Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 8 Feb, 2023

By Ronald Cecil

S&P Global Commodity Insights discusses consensus price forecasts for industrial and precious metals, including platinum group metals, amid broader market trends.

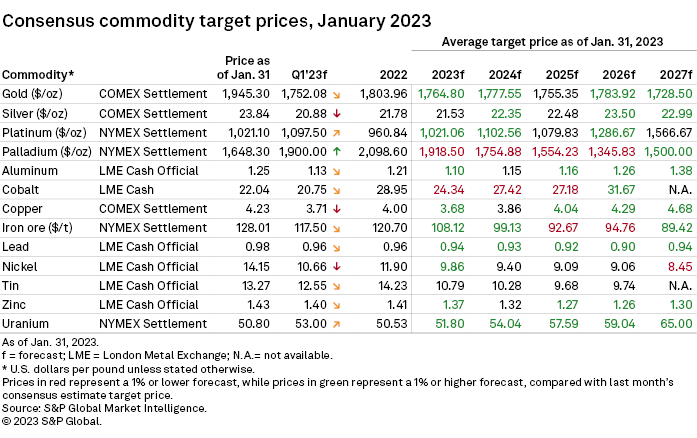

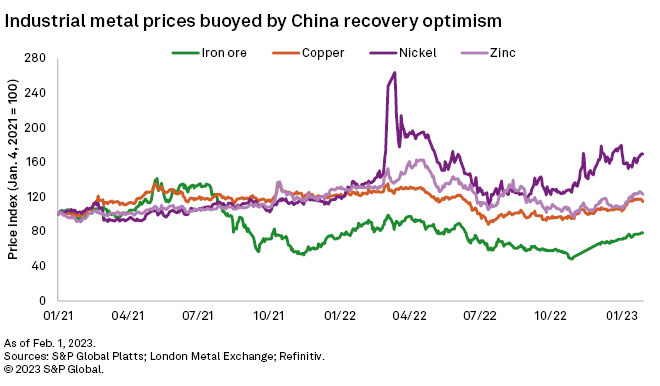

The year started on a positive note of lower inflation in the U.S., and China reopening, triggering a price rally across all commodities. Many touched multimonth highs in January, fueled by expectations of demand recovery, namely for copper and iron ore from China. On the other hand, the nickel market reacted negatively to news of potential refined material supply growth, with prices dropping in January. The outlook for the year nevertheless remains optimistic, with consensus metals prices mostly upgraded for 2023, except for palladium and cobalt — each getting the short end of its respective automotive segment as electric vehicles, or EVs, replace combustion engines while battery manufacturers favor less expensive cobalt-free batteries.

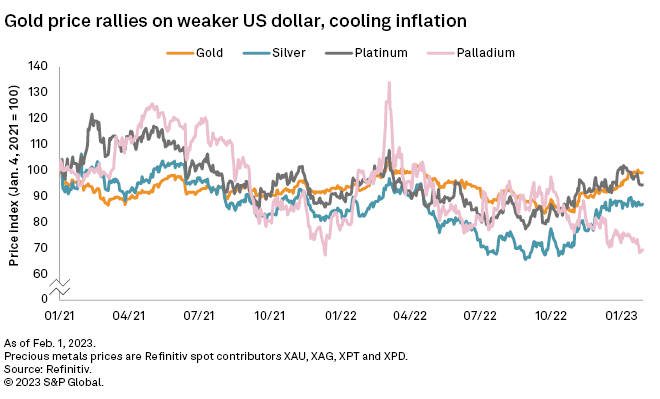

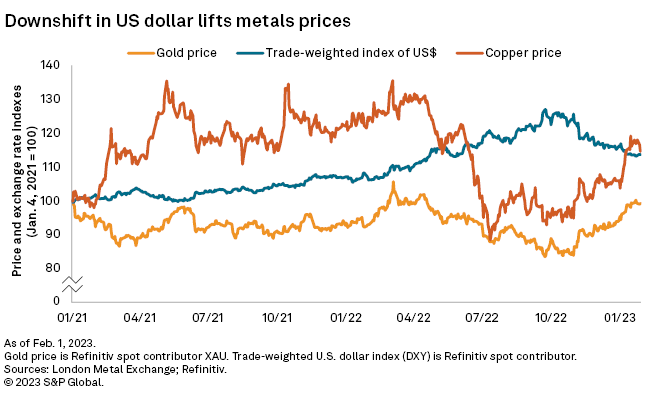

China's removal of stringent pandemic restrictions has sparked optimism for a domestic economic recovery in 2023. Fueled by expectations for stronger demand, most metals prices rallied significantly heading into the Lunar New Year holiday. Sentiment and prices were bolstered by a further downshift in U.S. inflation in December, while a less hawkish tone from the U.S. Federal Reserve drove the U.S. dollar trade-weighted index to a nine-month low in January.

