Mainland China saw an even more dramatic growth rate of 461% in fintech funding. Ant Group's consumer finance unit raised $1.5 billion, accounting for most of the country's $1.8 billion in fintech fundraising value.

AI trends

VCs may be deploying capital at a slower pace overall, but the promise of artificial intelligence has swayed many to pile into startups touting their focus on the frontier technology. In H1 2023, over 60 funding rounds totaling $1 billion involved startups claiming to employ AI across fintech verticals. As nearly 50 of them are operating in seed-to-growth stages, we will likely see some of these companies knocking on the doors of VCs for bigger checks in the next 12 months.

Digital lending, insurtech, and investment and capital market technology segments were the primary beneficiaries, with each of these verticals witnessing more than 10 AI-based fintechs raising capital. The largest investment in an AI-based fintech startup was a $100 million bet on Alphasense, a financial data solutions provider that plans to accelerate its deployment of generative AI to help customers glean summarized insight from financial documents with ease.

451 Research is part of S&P Global Market Intelligence.

Research