Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 10 Jan, 2023

By Ronald Cecil

S&P Global Commodity Insights discusses consensus price forecasts for industrial and precious metals, including platinum group metals, amid broader market trends.

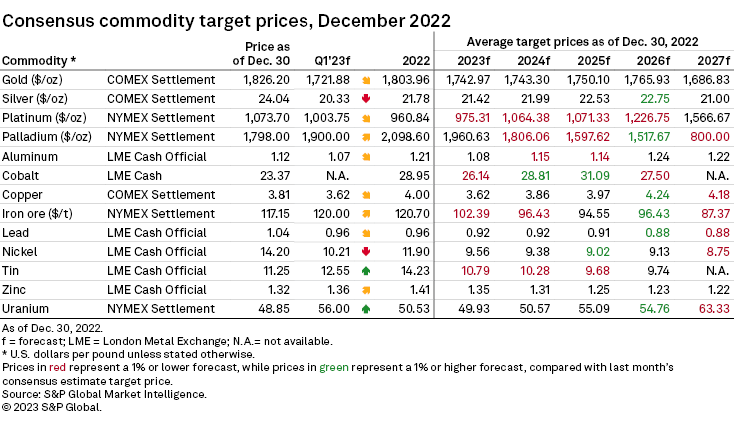

Metals prices rallied at the end of 2022 on demand optimism stoked by China abandoning its stringent zero-COVID policy. A softer U.S. dollar and moderated inflation rates fueled hopes for less aggressive U.S. interest rate hikes, which would support economic growth in 2023. Sentiment was quickly dampened, however, by the near-term economic risk of the surge of COVID-19 cases following China's reopening, and by the U.S. Federal Reserve pushing back on hopes for slower rate hikes. Consequently, mounting concerns over the slowing global economy and its negative impact on near-term demand have led to annual downgrades across the board for metals consensus price forecasts in 2023.

See Commodity Insights' most recent market outlooks for copper, gold, iron ore, lithium and cobalt, nickel, and zinc.

A combination of macroeconomic and geopolitical factors made 2022 a volatile year for metals prices. The outbreak of the Russia-Ukraine war in February sparked an energy crisis, helping to drive inflation to 40-year highs in the U.S. and Europe, with interest rates hiked by central banks in response. Although inflation has started to moderate over recent months, further rate hikes are in the offing and are expected to weigh on global economic growth in 2023 as the U.S. and Europe drift toward recession. The near-term outlook appears challenging, as surging COVID-19 cases in China threaten to overwhelm the health system after the government recently relaxed its zero-COVID policy. The negative risk of China reopening is weighing on sentiment for now and — along with expectations for a weaker global economy — underlies downgrades to consensus metals price forecasts in 2023.

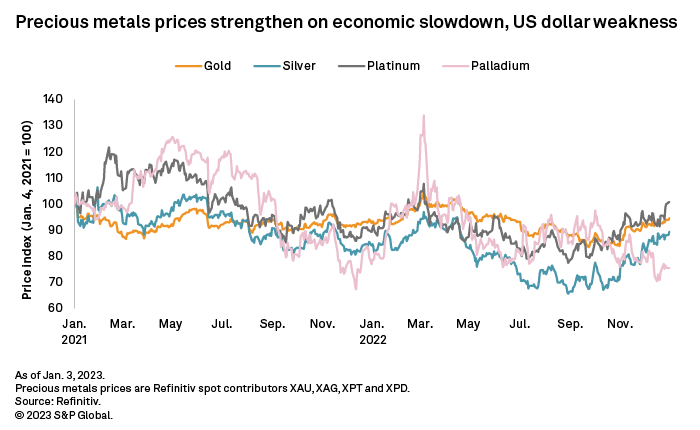

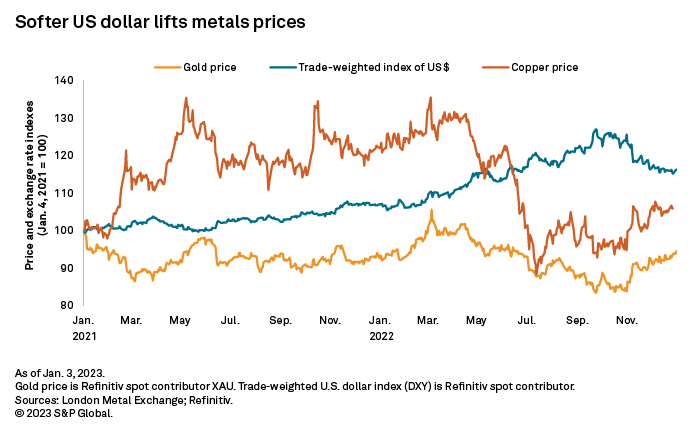

Gold prices rallied into the new year, reaching a six-month high of $1,837 per ounce Jan. 3, buoyed by global economic uncertainty and a softening U.S. dollar. The U.S. dollar trade-weighted index dropped to a six-month low at the end of December, after being persistently strong for most of 2022. The U.S. Federal Reserve is planning further interest rate hikes to combat inflation, and this will likely temper the upside for gold prices in the near term. Nevertheless, gold prices are expected to be stronger in the first half of 2023 as economic uncertainty prevails amid ongoing geopolitical tensions, and then to retreat in the second half as the global economy recovers. Consequently, consensus price forecasts for gold have been lowered by an average of 0.6% annually over 2023-2027, on expectations of the global economic recovery gathering pace.

