Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 7 Apr, 2021

Efficient ways to perform text analysis of S&P Global Ratings’ credit ratings research* using machine-readable technology

This is the second blog in a three-part series. View the first blog here.

In our last blog, we reviewed the use of textual data analysis to spot trends in credit ratings research as compared to earnings transcripts. In this blog, we discuss three additional refinements to gain insights from credit ratings reports.

Obtaining Additional Insights from Credit Ratings Research

There are ways to further improve the information gleaned from S&P Global Ratings credit ratings research.

Refinement #1: Reducing noise in text analysis

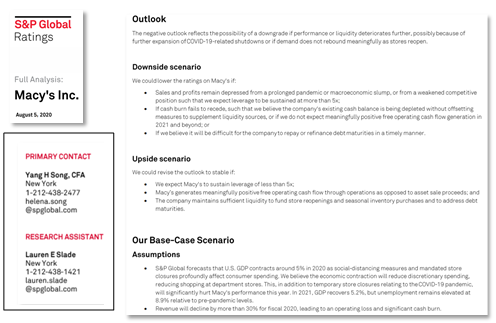

When conducting text analysis using RatingsXpress®: Research, which provides bulk access to credit research from S&P Global Ratings in XML files with metadata, users can isolate sections of the research that best inform credit quality. In Figure 1 below, for example, the “Primary Contact” section will be less informative about credit quality than the “Outlook” and “Downside scenario” sections. Since the report is divided into sections, users can zero in on the areas they want to include in the text analysis.

Figure 1: Sample of S&P Global Ratings Research of Macy’s Inc. Published in August 2020

Source: RatingsXpress: Research, S&P Global Market Intelligence, August 2020. For illustrative purposes only.

Refinement #2: Text-based analysis of aggregates and comparables

It is possible to aggregate information across entities, countries, industries, and sectors to identify trends. For example, the “Outlook” section can be combined for all U.S.-based retail firms to analyze the block of text and identify similarities and differences across companies to gain a perspective on the overall industry and pinpoint hot topics.

Refinement #3: Extract forward-looking statements and credit-sensitive keywords

Users can also develop text analyzed databases for specific sections of a report, defining relevant search terms and thresholds. For example, if reported or estimated financial metrics are close to thresholds that could impact a rating, we would expect the likelihood of a ratings downgrade to increase. As demonstrated in Figure 2 below, if Funds from Operation (FFO) to Debt is below 60% and Debt/EBITDA is less than 1.5x, the credit ratings of Company A (hypothetical issuer) could be downgraded.

Figure 2: Sample extractions from RatingsXpress that can be digitized for triggers of credit ratings changes

Downside scenario

We could lower our ratings on Company A, a major player in the oil and gas industry, if its financial measures do not recover in 2022 such that we expect its FFO to debt to remain below 60% and its debt to EBITDAX to exceed 1.5x. This would likely occur if crude oil prices fail to improve substantially or the company pursues a more aggressive financial policy than we currently anticipate. The failure of OPEC and other producers to comply with production limits to support crude oil prices and/or prolonged economic weakness due to the coronavirus that leads to significantly reduced demand beyond 2020 could keep crude oil prices and the company's operating cash flow below the necessary levels to support the rating.

Source: RatingsXpress: Research, S&P Global Market Intelligence, August 2020. For illustrative purposes only.

These additional refinements can expand the power of text analysis. RatingsXpress: Research provides bulk access to credit research from S&P Global Ratings in XML files with metadata. This enables users to develop text analysis algorithms to quickly summarize articles, filter relevant research, identify unique signals, monitor country and industry credit risk trends, and gain deeper insights from research reports in an automated fashion.

Click here to request more information about how to gain useful insights from text analysis of credit ratings research.

*Credit ratings are prepared by S&P Global Ratings.

Theme

Location

Products & Offerings

Segment