The inverse relationship between the U.S. dollar and metals prices held true for COMEX gold, which ended January at $1,945 per ounce — 6.5% higher month over month. U.S. inflation slowed to 6.5% in December, heightening expectations for softer interest rate hikes, with the potential of avoiding a hard landing for the U.S. economy in 2023. Robust physical demand is also supporting gold prices, as central bank holdings of gold reserves have risen over the past few months, led by China and Turkey, while net long positions and demand for bars and coins have also increased. Consensus gold price forecasts were upgraded 1.3% for 2023 and 2.0% for 2024, supported by a weakened U.S. dollar, geopolitical uncertainty and a slowing global economy.

Despite hitting a nine-month high of $24.4/oz on Jan. 16, silver lagged the gold price rally to end January moderately down from the start of the year — hampered by slower demand from the industrial sector. Silver is a key metal used in renewable energy technologies, led by silver-containing solar panels, which are expected to see strong growth over the forecast period. The biggest upgrades to consensus price forecasts for silver are in 2026 and 2027, at 3.3% and 9.5%, respectively. However, the global manufacturing slowdown constrains increases to near-term estimates.

The auto sales slump and the slower growth outlook for the global economy in 2023 led to platinum and palladium prices dropping 3.5%-6.7% through January. Contrasting trends are evident in the consensus price forecasts for these metals, with platinum prices rising, helped by January's average annual upgrades of 2.8% to 2027. Conversely, palladium consensus price forecasts are declining, soured by the latest downgrades of 2.2%-11.3% from 2023 to 2026. Beset by palladium's over-reliance on the auto sector, the gloomy outlook for its demand results from the expected phase-out of combustion-engine car production over the coming decade amid strong growth in the electric vehicle market. Platinum demand, on the other hand, may benefit more from the green energy transition given its use in other industries, such as hydrogen, which uses it in hydrogen fuel cells.

The London Metal Exchange copper cash price surged above $9,400 per tonne in January on positive sentiment from China reopening, slowing inflation and a softer U.S. dollar. Together, these factors are expected to help spur a growth recovery in the global economy, accelerating copper demand in 2023 and beyond, with consensus price upgrades averaging 3.4% annually through 2027. The strong medium-to-long-term copper demand outlook is based on the global ramp-up in EVs and the expanded infrastructure required to facilitate the energy transition. A lagging supply response, however, is expected to result in significant market deficits emerging in the medium term, which is reflected in rising consensus price forecasts for copper from 2024 through 2027.

China demand optimism helped drive the London Metal Exchange zinc cash price above $3,500/t in late January. Zinc's supply side appears even more constrained than copper's, however, with smelter production cuts in Europe and China driving zinc stocks on major exchanges to multidecade lows. With a rise in net long positions in the zinc market, the consensus price forecast is upgraded 1.9% in 2023, although a modest downgrade to the price estimate for 2024 accompanies expectations for smaller deficits in the zinc market.

Nickel prices declined over January on news of another major shift in Tsingshan Holding Group Co. Ltd.'s evolving primary nickel supply strategy, with the company announcing plans for idled copper plants in China to produce Class 1 nickel from its nickel matte. Despite the potential threat to an already oversupplied market, a weaker U.S. dollar and China's reopening are behind the 3.2% upgrade to the consensus price estimate in 2023. However, an expected growing market surplus will likely lower the average annual nickel price 17.2% annually to $21,735/t in 2023.

The protracted downward trend in cobalt prices continued into the New Year, with China's domestic price reaching a two-year low. Demand has been curbed by ongoing weakness in the global consumer electronics sector, while the phase-out of central government subsidies for EVs in China is causing a disproportionate decline in demand for cobalt-intensive batteries. With lithium-iron-phosphate batteries' share on the rise in China, driven by EV makers, an accelerated decline in cobalt intensity across batteries is expected over the coming years. The rising flow of supply from the Democratic Republic of Congo and from Indonesian high-pressure acid-leaching projects is also souring the consensus price outlook for cobalt, with downgrades averaging 8.1% annually through 2025.

Among the industrial metals' consensus price forecasts covered, iron ore had the biggest upgrades with 5.6% and 2.8%, respectively, in 2023 and 2024. China's return from the Lunar New Year holiday without COVID-19 restrictions for the first time in three years is expected to trigger a healthy rise in iron ore demand. Further government aid for China's subdued property sector could revive construction activity and therefore steel demand in 2023, which is buoying market sentiment. A seasonal slowdown in seaborne iron ore supply — due to recent weather-related disruptions in Brazil — helped drive the IODEX 62% Fe price to a seven-month high of $129/t at end-January.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Research

Research

Campaign