Silver prices rose to an eight-month high in early January, supported by lower U.S. Treasury real yields and a weaker dollar. Despite silver prices narrowing the gap with gold over recent months, the anticipation of muted global manufacturing activity in 2023 has prompted a 0.5% downgrade to the consensus price forecast. With the global slowdown threatening automotive demand in 2023, consensus price forecasts for platinum and palladium are reduced 1.8% and 0.7%, respectively. Platinum was the best-performing precious metal price over the course of 2022, rising 12.0%, compared with a 1.7% fall for palladium and 4.8% and 1.3% rises for silver and gold, respectively. With Russia normally a major supplier of platinum group metals, or PGMs, supply risks remain, as its invasion of Ukraine has prompted consumers in sanctions-imposing countries to divert supply chains away to other sources.

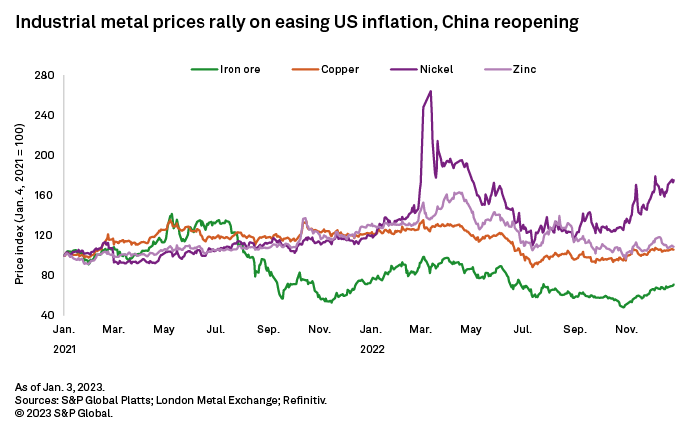

The positive news of softer inflation in the U.S. and the loosening of COVID-19 restrictions in China lifted copper prices to a near six-month high in December. March-quarter prices are nevertheless expected to labor on near-term challenges from rising COVID-19 cases in China, while the likelihood of further interest rates hikes in the U.S. and Europe will weigh on economic growth. The 2023 consensus price forecast for copper has been downgraded 0.4% amid the prospect of emerging surpluses in both the concentrate and refined copper markets. A recovering global economy is expected to reduce the refined market surplus in 2024, with emerging deficits from 2025 resulting in 0.4% average price upgrades across 2024-2026.

Surging cases of COVID-19 in China pulled zinc prices down to $3,000 per tonne at year-end. With the first half of 2023 expected to challenge zinc demand, the annual consensus price estimate is reduced 0.4%. Low stocks and smelter production cuts — notably in Europe, where the energy crisis is most acute — will provide some support for prices, with forecasts upgraded 0.4%-0.8% across 2024-2026 on expectations of a global economic recovery, although growing surpluses are expected to result in zinc prices trending lower.

Nickel prices on the London Metal Exchange, or LME, rallied to a near eight-month high at above $30,000/t in December, spurred by China's reopening. Nickel trading volumes on the LME remain low, however, with prices subject to increased volatility, disconnecting them from market fundamentals. Despite the reopening of China's economy, the consensus nickel price forecast has been lowered 0.7% in 2023, with the global primary market expected to remain in surplus as top primary nickel producer Indonesia expands its supply and slowing global economic growth crimps nickel demand.

Slowing electric vehicle sales and weakening demand led to cobalt prices in China falling sharply in December. The end of EV subsidies in China — and an expected further decline of nickel-manganese-cobalt battery production, especially for the more cobalt-intensive chemistries — underlie the 2.1% downgrade to the consensus forecast for the LME cobalt price in 2023. A subdued outlook for the global economy, along with affordability challenges, will weigh on consumer electronics sales and disproportionately affect EV sales in Europe and the U.S., where cobalt-containing batteries are more widely used.

Iron ore prices reached a five-month high at the end of December on restocking ahead of the Lunar New Year holiday in late January. Despite this, consensus price forecasts for 2023 and 2024 have been lowered 2.8% and 1.2%, respectively, amid mounting concerns for oversupply in China's steel market, with the demand side of China's property sector likely to take longer to respond, despite recent government stimulus and financial support for domestic property developers. A seasonal slowdown in seaborne iron ore supply is expected to provide near-term support for prices, however.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Research

Research

Campaign